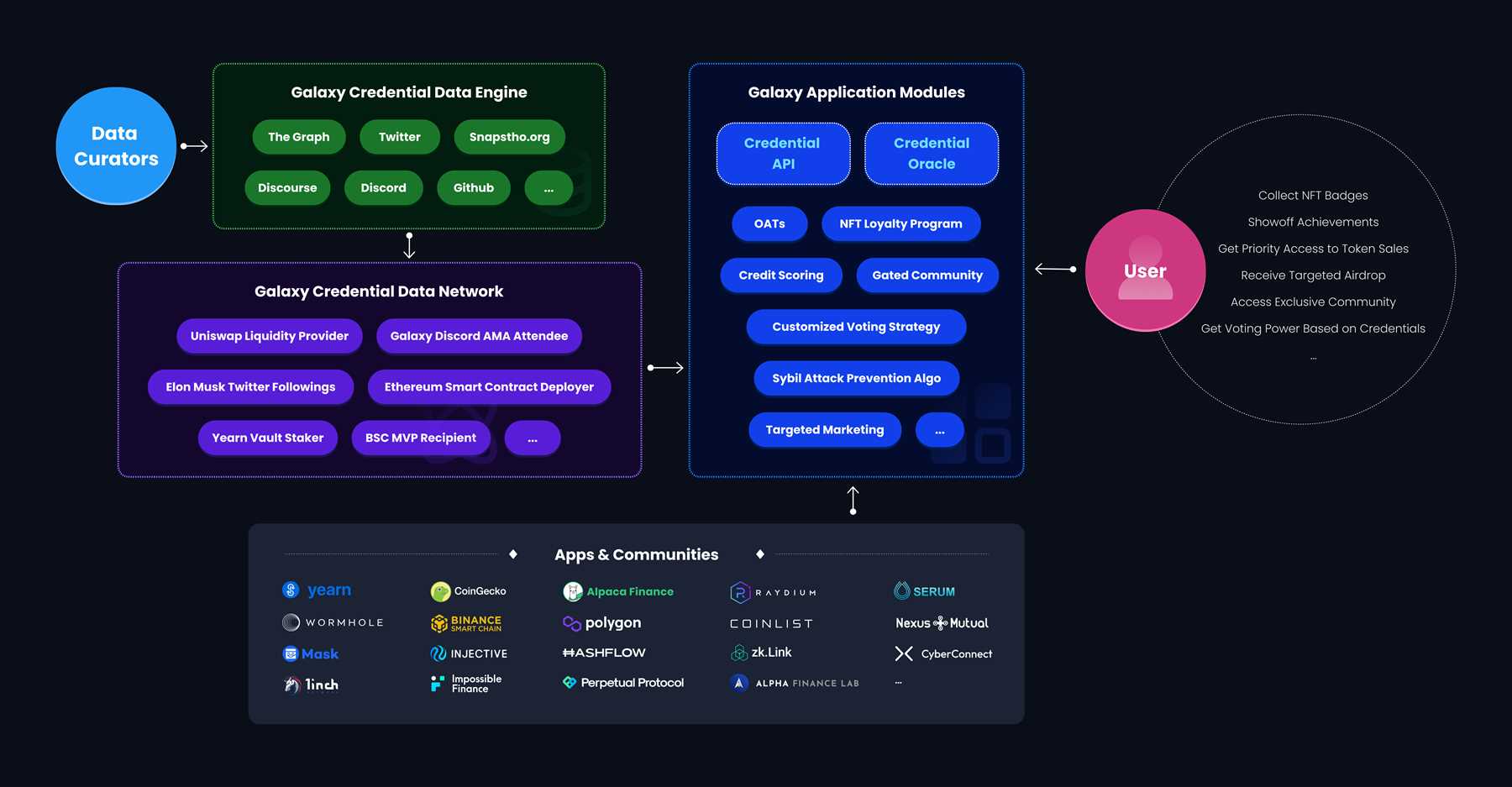

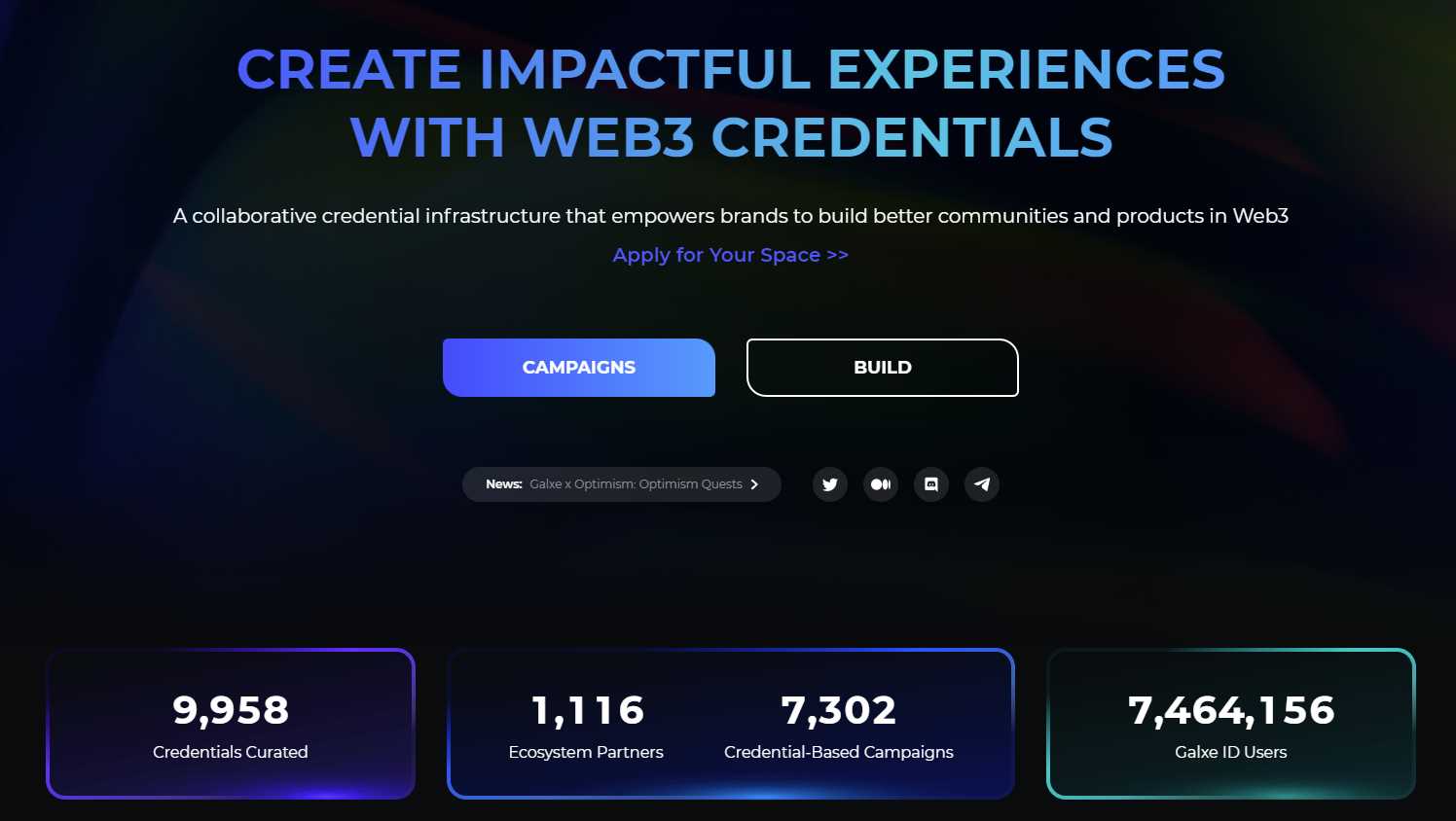

Galxe (GAL) is a revolutionary digital currency that offers numerous benefits to traditional financial institutions. With its advanced technology and decentralized nature, GAL is poised to disrupt and transform the way banks and other traditional financial institutions operate.

One of the key advantages of Galxe is its ability to provide secure and transparent transactions. Unlike traditional banking systems, which rely on intermediaries to facilitate transactions, Galxe uses blockchain technology to ensure that every transaction is recorded on a public ledger. This not only increases security and trust but also reduces the risk of fraud and money laundering.

In addition, Galxe offers faster transaction processing times compared to traditional banking systems. With the use of smart contracts, transactions can be executed and settled within seconds, eliminating the need for manual processing and reducing the potential for errors. This efficiency will not only improve customer experience but also reduce operational costs for financial institutions.

Furthermore, Galxe has the potential to increase financial inclusivity. Traditional financial institutions often have strict requirements and high fees, making it difficult for individuals with limited financial resources to access their services. Galxe provides a more inclusive and accessible financial system, allowing anyone with internet access to participate in the global economy.

Overall, Galxe offers traditional financial institutions a range of benefits, including increased security, faster transactions, and improved inclusivity. Embracing Galxe and incorporating it into their systems can help these institutions stay competitive in the rapidly evolving digital landscape.

Enhancing Efficiency and Security

Traditional financial institutions are often burdened with slow and inefficient processes that can be improved with the use of Galxe (GAL). By leveraging the power of blockchain technology, Galxe provides a more efficient and secure solution for these institutions.

One of the key benefits of Galxe is its ability to streamline processes such as cross-border transactions. Traditional financial institutions often face delays and high fees when sending money internationally. With Galxe, these transactions can be executed in a matter of minutes, with lower fees compared to traditional methods.

Furthermore, Galxe offers enhanced security features that protect sensitive financial data. The decentralized nature of blockchain technology ensures that transactions are recorded in a transparent and immutable manner. This reduces the risk of fraud, as the integrity of the data is maintained throughout the process.

In addition to transactional efficiency and security, Galxe also offers cost savings for traditional financial institutions. By leveraging blockchain technology, these institutions can reduce operational costs associated with manual processes and intermediaries. This allows them to allocate resources more effectively and focus on core business activities.

| Benefits of Galxe for Traditional Financial Institutions |

|---|

| Enhancing Efficiency and Security |

Streamlining Operations

Traditional financial institutions often face challenges when it comes to streamlining operations and reducing inefficiencies. However, with the advent of Galxe (GAL), these institutions can now benefit from a range of solutions that can optimize and streamline their daily operations.

One of the key benefits of Galxe (GAL) for traditional financial institutions is its ability to automate processes. By leveraging smart contracts and blockchain technology, Galxe allows for the automation of various tasks, such as verification, clearance, and settlement of transactions. This automation not only reduces the need for manual intervention but also minimizes the chances of human error, thus improving operational efficiency.

Furthermore, Galxe provides enhanced security measures that can protect sensitive financial information. With its decentralized and encrypted nature, Galxe ensures that data is stored securely and cannot be tampered with or accessed by unauthorized parties. This level of security is crucial for traditional financial institutions that handle large amounts of confidential and valuable data.

Another aspect where Galxe can streamline operations is through improved transparency and traceability. Every transaction on the Galxe network is recorded on the blockchain, creating a transparent and auditable trail. This feature helps financial institutions maintain regulatory compliance and easily track the flow of funds, reducing the risk of fraud or money laundering.

Finally, Galxe offers a user-friendly interface and comprehensive reporting tools. This allows financial institutions to easily manage and monitor their operations, providing real-time insights into their performance. These tools can help identify bottlenecks, analyze data trends, and make informed decisions to further streamline and optimize their operations.

By adopting Galxe (GAL), traditional financial institutions can benefit from the streamlining of their operations, improved efficiency, enhanced security, and increased transparency. To learn more about how Galxe can revolutionize the financial industry, visit the Portfolio Galxe (GAL) website.

Reducing Processing Time

One of the key benefits that Galxe (GAL) offers to traditional financial institutions is the significant reduction in processing time. With the use of blockchain technology, transactions can be completed almost instantly, eliminating the need for cumbersome manual processes and lengthy waiting periods.

Traditionally, financial transactions involve multiple intermediary steps, including verification, settlement, and reconciliation. These steps can often take days or even weeks to complete, leading to delays and potential errors. However, with Galxe, these processes are streamlined and automated, reducing the overall processing time to a fraction of what it used to be.

By utilizing smart contracts and decentralized ledger technology, Galxe ensures that transactions are executed quickly and securely. The immutability and transparency of the blockchain also eliminate the need for time-consuming audits and manual checks, as all transaction data is recorded and verifiable in real-time.

For financial institutions, the reduction in processing time not only improves operational efficiency but also enhances customer satisfaction. Customers can enjoy faster fund transfers, quicker loan approvals, and prompt resolution of any transaction-related issues. This not only saves time but also enables businesses to seize new opportunities and stay ahead in the rapidly evolving financial landscape.

In conclusion, Galxe’s capability to reduce processing time revolutionizes traditional financial institutions by accelerating transactions and simplifying complex processes. This technology-driven transformation has the potential to optimize the overall efficiency and effectiveness of financial services, benefitting both institutions and their customers.

Eliminating Human Error

Traditional financial institutions heavily rely on human input for various tasks, including data entry, verification, and transaction processing. However, humans are prone to making mistakes, no matter how skilled or experienced they are.

By integrating Galxe (GAL) into their operations, traditional financial institutions can significantly reduce human error. Galxe utilizes blockchain technology, which ensures that all transactions and data entries are immutable and transparent.

With Galxe, financial institutions can automate and streamline their processes, eliminating the need for manual data entry and verification. This automation greatly reduces the risk of human error and enhances the overall efficiency of operations.

Moreover, Galxe enables real-time monitoring and auditing of transactions. Traditional financial institutions often face challenges in detecting and rectifying errors promptly. With Galxe, all transactions are recorded on the blockchain, allowing for instant identification and correction of errors.

By eliminating human error, Galxe promotes trust and reliability within the financial industry. Clients and customers can have confidence that their transactions and data are accurate and secure, leading to enhanced customer satisfaction and loyalty.

In conclusion, Galxe offers traditional financial institutions a powerful solution to eliminate human error. Its blockchain technology ensures accurate and efficient transaction processing, reducing risks and enhancing overall operational performance.

Strengthening Data Protection

One of the key benefits that Galxe (GAL) brings to traditional financial institutions is the strengthening of data protection measures. With the increasing number of cyber threats and data breaches, it is crucial for financial institutions to have robust security measures in place to safeguard sensitive customer information.

GAL utilizes advanced encryption techniques and distributed ledger technology to enhance data protection. The decentralized nature of the GAL network ensures that there is no single point of failure, making it highly resistant to hacking attempts. Additionally, all transactions on the GAL network are stored on a distributed ledger, which provides an immutable record of every transaction and eliminates the risk of fraud or tampering.

Furthermore, GAL incorporates multi-factor authentication and biometric verification methods to ensure that only authorized individuals have access to sensitive financial data. This helps prevent unauthorized access and strengthens overall security.

By leveraging GAL, traditional financial institutions can significantly enhance their data protection capabilities, mitigating the risks associated with cyber attacks and data breaches. With GAL, customers can have peace of mind knowing that their personal and financial information is safeguarded with state-of-the-art security measures.

Implementing Blockchain Technology

Blockchain technology has gained significant attention in recent years for its potential to revolutionize traditional financial systems. Traditional financial institutions, such as banks and insurance companies, are exploring the implementation of blockchain technology due to its numerous benefits.

One of the key advantages of blockchain technology for traditional financial institutions is increased efficiency. By using blockchain, institutions can streamline their operations, eliminate intermediaries, and significantly reduce transaction processing time. Additionally, the immutable nature of blockchain provides a transparent and tamper-proof ledger, reducing the risk of fraud and improving overall security.

In addition to efficiency, blockchain technology offers cost savings for financial institutions. The decentralized nature of blockchain eliminates the need for intermediaries and middlemen, resulting in reduced operational costs. Blockchain also allows for instant settlement and eliminates the need for reconciliation, further reducing costs associated with traditional financial processes.

Furthermore, implementing blockchain technology can enhance trust and transparency in financial transactions. The decentralized nature of blockchain eliminates the reliance on a single entity, making it more difficult for malicious actors to manipulate or falsify data. By using blockchain, financial institutions can demonstrate transparency to their customers, which can enhance customer trust and loyalty.

Another benefit of implementing blockchain technology is increased accessibility. Traditional financial systems often exclude certain individuals or communities due to the requirements for access, such as a bank account or credit history. With blockchain, individuals can have direct access to financial services, allowing for greater financial inclusion and economic empowerment.

In conclusion, the implementation of blockchain technology offers numerous benefits for traditional financial institutions. Increased efficiency, cost savings, enhanced trust and transparency, and increased accessibility are just some of the advantages that blockchain can provide. As the technology continues to advance and mature, it is expected that more financial institutions will adopt blockchain to stay competitive in the ever-evolving financial landscape.

Enhancing Encryption Methods

One of the key benefits that Galxe (GAL) brings to traditional financial institutions is the enhancement of encryption methods. Encryption plays a crucial role in safeguarding sensitive data and ensuring the privacy of transactions. With the increasing number of cyber threats and evolving hacking techniques, it has become paramount for financial institutions to adopt advanced encryption methods to protect their systems and customer information.

Galxe introduces state-of-the-art encryption technology that significantly enhances the security measures employed by traditional financial institutions. The blockchain platform utilizes a combination of symmetric encryption, asymmetric encryption, and hashing algorithms to ensure the utmost protection of data. This multi-layered encryption approach makes it extremely difficult for hackers to gain unauthorized access to sensitive information.

In addition to strengthening existing encryption methods, Galxe also introduces innovative encryption techniques such as homomorphic encryption and zero-knowledge proofs. Homomorphic encryption allows for computations to be performed on encrypted data without decrypting it, providing an added layer of security when processing transactions. Zero-knowledge proofs, on the other hand, enable parties to prove the validity of a transaction without revealing any underlying information, ensuring confidentiality and privacy.

Furthermore, Galxe continuously updates and improves its encryption methods to stay one step ahead of emerging threats. With its dedicated team of cybersecurity experts, Galxe actively monitors the latest security trends and incorporates cutting-edge technologies into its encryption protocols. This commitment to ongoing improvement ensures that traditional financial institutions can trust Galxe to provide them with the highest level of encryption security.

| Benefits of Galxe (GAL) for Traditional Financial Institutions |

|---|

| Enhancing Encryption Methods |

| Improved Security Measures |

| Increased Efficiency and Speed of Transactions |

| Cost Reduction and Streamlined Processes |

| Enhanced Compliance and Regulatory Transparency |

Enabling Global and Instant Transactions

The introduction of Galxe (GAL) into traditional financial institutions brings several benefits, including the ability to enable global and instant transactions. One of the main challenges faced by traditional financial institutions is the time it takes for transactions to settle, especially for cross-border transfers. These delays can cause inconvenience and uncertainty for individuals and businesses.

With Galxe, transactions can be processed and settled almost instantly, regardless of geographical location. This is made possible by the decentralized nature of the Galxe network, which eliminates the need for intermediaries and allows for direct peer-to-peer transactions. The use of blockchain technology ensures transparency and security, reducing the risk of fraud and error.

Furthermore, Galxe enables global transactions by overcoming the barriers of traditional banking systems. With Galxe, individuals and businesses can send and receive money across borders seamlessly, without the need for intermediaries such as correspondent banks. This not only saves time and costs, but also makes international transactions more accessible and inclusive.

Additionally, Galxe leverages its native token, GAL, to facilitate transactions within the network. The GAL token acts as a medium of exchange and provides liquidity, enabling users to send and receive different currencies quickly and efficiently. This eliminates the need for currency conversions and reduces the associated fees and risks.

In conclusion, the integration of Galxe into traditional financial institutions brings the benefit of enabling global and instant transactions. By leveraging the decentralized nature of the Galxe network and the use of blockchain technology, transactions can be settled almost instantly, regardless of geographical location. This not only improves the efficiency of financial transactions but also enhances accessibility and inclusivity in the global financial system.

Facilitating Cross-Border Payments

One of the key advantages of Galxe (GAL) for traditional financial institutions is its ability to facilitate cross-border payments. Due to the decentralized nature of Galxe, transactions can be processed and settled faster than traditional methods.

With Galxe, traditional financial institutions can avoid costly intermediaries, such as correspondent banks, and instead directly settle transactions with other institutions on the Galxe network. This not only reduces costs but also minimizes the time required to process cross-border payments.

Moreover, Galxe offers improved transparency and security in cross-border transactions. All transactions on the Galxe network are recorded on a public ledger, which can be accessed and verified by participating institutions. This helps in reducing fraud and enhancing trust in the payment process.

Another benefit of Galxe for cross-border payments is its ability to support multiple currencies. Traditional financial institutions often face challenges when dealing with different currencies, as they need to convert between them and incur additional costs. Galxe eliminates the need for currency conversion by enabling direct transactions in various currencies, making it easier for institutions to settle cross-border payments.

Overall, Galxe plays a vital role in simplifying and streamlining cross-border payments for traditional financial institutions. Its decentralized nature, transparency, security, and support for multiple currencies make it a reliable and efficient solution for conducting international transactions. With Galxe, financial institutions can improve their operational efficiency, reduce costs, and enhance customer satisfaction in the cross-border payment process.

FAQ:

What is Galxe (GAL) and how can it benefit traditional financial institutions?

Galxe (GAL) is a cryptocurrency that offers several benefits to traditional financial institutions. It is based on blockchain technology, which provides enhanced security, transparency, and efficiency for financial transactions. GAL can streamline the process of fund transfers, eliminate intermediaries, and reduce costs for financial institutions.

How can Galxe (GAL) improve the security of traditional financial institutions?

Galxe (GAL) can enhance the security of traditional financial institutions through its use of blockchain technology. Blockchain provides a decentralized and immutable ledger that records all transactions. This makes it extremely difficult for hackers to tamper with transaction data or manipulate financial records. Additionally, GAL uses advanced cryptographic algorithms to secure transactions, protecting sensitive financial information from unauthorized access.