In today’s globalized world, the economic development of countries, especially those considered developing economies, is of utmost importance. Many factors contribute to the growth and progress of these nations, and one such factor is the adoption and utilization of innovative technologies and financial systems.

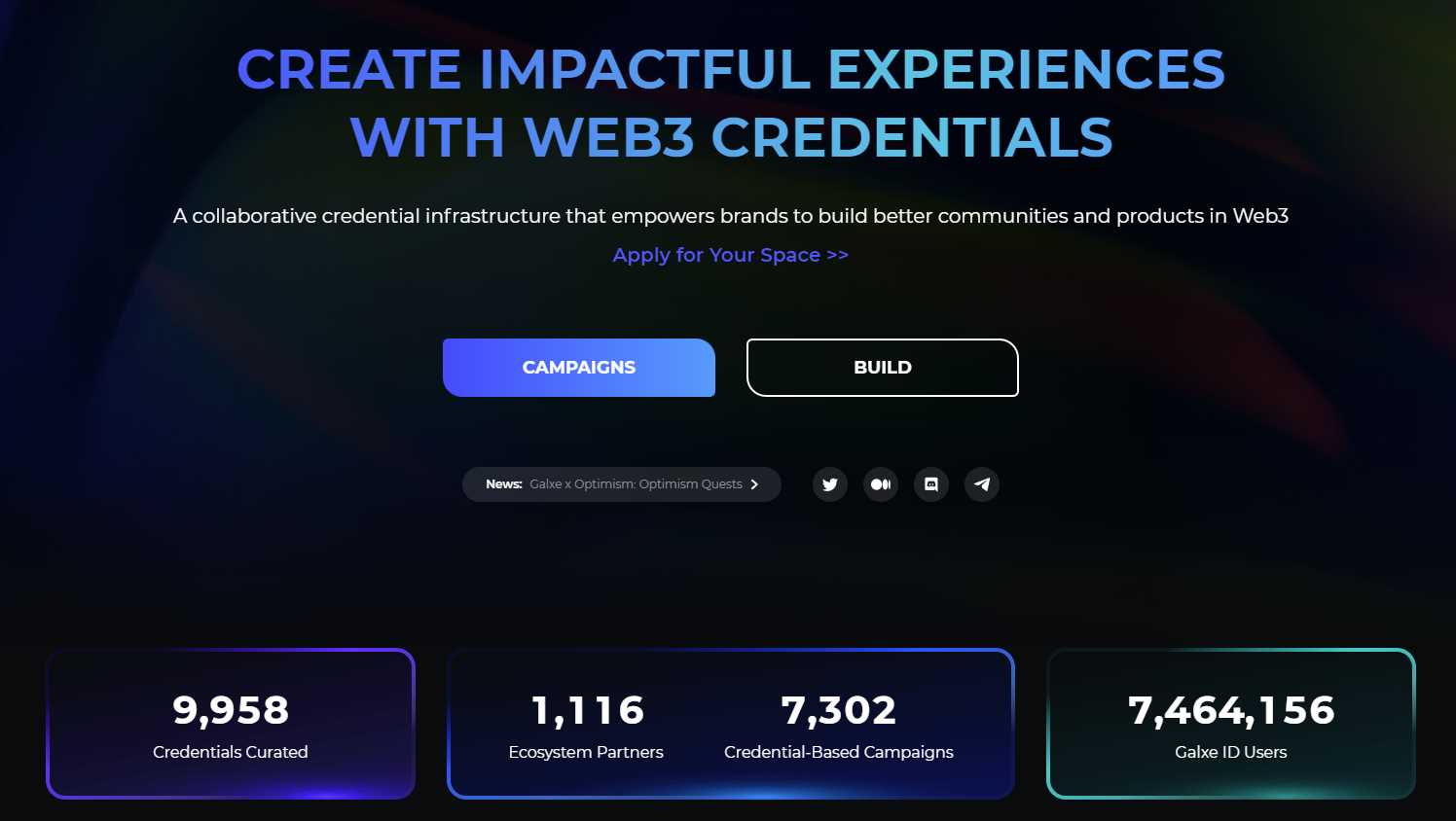

Galxe (GAL) is a revolutionary cryptocurrency that holds great potential for developing economies. The decentralized nature of Galxe empowers individuals and businesses by providing them with a secure and transparent platform to engage in financial transactions. This technology has the potential to overcome many of the barriers faced by developing economies, such as limited access to traditional banking systems and high transaction costs.

One of the main benefits of Galxe for developing economies is its ability to foster financial inclusion. By using Galxe, individuals without access to traditional banking services can participate in the global economy. This opens up a world of opportunities for individuals to save, invest, and conduct financial transactions, ultimately empowering them to improve their standard of living.

In addition, Galxe has the potential to revolutionize cross-border transactions. Developing economies often face challenges in conducting international trade due to high transaction fees and lengthy settlement times. Galxe offers a cost-effective and efficient solution to these issues, enabling businesses to engage in global trade with ease. This can lead to increased economic growth, job creation, and enhanced market access for developing economies.

Furthermore, Galxe’s underlying blockchain technology provides an immutable and transparent record of all financial transactions. This can help combat corruption and promote good governance in developing economies, fostering a more stable and sustainable economic environment.

Overall, Galxe has the potential to bring about positive change for developing economies. By fostering financial inclusion, facilitating cross-border transactions, and promoting transparency, Galxe can contribute to the economic growth and prosperity of nations striving to overcome the challenges of development.

Overview of Galxe (GAL)

Galxe (GAL) is a cryptocurrency that is gaining popularity in developing economies due to its numerous benefits and unique features. Developed with the aim of providing financial inclusion and empowerment to people in these economies, Galxe has seen widespread adoption and has become a vital tool for economic development.

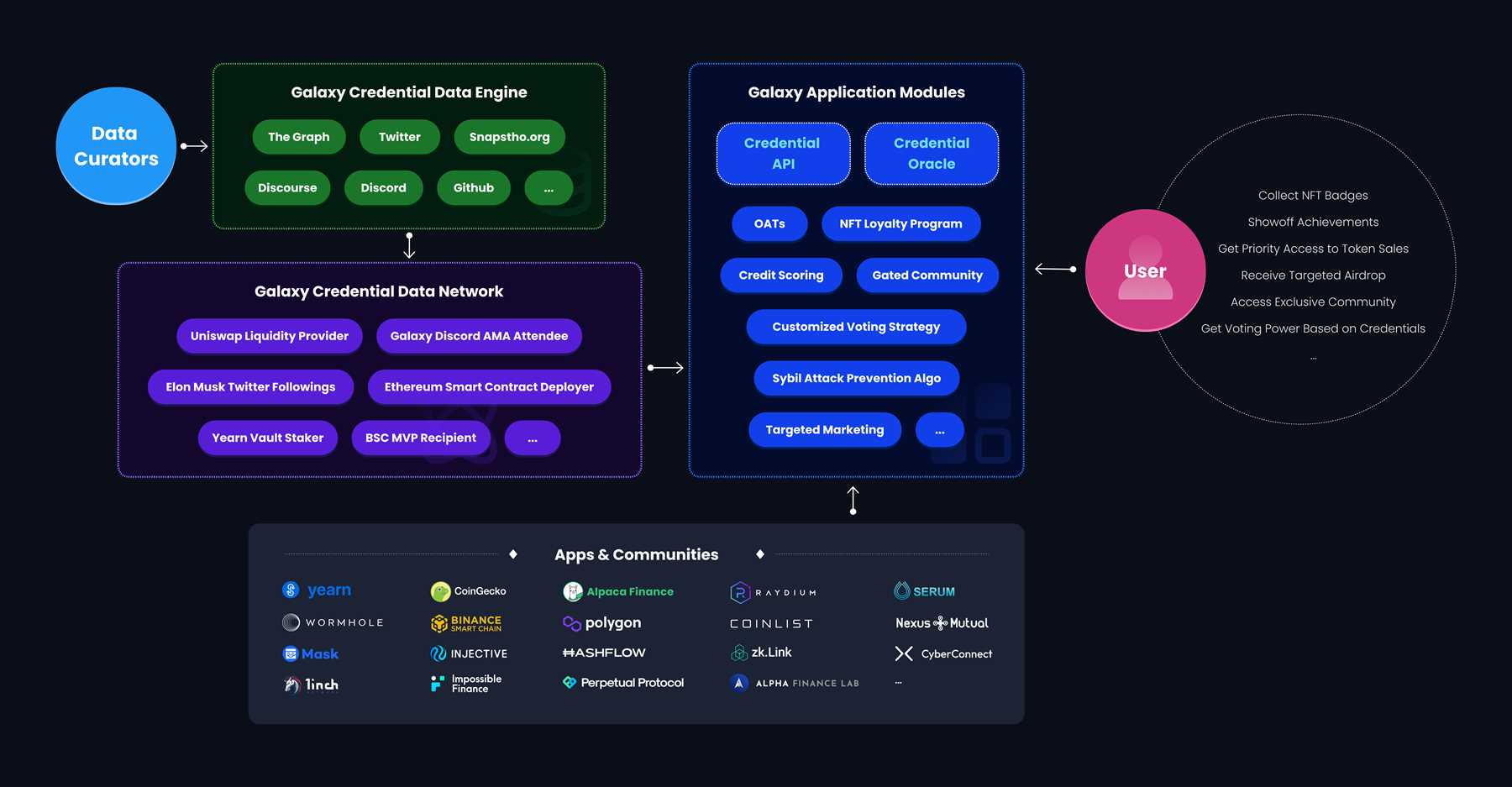

One of the main advantages of Galxe is its decentralized nature. Unlike traditional financial systems that are controlled by banks and governments, Galxe operates on a peer-to-peer network, meaning that transactions can be made directly between users without intermediaries. This not only reduces costs but also increases transparency and security, making it an ideal choice for individuals and businesses in developing economies.

In addition to its decentralized nature, Galxe offers fast and low-cost transactions. Using blockchain technology, transactions can be completed within seconds, providing a quick and efficient way to send and receive funds. This is particularly important in developing economies where the traditional banking system may be slow and expensive.

Furthermore, Galxe provides financial access to the unbanked populations in developing economies. According to the World Bank, around 1.7 billion adults worldwide do not have access to a formal banking system. Galxe aims to bridge this gap by providing a secure and accessible platform for individuals to store their wealth and engage in financial transactions.

Moreover, Galxe is designed to be scalable, ensuring that it can handle a large volume of transactions without compromising its efficiency. This makes it suitable for economies that are experiencing rapid growth and an increasing demand for financial services.

In conclusion, Galxe (GAL) is a cryptocurrency that offers numerous benefits for developing economies. Its decentralized nature, fast and low-cost transactions, financial inclusion, and scalability make it an attractive choice for individuals and businesses in these economies. As Galxe continues to gain traction, it has the potential to transform the financial landscape and drive economic growth in developing countries.

Importance of Developing Economies

Developing economies play a crucial role in the global economic landscape. These economies, characterized by emerging markets and developing countries, contribute to global growth, trade, and development. Supporting and nurturing these economies is essential for sustainable global development and reducing poverty.

There are several reasons why developing economies are important:

- Driving economic growth: Developing economies have the potential to become major contributors to global economic growth. With their young and growing populations, these economies can attract investments, create jobs, and spur innovation. Their vibrant markets offer new opportunities for businesses, both domestic and international.

- Reducing poverty: Developing economies often face significant poverty challenges. By supporting these economies, we can help lift people out of poverty and improve their quality of life. Through various initiatives such as education and infrastructure development, these economies can create a more inclusive and prosperous society.

- Promoting global trade: Developing economies are not only important as destinations for exports but also as sources of valuable resources and labor. By fostering trade relationships with these economies, countries can enhance their competitiveness, access new markets, and promote economic integration.

- Addressing global challenges: Developing economies are often at the forefront of global challenges such as climate change, healthcare, and food security. By supporting these economies, we can collectively address these challenges through knowledge-sharing, technology transfer, and collaborative efforts.

Overall, developing economies are key players in shaping the future of the global economy. It is crucial to invest in their growth and development to ensure a more prosperous and sustainable world economy.

To learn more about how Galxe (GAL) can contribute to the development of these economies, visit How to Galxe (GAL).

Enhancing Financial Inclusion

One of the key benefits of Galxe (GAL) for developing economies is the potential to enhance financial inclusion. Financial inclusion refers to the accessibility and availability of financial services to all individuals, especially those who are traditionally underserved or excluded from the formal financial system.

In many developing countries, a significant percentage of the population does not have access to basic financial services such as bank accounts, credit, and insurance. This lack of access hinders economic growth and development, as individuals and businesses are unable to save, invest, or access funds for entrepreneurship and innovation.

Galxe can help bridge this gap by providing a decentralized financial infrastructure that is accessible to anyone with a smartphone and an internet connection. Through the Galxe platform, individuals can create and manage digital wallets, securely store and transfer funds, and access a range of financial services.

This technology can be particularly beneficial for populations in remote or underserved areas, as it does not require the presence of physical banking infrastructure. Instead, Galxe leverages blockchain technology to provide an inclusive and secure financial system that is not dependent on traditional banking institutions.

Furthermore, Galxe can enable individuals to build a financial identity and credit history, which can open up opportunities for accessing loans and other financial services. This can empower individuals to start businesses, invest in education, or improve their living conditions.

Overall, by enhancing financial inclusion, Galxe has the potential to empower individuals and communities in developing economies, fostering economic growth, and reducing poverty.

Accessible Banking Services

One of the key benefits that Galxe (GAL) brings to developing economies is the accessibility of banking services. Traditional banking systems often have limited reach, especially in rural areas or remote regions, making it difficult for people to access financial services. However, with the advent of Galxe, individuals in developing economies can now enjoy greater access to banking services.

Through the Galxe network, individuals can create digital wallets that allow them to store, send, and receive GAL tokens. These digital wallets can be accessed through a mobile device or a computer with an internet connection, making it convenient for individuals to manage their finances. This accessibility is particularly crucial for those who do not have access to physical banking institutions in their vicinity.

The accessibility of Galxe extends beyond geographical limitations. Traditional banking systems often have high entry barriers, such as minimum deposit requirements or proof of employment. These barriers can exclude individuals who do not meet the criteria or who lack the necessary documentation. In contrast, Galxe provides an inclusive banking solution that is accessible to anyone with an internet connection.

Furthermore, Galxe offers a wide range of banking services, including savings accounts, loans, and remittance services. These services are designed to meet the needs of individuals in developing economies, allowing them to save, invest, and access credit when needed. This comprehensive suite of financial services empowers individuals to take control of their money and participate in the formal economy.

In conclusion, Galxe’s accessible banking services have the potential to revolutionize the financial landscape in developing economies. By providing individuals with greater access to banking services, Galxe enables them to overcome geographical and entry barriers, empowering them to manage their finances and participate in the formal economy.

Empowering the Unbanked

The Galxe (GAL) cryptocurrency has the potential to empower the unbanked population in developing economies. With traditional banking systems often inaccessible or unreliable in these regions, many individuals are unable to access basic financial services. However, the decentralized nature of Galxe allows for financial inclusion on a global scale.

By utilizing Galxe, the unbanked population can send and receive funds securely and instantly. This eliminates the need for traditional banking intermediaries and reduces transaction costs. The peer-to-peer nature of Galxe transactions ensures that individuals have full control over their finances, without relying on centralized authorities.

Furthermore, Galxe can provide a safe and accessible way for the unbanked to save and store their money. With a digital wallet, individuals can store their GAL securely and conveniently. This eliminates the need for physical cash, which can be lost or stolen. Additionally, Galxe wallets can be accessed using basic mobile phones, making it accessible to even the most remote populations.

In addition to basic financial services, Galxe can also open up opportunities for microfinancing and entrepreneurship. By using GAL as collateral, individuals can access small loans to start their businesses or invest in education and healthcare. This can help break the cycle of poverty and empower individuals to improve their own lives and communities.

The benefits of Galxe extend beyond just financial inclusion. By empowering the unbanked, Galxe can contribute to economic growth and development in developing economies. With increased financial stability and access to capital, individuals can participate in the formal economy and contribute to overall economic growth.

In conclusion, Galxe has the potential to empower the unbanked population in developing economies by providing secure, accessible, and affordable financial services. By utilizing Galxe, individuals can gain control over their finances, save securely, access microfinancing, and contribute to economic growth. Galxe is a technology that has the power to transform the lives of millions and create a more inclusive and equitable global financial system.

Reducing Financial Exclusion

Financial exclusion refers to the lack of access to financial services and products, such as banking, loans, and insurance, that are essential for economic participation and development. It is a significant issue faced by many individuals in developing economies, especially those living in rural areas or belonging to marginalized communities.

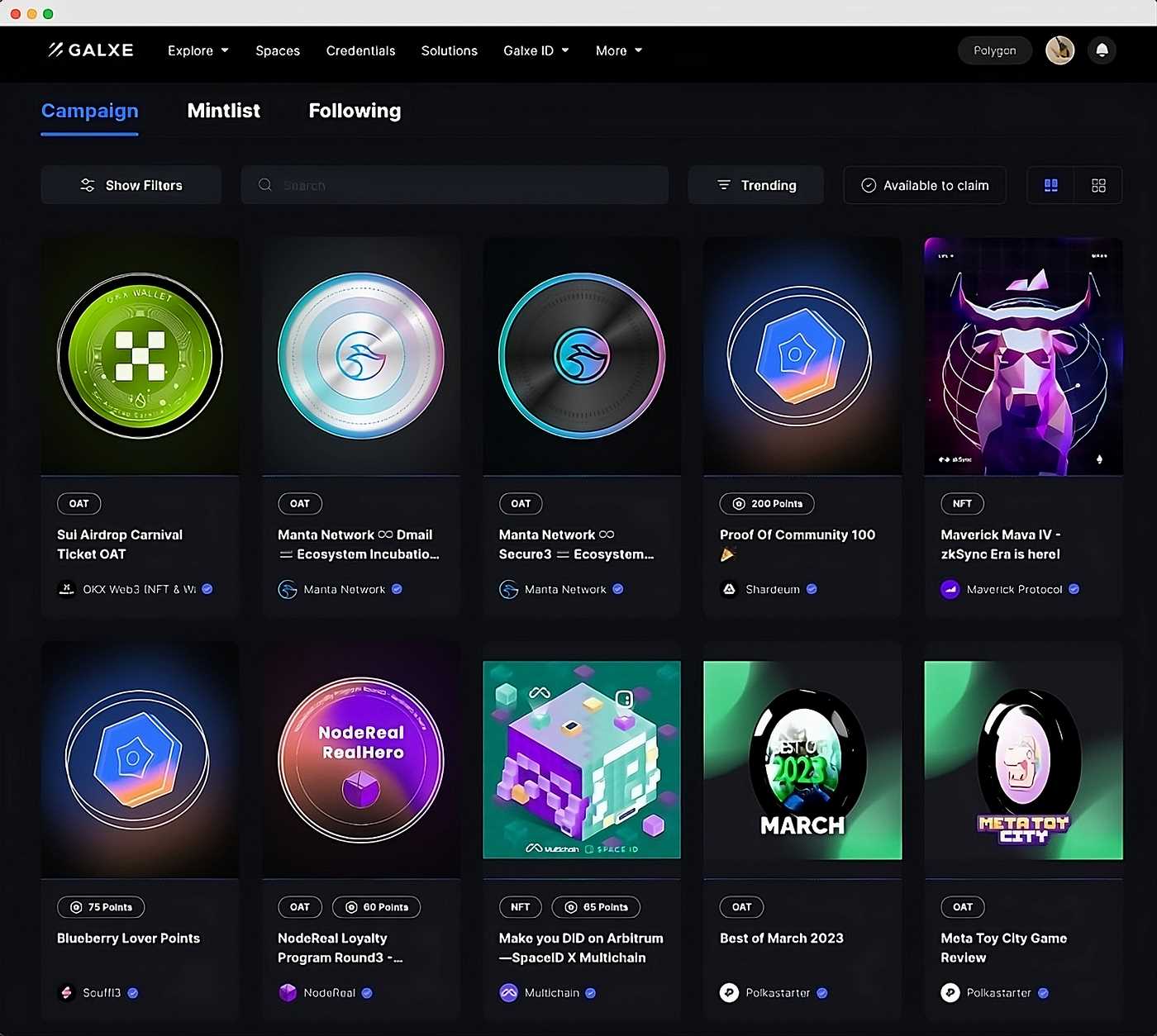

Galxe (GAL) can play a crucial role in reducing financial exclusion by providing a decentralized and inclusive financial ecosystem. Here are some ways in which Galxe can address this issue:

| 1. Access to Banking Services | With the Galxe platform, individuals who do not have access to traditional banking services can create a digital wallet and gain access to various financial services. They can store, send, and receive GAL tokens, making transactions easier and more convenient. |

| 2. Microfinancing | Galxe can enable microfinancing by connecting borrowers and lenders directly through smart contracts. This can empower individuals who lack collateral or credit history to obtain loans for their small businesses or personal needs, thereby fostering entrepreneurship and economic growth. |

| 3. Insurance Solutions | By leveraging blockchain technology, Galxe can provide affordable and accessible insurance solutions. This can protect individuals and businesses from financial risks and uncertainties, offering a safety net for those who are often excluded from traditional insurance markets. |

| 4. Financial Education and Empowerment | Galxe can facilitate financial education and empower individuals with knowledge and skills to make informed financial decisions. Through the Galxe platform, users can access educational resources, financial planning tools, and participate in community-driven initiatives aimed at improving financial literacy. |

By reducing financial exclusion, Galxe can contribute to the overall economic development and empowerment of individuals in developing economies. It has the potential to create a more inclusive and equitable financial system, where everyone has equal access to financial services and opportunities.

Promoting Economic Growth

Galxe (GAL) has the potential to significantly promote economic growth in developing economies. By leveraging blockchain technology, Galxe offers a secure and transparent platform for financial transactions, which can enhance trust and confidence in the local economy.

One of the key advantages of Galxe is its ability to enable fast and low-cost cross-border transactions. This can open up new opportunities for businesses in developing economies to engage in international trade and attract foreign investment. The seamless transfer of funds across borders reduces the cost and complexity associated with traditional banking systems, making it easier for businesses to expand their operations and participate in global markets.

In addition, Galxe can facilitate financial inclusion by providing access to basic financial services for individuals and businesses that may not have easy access to traditional banking services. With Galxe, people can have a secure and convenient way to store and transfer funds, make payments, and access other financial services. This can help empower individuals and businesses, enabling them to participate more fully in the economy and unlock their potential for growth.

Furthermore, Galxe can contribute to reducing corruption and promoting good governance. The transparency and immutability of blockchain technology make it harder for corrupt practices to go unnoticed. By enabling secure and trackable financial transactions, Galxe can help deter corruption and promote transparency in financial systems.

Overall, the adoption of Galxe in developing economies has the potential to unleash economic growth by improving access to financial services, facilitating cross-border transactions, and promoting transparency and good governance. By harnessing the power of blockchain technology, Galxe can empower individuals and businesses, driving sustainable economic development and improving livelihoods in these economies.

Supporting Small and Medium Enterprises (SMEs)

Small and Medium Enterprises (SMEs) play a crucial role in the economic growth and development of developing economies. These businesses often face numerous challenges, such as limited access to capital, lack of market information, and difficulties in finding reliable suppliers and customers.

Galxe (GAL) offers several benefits that can support SMEs and help them overcome these challenges. Here are some ways in which Galxe can benefit small and medium enterprises:

- Access to Capital: One of the primary challenges faced by SMEs is limited access to capital. Galxe can provide a decentralized financing platform through its blockchain technology, allowing SMEs to raise funds without relying solely on traditional financial institutions. This can help businesses secure the necessary capital to expand their operations, invest in new technology, and improve their competitiveness.

- Reduced Transaction Costs: SMEs often struggle with high transaction costs, especially when dealing with cross-border transactions. Galxe’s blockchain technology enables fast, secure, and low-cost transactions, eliminating the need for intermediaries and reducing transaction fees. This can significantly benefit SMEs by reducing their operational expenses and improving their overall profitability.

- Enhanced Market Access: Galxe’s decentralized marketplace can provide SMEs with access to a global network of buyers and suppliers. This can help them expand their customer base, explore new markets, and find reliable suppliers or customers. By connecting SMEs directly with potential partners and customers, Galxe can facilitate trade and business growth, creating new opportunities for SMEs to thrive.

- Transparent and Trustworthy Transactions: Trust is crucial in business transactions, especially for SMEs that may lack a well-established reputation. Galxe’s blockchain technology enables transparent and secure transactions, ensuring that all parties involved can verify and trust the integrity of the transaction. This can help SMEs build trust with their partners and customers, leading to long-term business relationships and repeat business.

- Access to Digital Services: Galxe can provide SMEs with access to various digital services, such as financial management tools, supply chain management systems, and customer relationship management platforms. These digital services can help SMEs streamline their operations, improve efficiency, and make data-driven decisions. By leveraging Galxe’s ecosystem, SMEs can enhance their capabilities and competitiveness in the digital age.

In conclusion, Galxe (GAL) offers several benefits that can support the growth and development of small and medium enterprises in developing economies. From providing access to capital and reducing transaction costs to enhancing market access and enabling trustworthy transactions, Galxe’s blockchain technology can empower SMEs and help them overcome common challenges. By leveraging Galxe’s ecosystem, SMEs can unlock new opportunities and thrive in the global marketplace.

Attracting Foreign Investments

Foreign investments play a critical role in the development of any economy. The influx of foreign capital can stimulate economic growth, create employment opportunities, and enhance domestic industries. Galxe (GAL) offers a unique opportunity for developing economies to attract foreign investments.

One of the key advantages of Galxe is its decentralized nature. Unlike traditional financial systems, Galxe operates on a blockchain network, which provides transparency, security, and immutability. This decentralized approach eliminates the need for intermediaries, such as banks or financial institutions, reducing transaction costs and increasing efficiency.

Moreover, Galxe provides a seamless cross-border payment infrastructure. Developing economies often struggle with costly and slow international transactions. With Galxe, businesses can easily receive and send payments from anywhere globally, improving the overall efficiency of financial transactions.

Another advantage of Galxe is its low transaction fees. Unlike traditional financial systems that often charge high fees for international transfers, Galxe offers affordable transaction fees. This makes it attractive for foreign investors to invest in businesses or projects within developing economies, as they can save on transaction costs and maximize their returns.

In addition, Galxe offers smart contract capabilities, which can revolutionize the way businesses operate. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This automation reduces the need for trust and intermediaries, making it easier for foreign investors to engage in business activities in developing economies.

| Benefits of Attracting Foreign Investments with Galxe: |

|---|

| 1. Transparent and secure transactions |

| 2. Affordable transaction fees |

| 3. Seamless cross-border payment infrastructure |

| 4. Smart contract capabilities for efficient business operations |

In conclusion, Galxe provides a range of benefits for developing economies to attract foreign investments. Its decentralized nature, low transaction fees, cross-border payment infrastructure, and smart contract capabilities make it an ideal platform for foreign investors looking to engage in businesses or projects within these economies. By leveraging the advantages of Galxe, developing economies can attract foreign capital, stimulate economic growth, and advance their industries.

Facilitating Cross-Border Transactions

The advent of Galxe (GAL) has brought about significant advancements in the field of cross-border transactions, particularly for developing economies. This cryptocurrency has revolutionized the process of conducting international transactions by providing a secure, fast, and cost-effective solution.

One of the key benefits of Galxe for cross-border transactions is its decentralized nature. Unlike traditional banking systems, which require intermediaries to facilitate transactions between different countries, Galxe allows for direct peer-to-peer transactions. This eliminates the need for intermediaries, reducing costs and transaction times.

In addition, the use of Galxe enables greater financial inclusion for individuals in developing economies. Traditional banking systems often have stringent requirements that make it difficult for individuals without access to the necessary documentation or infrastructure to participate in cross-border transactions. Galxe, on the other hand, is accessible to anyone with an internet connection, making it an ideal solution for those in underserved areas.

Furthermore, Galxe offers enhanced security for cross-border transactions. The blockchain technology underlying Galxe ensures that each transaction is recorded and verified, making it virtually impossible to alter or manipulate transaction data. This increased security instills trust in the system and provides a reliable platform for conducting cross-border transactions.

Another advantage of using Galxe for cross-border transactions is its speed of transaction settlement. Traditional banking systems often involve multiple intermediaries that can result in delays and longer settlement times. Galxe’s peer-to-peer nature allows for instant transactions, enabling individuals and businesses to transact with ease and efficiency.

Overall, the benefits of Galxe for facilitating cross-border transactions are numerous. Its decentralized nature, accessibility, security, and speed make it an invaluable tool for individuals and businesses in developing economies, enabling them to participate in the global economy and reap the benefits of international trade.

FAQ:

What is Galxe (GAL)?

Galxe (GAL) is a cryptocurrency that aims to provide financial inclusion and economic empowerment to developing economies. It is built on the blockchain technology, which ensures transparency and security in financial transactions.

How does Galxe benefit developing economies?

Galxe benefits developing economies in several ways. Firstly, it provides access to financial services to the unbanked population, allowing them to save, invest, and transact securely. Secondly, it promotes economic growth by facilitating trade and investment through a global and decentralized financial system. Lastly, it reduces the reliance on traditional banking systems, which often have stringent requirements and are inaccessible to many individuals and businesses in developing countries.

Can Galxe be used for remittances?

Yes, Galxe can be used for remittances. It offers a fast and cost-effective way to send money across borders, bypassing the traditional remittance channels that are often expensive and time-consuming. This is particularly beneficial for developing economies where remittances play a crucial role in supporting the local economies.

How does Galxe ensure the security of financial transactions?

Galxe ensures the security of financial transactions through the use of blockchain technology. The blockchain is a decentralized ledger that records all transactions in a transparent and immutable manner. This means that transactions cannot be altered or tampered with, providing a high level of security. Additionally, Galxe uses advanced encryption techniques to protect user data and prevent unauthorized access.