In today’s interconnected world, the need for efficient and secure global financial transactions has never been greater. As technology continues to advance at an unprecedented rate, so too do the challenges and opportunities facing the global financial system. One of the most exciting developments in this field is the rise of Global Asset Ledger (GAL) technology, which promises to revolutionize the way we conduct financial transactions across borders.

GAL is a decentralized and transparent ledger system built on blockchain technology. It enables the secure and efficient transfer of digital assets, such as cryptocurrencies, across the globe without the need for intermediaries. This means that individuals and businesses can transact directly with each other, reducing the costs and time associated with traditional financial transactions.

But GAL is not just limited to cryptocurrencies. With its ability to tokenize and transfer any type of digital asset, GAL has the potential to transform industries beyond finance. From real estate transactions to supply chain management, GAL can streamline processes and reduce the risk of fraud and error.

In addition to its technical capabilities, GAL also offers advantages in terms of security and privacy. Unlike traditional financial systems, which rely on centralized intermediaries to verify and process transactions, GAL utilizes advanced cryptographic algorithms to ensure the integrity and confidentiality of data. This makes GAL not only more secure but also more resistant to hacking and fraud.

As the world becomes increasingly interconnected, the need for a global financial system that is efficient, secure, and inclusive has become paramount. With its decentralized and transparent nature, GAL technology holds great promise in transforming the way we conduct financial transactions on a global scale. Whether it’s transferring cryptocurrencies or tokenizing digital assets, GAL is paving the way for a future where financial transactions are faster, cheaper, and more accessible to all.

What is GAL?

GAL stands for Global Asset Ledger, a decentralized platform designed to revolutionize global financial transactions. Powered by blockchain technology, GAL provides a transparent and secure environment for individuals and businesses to transfer and manage assets across borders.

By eliminating intermediaries and utilizing smart contracts, GAL ensures direct peer-to-peer transactions without the need for traditional financial institutions. This not only reduces costs and processing times but also enhances security and privacy.

With GAL, users can send and receive various types of assets, such as cryptocurrencies, digital representations of physical assets, and even traditional fiat currencies. This flexibility enables seamless cross-border transactions and promotes financial inclusion on a global scale.

GAL’s innovative features include instant settlement, immutable transaction records, and automated compliance checks. These attributes not only simplify the process but also reduce the risk of fraud and error.

Furthermore, GAL supports decentralized applications (dApps) that can be built on top of its platform. This opens up endless possibilities for developers to create and deploy innovative financial solutions that can cater to a wide range of industries and use cases.

To learn more about GAL and its potential impact on global financial transactions, you can visit the official website finance Galxe (GAL).

The Importance of Global Financial Transactions

In today’s interconnected world, global financial transactions play a pivotal role in the functioning of the global economy. These transactions involve the movement of money, goods, and services across borders, enabling businesses and individuals to engage in international trade and investment.

The importance of global financial transactions can be seen in several key aspects:

1. Facilitating International Trade:

Global financial transactions enable businesses to import and export goods and services across borders. These transactions involve the exchange of currencies, allowing companies to pay for imports and receive payments for exports. This smooth flow of funds is crucial for ensuring the continuity and growth of international trade, which contributes significantly to economic development.

2. Attracting Foreign Investment:

Efficient global financial transactions attract foreign investment. When companies can easily transfer funds across borders, it increases the confidence of foreign investors in the stability and accessibility of a country’s financial system. This, in turn, encourages greater inflows of investments, leading to job creation, technological advancements, and overall economic growth.

3. Supporting Remittances:

Global financial transactions also play a critical role in enabling the transfer of remittances, which are funds sent by individuals working abroad to their families in their home countries. These remittances serve as a vital source of income for many households in developing countries and contribute to poverty reduction and local economic development.

4. Enhancing Financial Inclusion:

Through global financial transactions, individuals and businesses gain access to a wide range of financial services, such as banking, credit, and insurance services. This inclusion in the global financial system empowers people to save, invest, and manage their finances more efficiently, ultimately raising living standards and promoting economic stability.

In conclusion, global financial transactions are not only essential for the smooth functioning of the global economy but also contribute to economic development, job creation, poverty reduction, and financial inclusion. Governments, financial institutions, and businesses must continue to work together to ensure the efficiency, security, and accessibility of these transactions to harness their full potential for a prosperous future.

The Benefits of GAL

Global Automated Ledger (GAL) offers numerous benefits in the world of global financial transactions. By leveraging blockchain technology, GAL brings enhanced security, efficiency, and transparency to financial transactions across borders.

Enhanced Security: GAL provides a secure and tamper-proof environment for financial transactions. As each transaction is recorded on the blockchain, it becomes virtually impossible for any unauthorized parties to alter the transaction details. This greatly reduces the risk of fraud and ensures the integrity of financial transactions.

Efficiency: GAL streamlines the financial transaction process by eliminating the need for intermediaries such as banks or clearinghouses. Transactions can be executed directly between parties, cutting down on processing time and reducing costs associated with intermediary fees. Additionally, GAL allows for faster settlement times, as transactions can be verified and settled in near real-time.

Transparency: With GAL, all financial transactions are recorded on a public ledger, accessible to all participants in the network. This promotes transparency and trust among participants, as they can independently verify the details of each transaction. Additionally, GAL provides an auditable trail of transactions, making it easier to detect and investigate any suspicious activities.

In conclusion, GAL offers enhanced security, efficiency, and transparency in global financial transactions. By leveraging blockchain technology, GAL revolutionizes the way financial transactions are conducted across borders, bringing numerous benefits to businesses and individuals alike.

Enhanced Security and Privacy

The development of GAL (Global Access Ledger) technology brings with it a new level of security and privacy for global financial transactions. One of the key features of GAL is its decentralized nature, which means that there is no central authority that controls the ledger. Instead, transactions are recorded and verified by a network of computers known as nodes. This decentralized approach eliminates the risk of a single point of failure and makes it more difficult for malicious actors to manipulate the ledger.

In addition to decentralization, GAL incorporates advanced cryptographic techniques to secure financial transactions. Transactions recorded on the GAL ledger are encrypted using strong encryption algorithms, making it virtually impossible for unauthorized parties to access or alter the data. The use of encryption also ensures the privacy of transaction details, protecting the sensitive financial information of individuals and businesses.

GAL also employs a consensus mechanism known as proof-of-stake (PoS) to ensure the integrity of the ledger. In PoS, nodes in the network are chosen to validate transactions based on the amount of GAL tokens they hold and are willing to “stake” as collateral. This mechanism incentivizes honest behavior and discourages malicious activity, further enhancing the security of the ledger.

Furthermore, GAL technology includes features such as multi-factor authentication and biometric verification to enhance the security of user accounts. These additional layers of authentication make it significantly more difficult for unauthorized individuals to access GAL accounts, reducing the risk of identity theft and fraud.

| Benefit | Description |

| Enhanced Fraud Protection | GAL’s decentralized nature and strong encryption techniques make it highly resistant to fraud and hacking attempts. |

| Improved Privacy | Transactions recorded on the GAL ledger are encrypted, ensuring the privacy of sensitive financial information. |

| Reduced Risk of Identity Theft | The use of multi-factor authentication and biometric verification minimizes the risk of unauthorized access and identity theft. |

| Secure Global Transactions | GAL’s advanced security features make it a reliable and secure platform for conducting global financial transactions. |

In conclusion, GAL technology offers enhanced security and privacy for global financial transactions through decentralization, advanced encryption, consensus mechanisms, and additional authentication measures. These features make GAL a robust solution for the future of global financial transactions, providing individuals and businesses with greater confidence and trust in the digital economy.

Efficiency and Speed

One of the key advantages of GAL (Global Asset Ledger) is its efficiency and speed in global financial transactions. Traditional financial systems often suffer from slow processing times and cumbersome procedures, which can lead to delays and increased costs. GAL, on the other hand, leverages blockchain technology to enable near-instantaneous settlement and reduce transaction costs.

By eliminating the need for intermediaries and central authorities, GAL streamlines the transaction process, making it more efficient and secure. With GAL, participants can transact directly with each other, eliminating the need for third-party verification and reducing the risk of fraud or errors.

Furthermore, with GAL, transactions can be processed 24/7, enabling global financial transactions to occur seamlessly across different time zones and geographical boundaries. This ensures that funds can be transferred quickly and without delay, which is especially crucial for time-sensitive transactions or cross-border payments.

| Advantages of GAL’s Efficiency and Speed | |

|---|---|

| 1. Near-instantaneous settlement | 2. Reduced transaction costs |

| 3. Streamlined process | 4. Increased security |

| 5. 24/7 availability | 6. Seamless global transactions |

Reduced Costs and Fees

One of the key benefits of utilizing GAL for global financial transactions is the potential to significantly reduce costs and fees. Traditional methods of transferring money across borders, such as wire transfers or utilizing intermediary banks, can come with high transaction fees and additional charges.

GAL, on the other hand, is designed to streamline and simplify the process of global financial transactions, reducing the need for intermediaries and minimizing associated costs. By utilizing GAL’s secure and efficient network, users can avoid high fees typically associated with traditional methods.

Additionally, GAL’s decentralized nature eliminates the need for third-party verification and processing, further reducing costs. Unlike traditional banking systems, which often rely on multiple intermediaries and manual processing, GAL’s blockchain technology enables direct peer-to-peer transactions without the need for costly middlemen.

Furthermore, GAL’s efficient and automated processes contribute to cost reduction. By leveraging smart contracts and advanced algorithms, GAL can eliminate manual errors and inefficiencies, reducing the overall cost of transactions.

Overall, by harnessing the power of GAL, users can enjoy reduced costs and fees compared to traditional methods, making global financial transactions more accessible and cost-effective.

The Impact of GAL on Global Finances

GAL, or Global Action Ledger, is transforming the way financial transactions are conducted on a global scale. With its decentralized and transparent nature, GAL brings several positive changes to the world of finance.

One of the main impacts of GAL on global finances is the reduction in transaction costs. Traditional financial systems often involve intermediaries and multiple layers of bureaucracy, leading to high fees and delays. GAL eliminates the need for intermediaries by using blockchain technology, resulting in faster and more cost-effective transactions.

Furthermore, GAL improves financial inclusivity by granting access to financial services for individuals who were previously excluded. In many parts of the world, people lack access to traditional banking services due to various reasons such as distance, lack of infrastructure, or lack of documentation. GAL addresses these challenges by providing a decentralized platform that enables anyone with an internet connection to participate in global financial transactions.

Another significant impact of GAL is in enhancing security and reducing fraud. Traditional financial systems are vulnerable to fraud and hacking, putting individuals and institutions at risk. GAL’s blockchain technology ensures a high level of security by storing transaction data on a decentralized and immutable ledger. This eliminates the need for trust in intermediaries and provides a transparent record of transactions, reducing the opportunities for fraudulent activities.

GAL also has the potential to streamline cross-border transactions and reduce the reliance on traditional banking systems. The current process of cross-border transactions involves several intermediaries, clearinghouses, and regulatory requirements, leading to delays and additional costs. With GAL’s decentralized platform, cross-border transactions can be conducted seamlessly and efficiently, reducing costs and increasing the speed of financial exchanges.

Overall, GAL is revolutionizing global finances by introducing a decentralized, transparent, and efficient system for financial transactions. The impact of GAL includes reduced transaction costs, improved financial inclusivity, enhanced security, and streamlined cross-border transactions. As GAL continues to evolve and gain adoption, its impact on global finances is expected to be even more profound.

| Benefits of GAL on Global Finances |

|---|

| 1. Reduced transaction costs |

| 2. Improved financial inclusivity |

| 3. Enhanced security and reduced fraud |

| 4. Streamlined cross-border transactions |

Increased Accessibility

One of the key benefits of GAL is the increased accessibility it offers in global financial transactions. Traditional financial systems are often hindered by barriers such as high fees, limited working hours, and bureaucratic processes that make it difficult for individuals and businesses in certain regions to access and participate in international transactions.

With GAL, these barriers are significantly reduced. The decentralized nature of GAL allows for transactions to be conducted 24/7, without the need for intermediaries or middlemen. This means that individuals and businesses can make transactions at any time, regardless of their geographical location or the time zone they are in.

In addition, GAL offers lower transaction fees compared to traditional financial systems. The absence of intermediaries and the use of blockchain technology help to eliminate unnecessary costs, making transactions more affordable for everyone.

The increased accessibility provided by GAL also benefits individuals who are unbanked or underbanked. In many parts of the world, there are still a large number of people who do not have access to basic financial services, such as bank accounts or credit cards. GAL can help bridge this gap by allowing individuals to store and transfer value using their mobile phones or other internet-enabled devices.

Furthermore, GAL’s user-friendly interface and intuitive design make it easy for individuals with limited technical knowledge to participate in global financial transactions. This means that anyone, regardless of their level of expertise, can easily send and receive payments using GAL.

In conclusion, GAL’s increased accessibility revolutionizes global financial transactions by overcoming barriers and making it easier for individuals and businesses to participate in the global economy.

Emerging Markets and Financial Inclusion

In recent years, emerging markets have become a significant focus for global financial institutions and technology companies. These markets, which include countries in Africa, Asia, and Latin America, present tremendous opportunities for growth and innovation in the financial sector.

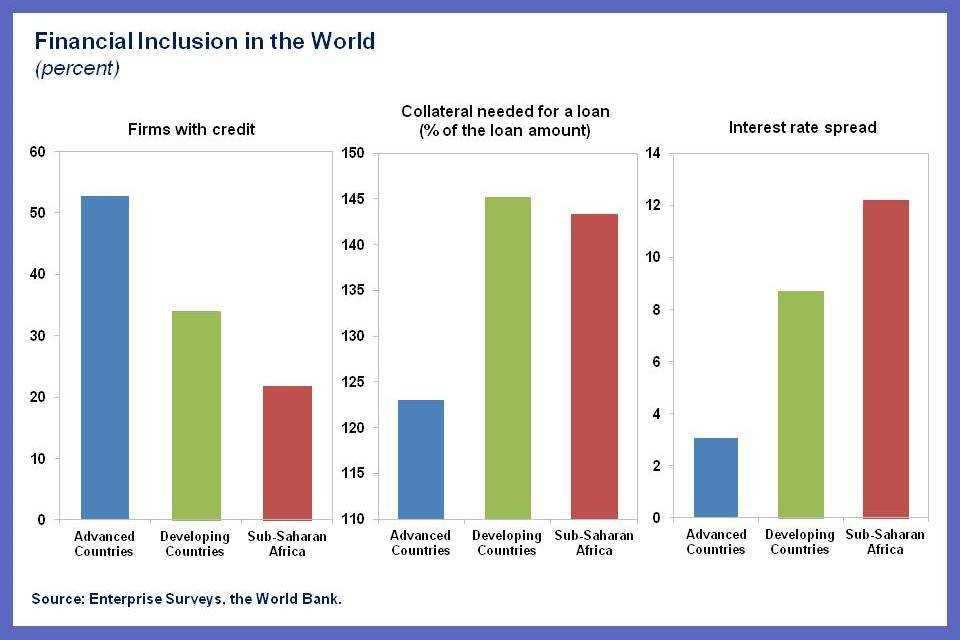

One of the key areas of focus in these emerging markets is financial inclusion. Financial inclusion refers to the process of ensuring that individuals and businesses have access to affordable and appropriate financial products and services. This includes access to basic banking services, such as savings accounts, credit, insurance, and payment services.

In many emerging markets, a significant portion of the population remains unbanked or underbanked, meaning they lack access to formal financial institutions or rely on informal alternatives. This lack of financial inclusion can hinder economic development and exacerbate inequality within societies.

However, with the rise of mobile technology and digital payments, there is a unique opportunity to bridge the financial inclusion gap in emerging markets. Mobile money services, for example, have gained widespread adoption in countries such as Kenya and Tanzania, enabling people to send and receive money, pay bills, and access other financial services using their mobile phones.

Similarly, blockchain technology and cryptocurrencies have the potential to revolutionize financial services in emerging markets. These technologies can provide secure and low-cost alternatives to traditional banking systems, enabling individuals and businesses to access financial services without the need for a physical bank account.

By leveraging these technological innovations, financial institutions and technology companies can work together to provide tailored financial solutions to the underserved populations in emerging markets. This can help drive economic growth, reduce poverty, and promote financial inclusion on a global scale.

The Future of Global Financial Transactions

In recent years, the world has witnessed a rapid evolution in global financial transactions. With the advent of new technologies, such as blockchain and artificial intelligence, the future of global financial transactions is expected to be revolutionized.

One of the most significant advancements in this regard is the emergence of Global Accounting Ledger (GAL). GAL is a decentralized ledger that allows for secure and transparent financial transactions across borders. It eliminates the need for traditional intermediaries, such as banks, and enables faster, more cost-effective, and secure transactions.

GAL is built on blockchain technology, which provides a decentralized and immutable record of transactions. This ensures that all financial transactions are recorded accurately and can be verified by all participants in real-time. Additionally, GAL incorporates smart contracts, which are self-executing agreements that automatically perform certain actions when predefined conditions are met. This further enhances the efficiency and reliability of global financial transactions.

Furthermore, GAL is powered by artificial intelligence, which enables advanced data analytics and predictive modeling. This allows for real-time risk assessment and fraud detection, minimizing the potential for financial crime. Additionally, artificial intelligence can automate various tasks, such as KYC (Know Your Customer) checks, reducing the administrative burden and improving efficiency.

The future of global financial transactions also involves greater integration with digital currencies, such as cryptocurrencies. Cryptocurrencies provide a decentralized and borderless means of transferring value, making them ideal for global transactions. As digital currencies gain wider acceptance, they are likely to play a more significant role in the global economy, further driving the evolution of global financial transactions.

In conclusion, the future of global financial transactions holds great promise. With technologies like GAL, blockchain, and artificial intelligence, we can expect faster, more efficient, and secure financial transactions on a global scale. As these technologies continue to evolve, they will reshape the way we conduct business and interact with the global financial system.

FAQ:

What is GAL?

GAL stands for Global Asset Ledger, which is a decentralized ledger technology that aims to revolutionize global financial transactions.

How does GAL work?

GAL works by using blockchain technology to create a secure and transparent ledger of financial transactions. It allows for peer-to-peer transactions without the need for intermediaries, reducing costs and increasing efficiency.

What are the benefits of using GAL for global financial transactions?

Using GAL for global financial transactions offers several benefits. First, it provides faster and more efficient transactions by eliminating the need for intermediaries. Second, it offers greater transparency and security through its decentralized ledger. Lastly, it reduces costs by eliminating expensive transaction fees associated with traditional financial systems.

What are the challenges facing the adoption of GAL for global financial transactions?

There are several challenges facing the adoption of GAL for global financial transactions. First, there is a lack of regulation and legal framework surrounding decentralized ledger technologies. Second, there may be resistance from existing financial institutions that have a vested interest in maintaining the status quo. Lastly, there is a need for widespread adoption and understanding of blockchain technology among the general public.