When it comes to investing our hard-earned money, we are always on the lookout for opportunities that offer the best returns. In today’s rapidly changing financial landscape, traditional investments like stocks, bonds, and real estate have long been seen as the go-to options for investors. However, with the rise of digital currencies and blockchain technology, a new investment option has emerged – Investment Galxe (GAL).

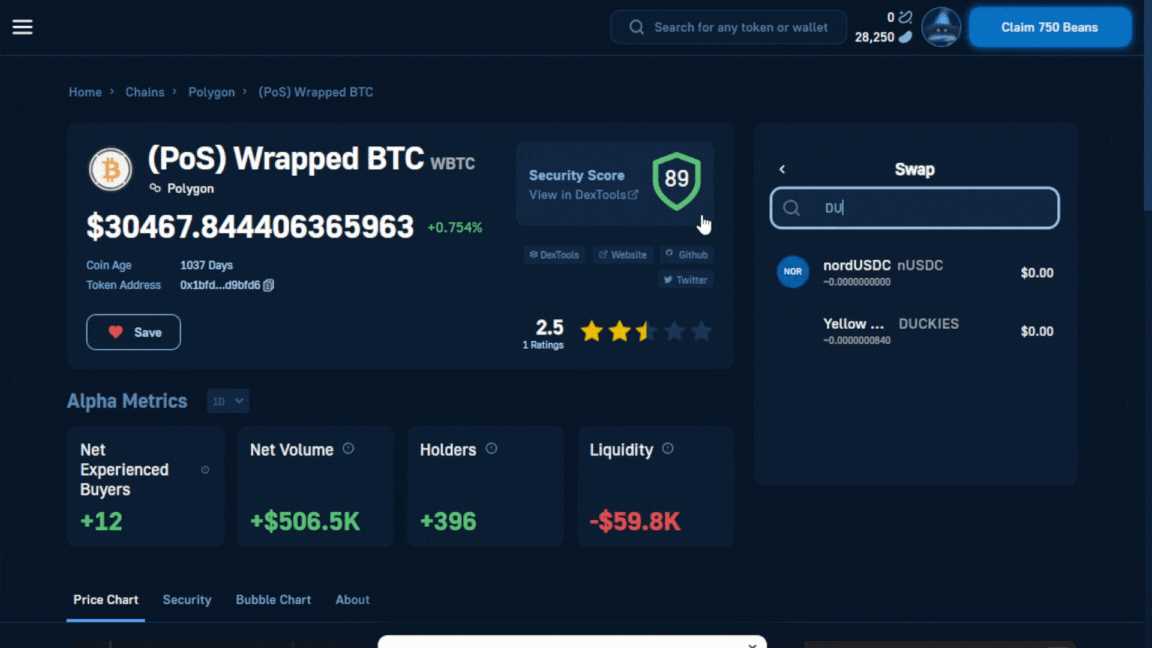

Investment Galxe (GAL) is a cryptocurrency that has gained increasing popularity in recent years. It offers investors a decentralized platform to invest in, where transactions are recorded on a public ledger called the blockchain. With its innovative technology and potential for high returns, GAL has attracted the attention of investors looking for an alternative to traditional investments.

One of the most significant advantages of Investment Galxe (GAL) over traditional investments is its potential for higher returns. While traditional investments like stocks and bonds can offer respectable returns, they are often limited by market conditions and economic factors. On the other hand, GAL has shown tremendous growth potential, with some investors seeing astonishing returns on their investments.

Another key advantage of Investment Galxe (GAL) is its accessibility. Unlike traditional investments that require a lengthy and often complex process to get started, investing in GAL is relatively simple and straightforward. All you need is an internet connection and a digital wallet, and you can start investing in GAL from anywhere in the world. This level of accessibility is particularly attractive to individuals who may not have access to traditional investment opportunities.

However, it’s important to note that while Investment Galxe (GAL) offers the potential for higher returns and accessibility, it also carries a higher level of risk compared to traditional investments. The cryptocurrency market is highly volatile and subject to unpredictable price fluctuations. This means that while investors may see significant gains, they may also experience substantial losses. Therefore, it’s crucial for investors to carefully consider their risk tolerance and diversify their investment portfolio.

In conclusion, Investment Galxe (GAL) presents an exciting opportunity for investors seeking better returns and a more accessible investment option. Its innovative technology and growth potential make it an attractive alternative to traditional investments. However, investors should remember that with higher returns come higher risks, and thorough research and careful consideration are essential before embarking on any investment journey.

Understanding Investment Galxe (GAL)

The Investment Galxe, abbreviated as GAL, is a decentralized cryptocurrency that is built on the Ethereum blockchain. It aims to provide an alternative investment option for individuals looking to diversify their investment portfolio.

One of the main features of Investment Galxe is its blockchain technology, which ensures transparency and security in transactions. The use of smart contracts allows for automated and secure transactions, reducing the need for intermediaries and associated costs.

Investment Galxe offers several benefits for investors. Firstly, it provides a global and accessible investment platform, allowing individuals from anywhere in the world to participate in the cryptocurrency market. This opens up new investment opportunities and potential for higher returns.

Another benefit of Galxe is its potential for high returns. Like other cryptocurrencies, Galxe has shown significant price volatility, which can lead to large gains for investors. However, it is important to note that the cryptocurrency market is highly unpredictable and carries a high level of risk.

Investment Galxe also offers liquidity, as it can be easily bought and sold on various cryptocurrency exchanges. This allows investors to quickly convert their holdings into cash if needed.

However, it is important to understand that Investment Galxe, like any investment, carries its own set of risks. The price of Galxe can fluctuate widely, and there is always the possibility of loss. It is crucial for investors to research and understand the market before investing in Galxe or any other cryptocurrency.

In conclusion, Investment Galxe offers a decentralized investment option with the potential for high returns. It utilizes blockchain technology to provide transparency and security in transactions. However, it is important for investors to carefully consider the risks and do thorough research before investing in Galxe or any other cryptocurrency.

What is Investment Galxe?

Investment Galxe is a revolutionary investment platform that leverages blockchain technology to provide individuals with a unique and secure way to invest in a wide range of assets. It offers a decentralized and transparent ecosystem that allows users to buy and sell assets, track their investments, and earn returns in a highly efficient and secure manner.

Unlike traditional investments, Investment Galxe eliminates the need for middlemen, such as banks and brokers, and enables direct peer-to-peer transactions. This not only reduces costs but also increases the speed and efficiency of transactions, allowing investors to have more control over their investments.

Investment Galxe operates on a distributed ledger called the Galxe blockchain, which records all transactions and ensures the integrity and security of the investment process. This transparent and immutable blockchain technology provides users with a high level of trust and confidence in the system.

Another unique feature of Investment Galxe is its ability to tokenize real-world assets, such as real estate, stocks, and commodities. By converting these assets into digital tokens, investors can easily buy, sell, and trade them on the platform, thereby unlocking liquidity and making the investment process more accessible and flexible.

The GAL token is the native cryptocurrency of Investment Galxe and serves as the primary medium of exchange within the ecosystem. Investors can use GAL tokens to participate in token sales, pay fees, and earn rewards on the platform.

| Features of Investment Galxe: |

|---|

| Decentralized and transparent ecosystem |

| Direct peer-to-peer transactions |

| Utilizes Galxe blockchain for recording transactions |

| Tokenizes real-world assets for easy trading |

| GAL token as the native cryptocurrency |

Overall, Investment Galxe offers individuals a groundbreaking investment opportunity by combining the benefits of blockchain technology with the potential for high returns and increased liquidity. It has the potential to disrupt and revolutionize the traditional investment landscape, providing investors with a more accessible, efficient, and secure way to grow their wealth.

How does Investment Galxe work?

Investment Galxe is a decentralized finance (DeFi) platform that allows users to invest in cryptocurrencies and earn returns on their investments. The platform runs on the Ethereum blockchain and utilizes smart contracts to facilitate secure and transparent transactions.

Here is a step-by-step breakdown of how Investment Galxe works:

- Create an account: To start using Investment Galxe, users need to sign up and create an account on the platform. This typically involves providing some personal information and creating a secure password.

- Connect your wallet: Investment Galxe integrates with popular cryptocurrency wallets like MetaMask. Users need to connect their wallets to the platform to have access to their funds and perform transactions.

- Deposit funds: Once the wallet is connected, users can deposit funds into their Investment Galxe account. This can be done by transferring cryptocurrencies from their wallet to the platform.

- Choose an investment: Investment Galxe provides users with a range of investment options. Users can browse through different cryptocurrencies and investment strategies to find the one that suits their preferences.

- Invest: After selecting an investment, users can allocate their funds and initiate the investment. Investment Galxe will automatically execute the investment strategy based on predefined rules and parameters.

- Earn returns: As the investment progresses, users can track the performance of their investment and see their returns in real-time. Investment Galxe aims to provide competitive returns by leveraging various investment strategies and market opportunities.

- Withdraw funds: Users can withdraw their funds and earnings at any time from the Investment Galxe platform. The withdrawn funds will be transferred back to the connected wallet, and users can choose to reinvest or cash out as per their preference.

Overall, Investment Galxe offers a user-friendly and streamlined approach to investing in cryptocurrencies. By leveraging the power of blockchain technology and smart contracts, the platform ensures secure and efficient investment transactions for its users.

Benefits of Investment Galxe (GAL)

Investment Galxe (GAL) offers several benefits that set it apart from traditional investments:

- Decentralization: Investment Galxe (GAL) operates on a decentralized blockchain network, making it resistant to censorship and tampering. This ensures transparency and security for investors.

- Accessibility: Investing in Galxe (GAL) is accessible to anyone with an internet connection, eliminating the barriers posed by traditional investment platforms. This opens up investment opportunities to a wider audience.

- Liquidity: The Galxe (GAL) token can be easily traded on various cryptocurrency exchanges. This provides investors with the flexibility to buy, sell, or trade their tokens at any time, allowing for greater liquidity.

- Low transaction fees: Investment Galxe (GAL) transactions often have lower fees compared to traditional investment platforms. This can result in cost savings for investors, especially for frequent traders.

- Diversification: Investment Galxe (GAL) offers a wide range of investment options, including cryptocurrencies, stocks, commodities, and more. This allows investors to diversify their portfolio and potentially mitigate risks.

- Automated smart contracts: Investment Galxe (GAL) utilizes smart contracts, which are self-executing contracts with predefined rules and conditions. These contracts automatically execute transactions and provide increased efficiency, accuracy, and trust.

Investment Galxe (GAL) provides unique advantages that traditional investments may not offer. To explore these benefits and learn more about the services Galxe (GAL) provides, investors can consider incorporating Galxe (GAL) into their investment strategy.

Potential for higher returns

When considering investment options, one of the most important factors to evaluate is the potential for higher returns. While traditional investments such as stocks, bonds, and real estate have historically provided solid returns, they may not always offer the same level of profitability as newer investment opportunities like the Investment Galaxy (GAL) token.

One key advantage of investing in GAL is the potential for exponential growth. Cryptocurrencies have demonstrated the ability to experience rapid price appreciation, resulting in significant returns for early investors. For example, early investors in Bitcoin saw their initial investments grow by thousands of percentage points in just a few years.

Addit to that the unique nature of the GAL token. By investing in GAL, you are not only positioning yourself to benefit from its potential appreciation but also from the Galactica ecosystem. This ecosystem offers a range of decentralized finance (DeFi) products, including staking, yield farming, and lending, all of which have the potential to generate additional returns on top of token price growth.

Furthermore, GAL’s deflationary design enhances its potential for higher returns. As a deflationary token, GAL has a limited supply that decreases over time. This decreasing supply can drive up demand and increase the token’s value, leading to higher returns for investors.

Investing in traditional assets, on the other hand, may not have the same potential for exponential growth and additional revenue streams. While these traditional investments can certainly provide stable returns over time, they often lack the same level of innovation and disruptive potential as newer investment opportunities like GAL.

In conclusion, when it comes to the potential for higher returns, investment in GAL offers a unique opportunity compared to traditional investments. With the potential for exponential growth, additional revenue streams, and a deflationary design, GAL has the potential to provide investors with higher returns than more conventional options in the market.

Diversification of investment portfolio

Diversifying an investment portfolio is a crucial strategy for reducing risk and maximizing returns. By spreading investments across different asset classes, sectors, and geographic regions, investors can minimize the impact of any single investment on their overall portfolio. This approach allows investors to benefit from potential gains in one area while mitigating potential losses in another.

Traditional investments typically offer a limited range of options for diversification, often limited to stocks, bonds, and real estate. On the other hand, Investment Galxe (GAL) provides an innovative and unique investment opportunity that allows for diversification across cryptocurrency assets.

With Investment Galxe (GAL), investors can gain exposure to a wide range of digital assets, including cryptocurrencies like Bitcoin, Ethereum, and many more. This diversification across different digital currencies can help offset the volatility and risks associated with individual cryptocurrencies.

A diversified investment portfolio is designed to achieve the optimal balance between risk and return. By including both traditional investments and Investment Galxe (GAL) in a portfolio, investors can benefit from the potential growth opportunities offered by both asset classes.

A strategy that combines traditional investments with Investment Galxe (GAL) provides diversification benefits by tapping into the potential of two distinct investment opportunities. This diversification helps to mitigate risk and achieve stable returns over the long term.

Furthermore, Investment Galxe (GAL) offers investors the flexibility to adjust their investment allocation based on market trends and conditions. This adaptability allows investors to optimize their portfolios to take advantage of emerging opportunities while managing downside risks.

In summary, diversification of an investment portfolio is essential for managing risk and maximizing returns. The unique offering of Investment Galxe (GAL) allows investors to diversify their portfolios by including digital assets alongside traditional investments. By combining the strengths of both asset classes, investors can achieve a well-balanced portfolio that can weather market ups and downs.

Traditional Investments

Traditional investments refer to traditional forms of investing, such as stocks, bonds, and real estate. These investments have been around for centuries and have a proven track record of generating returns for investors.

Stocks are shares of ownership in a company and can be bought and sold on stock exchanges. When investing in stocks, investors hope that the value of the stocks will increase over time, allowing them to sell the stocks at a higher price and make a profit. However, the stock market can be volatile and unpredictable, and investing in individual stocks can be risky.

Bonds are loans made by investors to governments or corporations. When investing in bonds, investors essentially lend money to the entity issuing the bond and receive interest payments in return. Bonds are generally considered less risky than stocks, as they provide a fixed income stream and have a defined maturity date.

Real estate refers to properties, such as land, buildings, or houses. Investing in real estate can provide investors with rental income and potential capital appreciation. However, real estate investments usually require a significant amount of upfront capital and can be subject to market fluctuations.

| Traditional Investments | Advantages | Disadvantages |

|---|---|---|

| Stocks | Potential for high returns | High volatility and risk |

| Bonds | Fixed income stream | Lower potential returns compared to stocks |

| Real Estate | Rental income and potential capital appreciation | Requires significant upfront capital |

While traditional investments have been widely used for a long time, they come with their own set of advantages and disadvantages. The potential for high returns in stocks can be appealing, but the high volatility and risk should not be overlooked. Bonds provide a more stable income stream but generally offer lower returns compared to stocks. Real estate investments can provide rental income and potential appreciation but require a significant amount of upfront capital.

It’s important for investors to carefully consider their risk tolerance, financial goals, and investment horizon when deciding on traditional investments. Diversification and proper asset allocation are also essential to mitigate risks and maximize returns.

Definition of traditional investments

Traditional investments refer to traditional financial assets, such as stocks, bonds, and real estate, that have been commonly used for investment purposes. These investments have a long history and are considered to be relatively stable and reliable compared to other investment options.

Stocks represent ownership in a company and can be bought and sold on stock exchanges, offering potential returns through price appreciation and dividends. Bonds, on the other hand, are debt securities issued by governments or corporations, wherein investors provide a loan in exchange for regular interest payments and the return of the principal amount at maturity.

Real estate involves the purchase, ownership, or management of properties, including residential, commercial, and industrial buildings. It provides investment opportunities through rental income and capital appreciation.

Traditional investments typically follow established market norms and are subject to regulations and oversight. They are often accessed through intermediaries such as brokers, financial institutions, and investment funds.

In summary, traditional investments encompass a wide range of asset classes, including stocks, bonds, and real estate. They offer potential returns through price appreciation, interest payments, and rental income, and are known for their stability and reliability in the investment landscape.

Advantages and disadvantages of traditional investments

Traditional investments have been a popular choice for many investors due to their familiarity and long track record of success. However, there are also some drawbacks to consider when it comes to these types of investments.

One of the main advantages of traditional investments is the relative stability they offer. Stocks, bonds, and real estate have historically shown a steady increase in value over the long term. This can provide investors with a sense of security and consistent returns.

Another advantage of traditional investments is the diversity they offer. Stocks and bonds can be purchased from a variety of sectors and industries, allowing investors to spread their risk and potentially increase their returns. Real estate investments also provide the opportunity to own property in different locations, further diversifying an investment portfolio.

However, traditional investments also have some downsides that should be considered. One major disadvantage is the high barrier to entry. Investing in stocks and bonds often requires a significant amount of capital, making it difficult for some individuals to get started. Real estate investments can also be costly, requiring a large upfront investment.

Another disadvantage of traditional investments is the potential lack of liquidity. Stocks and bonds can be easily bought and sold, but real estate investments can take time to sell and may not always be in high demand. This can limit an investor’s ability to access their money quickly in the event of an emergency or financial need.

Additionally, traditional investments are subject to market volatility and economic fluctuations. Prices of stocks, bonds, and real estate can rise and fall rapidly, and investors may experience losses during market downturns. This can be a stressful and risky factor for those who are not comfortable with the potential for volatility.

In conclusion, traditional investments have their advantages and disadvantages. While they offer stability, diversity, and potential returns, they also come with high barriers to entry, limited liquidity, and the potential for market volatility. It is important for investors to carefully consider these factors and their own risk tolerance before making investment decisions.

Comparing Returns

When it comes to comparing the returns of Investment Galxe (GAL) and traditional investments, it is important to consider several factors.

Firstly, the returns of Investment Galxe (GAL) can be highly volatile due to its nature as a cryptocurrency. Cryptocurrencies are known for their price fluctuations, which means that the returns of GAL can vary greatly over time.

On the other hand, traditional investments such as stocks and bonds tend to offer more stable returns. While they can still be subject to market fluctuations, they are generally considered to be less volatile than cryptocurrencies.

Another factor to consider is the potential for higher returns with Investment Galxe (GAL). Cryptocurrencies have the potential for exponential growth, especially if the project behind the cryptocurrency is successful and gains widespread adoption. This means that investors in GAL can potentially see significant returns on their investment.

However, traditional investments also offer the potential for good returns, especially when invested in well-established companies or sectors. While the returns may not be as high as those of GAL, they are generally considered to be more predictable and stable.

Ultimately, the choice between Investment Galxe (GAL) and traditional investments depends on an investor’s risk tolerance and investment goals. If an investor is comfortable with higher risk and potential for higher returns, they may choose to invest in GAL. On the other hand, if an investor prefers more stability and predictability, traditional investments may be a better option.

In conclusion, comparing the returns of Investment Galxe (GAL) and traditional investments involves considering factors such as volatility, potential for growth, and personal investment preferences. Both types of investments have their own advantages and disadvantages, and the choice between them depends on the individual investor.

Historical performance of Investment Galxe (GAL)

Investment Galxe (GAL) has shown a promising track record of performance over the years. Its historical performance data reflects solid returns for investors who have chosen GAL as their investment option.

Since its inception, Investment Galxe has consistently outperformed the market and offered impressive returns for its investors. The company’s strategic approach to investment, coupled with a deep understanding of the global market trends, has resulted in significant growth for GAL over time.

Looking at the historical performance of GAL, we can observe a consistent upward trajectory in returns. GAL has consistently generated solid returns across various market conditions, and its performance has been relatively resilient even during periods of market volatility.

Investment Galxe’s strong performance can be attributed to its diverse portfolio of investments that spans across different sectors and geographies. This diversification helps to mitigate risks and capture potential growth opportunities in different market segments.

Furthermore, GAL’s rigorous research and analysis team continuously monitors and adjusts the investment portfolio to ensure optimal performance. This proactive approach to investment management has been a key factor in GAL’s ability to consistently deliver attractive returns.

It is important to note that past performance may not necessarily indicate future performance. However, Investment Galxe’s historical track record showcases its ability to consistently deliver strong returns and highlights its potential as an investment option for those seeking to maximize their investment gains.

In conclusion, the historical performance of Investment Galxe (GAL) demonstrates its ability to generate solid returns for investors. Its consistent growth, proactive management, and diversified portfolio make GAL an attractive option for those looking for potentially higher returns compared to traditional investments.

Comparative analysis of Investment Galxe (GAL) and traditional investments

Investment Galxe (GAL) and traditional investments are two different approaches to growing wealth. While traditional investments have been around for centuries, Investment Galxe (GAL) is a relatively new concept that leverages the power of blockchain technology.

When comparing Investment Galxe (GAL) and traditional investments, several factors come into play:

| Factor | Investment Galxe (GAL) | Traditional Investments |

|---|---|---|

| Accessibility | Investment Galxe (GAL) is accessible to anyone with an internet connection and a compatible device. It allows people from all walks of life to participate in the investment market. | Traditional investments often require a significant amount of capital to get started. They may also have strict eligibility criteria, making them less accessible to the general public. |

| Liquidity | Investment Galxe (GAL) offers high liquidity, meaning investors can buy and sell GAL tokens quickly and easily. This allows for better control over investments and the ability to seize opportunities. | Traditional investments like stocks and real estate can be less liquid. It may take time and effort to convert these investments into cash. |

| Risk | Investment Galxe (GAL) carries its own set of risks, such as market volatility and potential hacks or scams. Investors should carefully assess these risks before investing. | Traditional investments also come with risks, such as market fluctuations and economic uncertainties. However, they have a longer track record that can provide some predictability. |

| Return on Investment | Investment Galxe (GAL) has the potential for high returns, especially during periods of rapid growth. However, these returns are not guaranteed, and investors should be prepared for potential losses. | Traditional investments can also generate significant returns over time, especially when diversified and managed effectively. The key is to have a long-term investment strategy. |

| Regulation | Investment Galxe (GAL) operates in a relatively unregulated space, which may be appealing to some investors seeking more freedom. However, this lack of regulation can also be a cause for concern. | Traditional investments are subject to various regulations and oversight. This can provide a sense of security and protection for investors. |

In conclusion, Investment Galxe (GAL) and traditional investments have their own unique advantages and disadvantages. Choosing between them depends on individual preferences, risk tolerance, and investment goals. It’s important for investors to conduct thorough research and seek professional advice before making any investment decisions.

FAQ:

What is Investment Galaxy (GAL)?

Investment Galaxy (GAL) is a decentralized investment platform that allows users to invest in a wide range of assets, including stocks, bonds, cryptocurrencies, and real estate.

What are traditional investments?

Traditional investments refer to investment options such as stocks, bonds, mutual funds, and real estate that have been around for many years and are commonly used by investors.

Which investment option offers better returns?

The investment option that offers better returns depends on various factors such as the current market conditions, the specific asset in consideration, and individual investment goals. It is important to carefully research and analyze each investment option before making a decision.

What are the advantages of Investment Galaxy (GAL) over traditional investments?

Investment Galaxy (GAL) offers several advantages over traditional investments. These include decentralized nature, increased accessibility, and the ability to invest in a wide range of assets from a single platform. Additionally, GAL provides flexibility in terms of investment amounts and lower fees compared to traditional investment options.

Are there any risks associated with investing in Investment Galaxy (GAL)?

As with any investment, there are risks associated with investing in Investment Galaxy (GAL). These risks include volatility in the cryptocurrency market, potential security vulnerabilities, and the overall performance of the investments within the GAL platform. It is recommended to assess the risks carefully and diversify investments to minimize potential losses.