If you’re considering Galxe (GAL) as an investment option, it’s important to carefully weigh the pros and cons before making a decision. Galxe is a relatively new cryptocurrency that has gained attention in the financial market for its potential investment opportunities. In this article, we will explore the advantages and disadvantages of investing in Galxe, helping you make an informed decision.

Pros of Investing in Galxe:

1. Potential for High Returns: Galxe has shown promising growth since its inception, with its value increasing significantly over time. Investing in Galxe can present an opportunity for high returns, especially for early adopters who bought the cryptocurrency at a lower price.

2. Increasing Popularity: Galxe has been gaining popularity among investors and traders, which can lead to greater liquidity in the market. With increased liquidity, it becomes easier to buy and sell Galxe, enhancing the overall investment experience.

3. Strong Technological Foundation: Galxe is built on a solid technological foundation, utilizing blockchain technology to ensure transparency, security, and decentralization. This strong foundation is an attractive feature for investors looking for a reliable investment option.

Cons of Investing in Galxe:

1. Volatility: Like any other cryptocurrency, Galxe is highly volatile, meaning its value can fluctuate significantly within a short period. This volatility can pose risks for investors, as it may result in substantial losses if the market takes a downturn.

2. Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and there is uncertainty regarding the future regulation of Galxe. This uncertainty can create additional risks for investors, as regulatory changes can have a significant impact on the value and legality of Galxe.

3. Competition: Galxe operates in a highly competitive market, with numerous other cryptocurrencies vying for investor attention. The competition within the cryptocurrency market can make it challenging for Galxe to stand out and attract widespread adoption.

It’s important to consider both the pros and cons of investing in Galxe before deciding to allocate your funds. While Galxe presents potential opportunities for high returns and has a strong technological foundation, the volatility, regulatory uncertainty, and competition in the market can pose risks for investors. As with any investment, thorough research and careful consideration are essential to make an informed decision.

Pros of Galxe (GAL) as an Investment Option

Investing in Galxe (GAL) has several advantages, making it an attractive option for investors. Here are some of the pros of investing in Galxe:

|

1. Potential for High Returns: |

Galxe has shown significant growth potential and has the potential to deliver high returns. Its innovative technology and strong team make it a promising investment option. |

|

2. Growing Demand: |

The demand for Galxe is growing rapidly in various industries, including finance, healthcare, and supply chain. As more companies adopt Galxe’s technology, the demand for GAL tokens is expected to increase, potentially driving up the token’s value. |

|

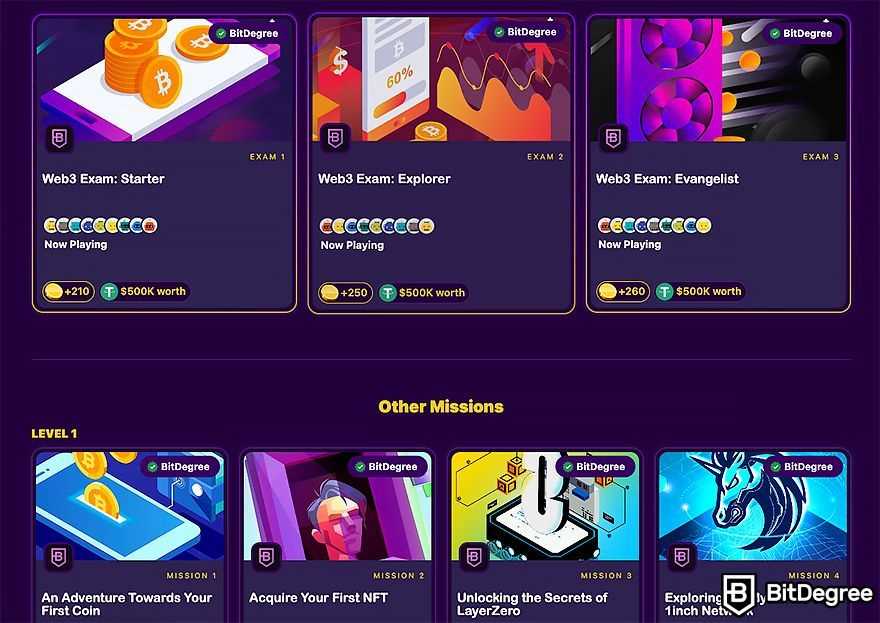

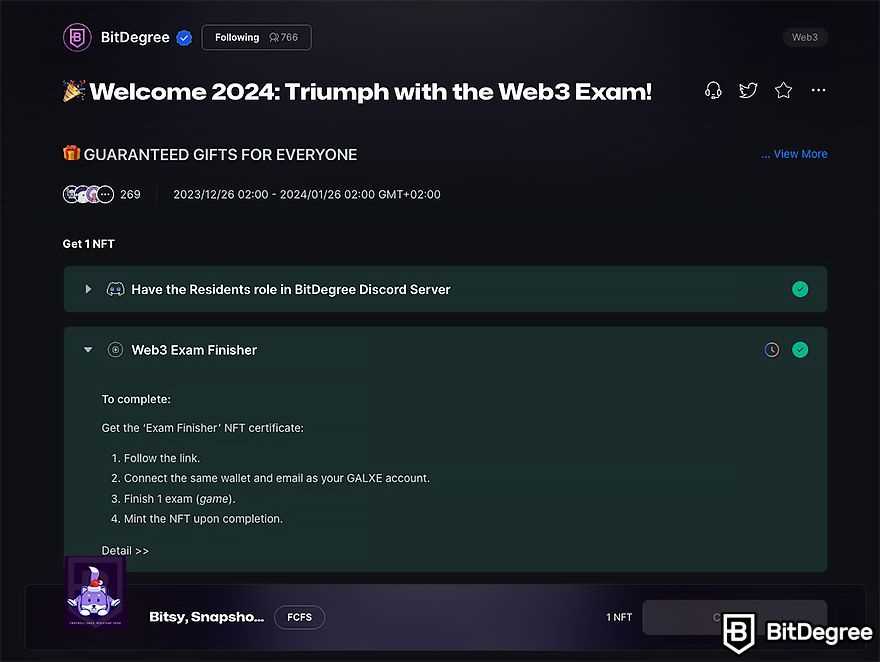

3. Utility and Use Cases: |

Galxe (GAL) has a wide range of use cases and utility within its ecosystem. The tokens can be used for transactions, staking, and participating in the governance of the network. This utility enhances the value of GAL tokens and provides additional earning opportunities for investors. |

|

4. Experienced Team: |

Galxe is backed by a team of experienced professionals who have a proven track record in the blockchain and cryptocurrency industry. Their expertise and vision provide confidence in the project’s success and make it a reliable investment option. |

|

5. Transparent and Secure: |

Galxe utilizes blockchain technology, providing transparency and security. The decentralized nature of the network ensures that transactions are tamper-proof and verifiable. This transparency and security make Galxe an appealing investment option for those seeking a reliable and trustworthy platform. |

In conclusion, Galxe (GAL) offers potential for high returns, has growing demand, provides utility and use cases, is backed by an experienced team, and offers transparency and security. These factors make Galxe an attractive investment option. To learn more about Galxe and its potential, visit Galxe’s website.

Potential for High Returns

Investing in Galxe (GAL) can offer the potential for high returns due to several factors.

1. Innovative Technology: Galxe utilizes cutting-edge technology, such as blockchain and smart contracts, which have the potential to revolutionize various industries. As the platform continues to develop and gain adoption, the value of GAL tokens may increase significantly.

2. Growing Adoption: Galxe has been gaining traction and attracting a growing user base over time. As more individuals and businesses recognize the benefits of the platform, demand for GAL tokens may rise, potentially increasing their value.

3. Limited Supply: GAL tokens have a finite supply, which means that as demand increases, the scarcity of these tokens may drive up their price. This limited supply can create a favorable environment for investors looking for high returns.

4. Potential for Mass Adoption: If Galxe achieves widespread adoption, the value of GAL tokens could skyrocket. As more users join the platform, the demand for GAL tokens will likely increase, driving their price higher and potentially resulting in significant returns for early investors.

5. Diversification: Investing in Galxe can provide diversification benefits to a portfolio. By adding GAL tokens to an investment mix, investors can spread their risk across different asset classes and potentially enhance overall returns.

Although Galxe offers the potential for high returns, it is important to remember that investing in cryptocurrencies carries inherent risks. The crypto market can be highly volatile, and the value of GAL tokens can fluctuate dramatically. It is crucial to conduct thorough research and carefully consider one’s risk tolerance before making any investment decisions.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Investing in cryptocurrencies involves risk, and individuals should carefully assess their financial situation and seek professional guidance before making any investment decisions.

Diversification

One of the key advantages of investing in Galxe (GAL) is the opportunity it provides for diversification. Diversification is the practice of spreading out investments across different assets in order to reduce risk. By diversifying your portfolio, you can potentially minimize the negative impact of any single investment on your overall wealth.

When it comes to Galxe, diversification can be achieved by investing in a range of cryptocurrencies or digital assets. This allows you to mitigate the risk associated with any one specific asset class. For example, if the value of Galxe were to decrease significantly, having other crypto investments in your portfolio could help balance out any losses.

In addition to diversifying across different cryptocurrencies, you can also diversify by investing in other types of assets such as stocks, bonds, or real estate. This further spread of investments can provide a hedge against market volatility and economic downturns, as different asset classes often react differently to changing market conditions.

It’s important to note that diversification does not guarantee profits or protect against losses, but it can be an effective risk management strategy. By allocating your investments across a variety of assets, you can potentially improve the overall stability and performance of your portfolio.

| Pros | Cons |

|---|---|

| Diversifying investments can reduce risk | May require more time and effort to manage a diversified portfolio |

| Opportunity to balance out potential losses | No guarantee of profits |

| Can provide a hedge against market volatility | Potential for missed opportunities if one asset outperforms others |

Transparent and Secure

One of the key advantages of investing in Galxe (GAL) is the transparency and security it offers. Galxe is built on blockchain technology, which provides a decentralized and transparent system for recording transactions.

Unlike traditional investment options, where the transaction history and information are often hidden or difficult to access, Galxe allows investors to view every transaction on the blockchain. This level of transparency ensures that there is no manipulation or tampering with the investment records.

In addition to transparency, Galxe also offers a high level of security. The blockchain technology used by Galxe utilizes advanced cryptographic algorithms to ensure the integrity and immutability of the transactions. Each transaction is verified and recorded on multiple nodes, making it virtually impossible for unauthorized individuals to tamper with the data.

Furthermore, Galxe implements solid security measures to protect its investors’ funds. The platform uses advanced encryption techniques to secure the wallet addresses and private keys of users. This ensures that only the rightful owner can access and control their funds, minimizing the risk of theft or hacking.

Overall, the transparency and security provided by Galxe make it an attractive investment option. Investors can have confidence in the system, knowing that their transactions are recorded in a transparent and tamper-proof manner. The use of blockchain technology and robust security measures further enhance the trustworthiness of the Galxe platform.

| Pros | Cons |

|---|---|

| Transparent transaction history | Volatility of cryptocurrency market |

| Decentralized system | Regulatory uncertainty |

| High level of security | Limited acceptance |

| Protection against manipulation | Complexity for beginners |

Cons of Galxe (GAL) as an Investment Option

While Galxe (GAL) may have some promising aspects, there are also several drawbacks to consider before investing in this cryptocurrency:

- Volatility: Galxe, like many other cryptocurrencies, is known for its volatility. The price of GAL can fluctuate significantly within a short period, which can make it a risky investment option.

- Limited Use Cases: GAL currently has limited use cases and adoption. It is primarily used within the Galxe platform and does not have widespread acceptance as a form of payment or store of value.

- Competition: The cryptocurrency market is highly competitive, and GAL faces competition from other well-established cryptocurrencies like Bitcoin and Ethereum. These established cryptocurrencies often have larger user bases and more established networks, which can make it challenging for GAL to gain traction.

- Lack of Regulatory Clarity: Cryptocurrencies operate in a largely unregulated space, and this lack of regulatory clarity can pose risks for investors. Changes in regulations or government actions can impact the value and future of GAL.

- Security Risks: Like any digital asset, Galxe carries security risks. It is susceptible to hacking, phishing attacks, and other forms of cybercrime. Investors need to take appropriate measures to secure their GAL holdings.

- Liquidity: GAL may have lower liquidity compared to more established cryptocurrencies. Lower liquidity can lead to difficulties in buying or selling GAL at desired prices, which can impact investment strategies and overall returns.

- Market Manipulation: Given the relatively small market cap and trading volume of GAL, it is vulnerable to market manipulation. This can lead to sudden price spikes or drops that may not reflect the true value of GAL.

Before investing in Galxe (GAL) or any cryptocurrency, it is crucial to thoroughly research and assess the risks involved. Investors should consider their risk tolerance, investment goals, and seek professional financial advice if needed.

Volatility

One of the key considerations when investing in any asset is its volatility. Volatility refers to the degree of variation or fluctuation in the price of an asset over time. It indicates the level of risk associated with the investment.

When it comes to Galxe (GAL), it is important to note that the cryptocurrency market is highly volatile in general. The price of GAL can experience significant fluctuations within short periods of time, which can result in both substantial gains and losses.

Volatility can be both a pro and a con for investors. On the one hand, high volatility means there is the potential for significant returns. If an investor is able to buy GAL at a low price and sell it at a higher price during a period of volatility, they may be able to make a substantial profit.

On the other hand, volatility also means there is a higher level of risk involved. The price of GAL can also experience sharp declines during periods of volatility, resulting in losses for investors. This can be particularly concerning for those with a lower risk tolerance or who are not willing to take on significant fluctuations in their portfolio.

It is important for investors to carefully consider their risk appetite and investment goals before deciding to invest in GAL or any other volatile asset. Diversifying the investment portfolio and staying updated with market trends and news can also help investors navigate the volatility associated with GAL and make informed investment decisions.

Lack of Regulation

One of the drawbacks of investing in Galxe (GAL) is the lack of regulatory oversight. As an emerging investment option, Galxe operates in a relatively unregulated market, which can expose investors to various risks and uncertainties.

Without proper regulation, there is a higher likelihood of fraudulent activities and scams within the Galxe ecosystem. Investors may fall victim to Ponzi schemes or pyramid schemes, where their investments could be lost entirely.

Additionally, the lack of regulation makes it difficult for investors to have access to reliable information and market data. Unlike traditional investment options, such as stocks or bonds, Galxe doesn’t have to disclose financial information or meet specific reporting standards.

Furthermore, the absence of regulation may hinder the development and adoption of Galxe as a mainstream investment option. Many institutional investors and financial institutions are hesitant to invest in unregulated assets due to concerns about money laundering, market manipulation, and overall stability.

While the absence of regulation could provide more flexibility and freedom for Galxe investors, it also exposes them to significant risks. It is essential for investors to thoroughly research and understand the potential risks associated with investing in an unregulated asset like Galxe before making any investment decisions.

Limited Acceptance

One of the major drawbacks of investing in Galxe (GAL) is its limited acceptance. Currently, Galxe is not widely accepted as a payment method by merchants and businesses. This limits the number of places where you can use GAL to make purchases.

Unlike popular cryptocurrencies like Bitcoin and Ethereum, which have gained wider acceptance in the market, Galxe still has a long way to go. This limited acceptance can make it challenging for GAL holders to find opportunities to use their GAL for everyday transactions.

Additionally, the limited acceptance of Galxe can also impact its liquidity. Since there are fewer avenues for spending GAL, it can be more difficult to convert GAL into fiat currency or other cryptocurrencies. This can pose challenges for investors who want to cash out their GAL holdings.

It’s important to consider this limited acceptance factor before investing in Galxe. While the potential for growth and innovation in the Galxe ecosystem is promising, the current lack of acceptance may hinder its adoption and impact its long-term value.

However, it’s worth noting that the acceptance of Galxe may improve in the future as more merchants and businesses start recognizing and adopting the cryptocurrency. This could positively impact the value and utility of GAL, making it a more attractive investment option.

FAQ:

What is Galxe (GAL) and how does it work?

Galxe (GAL) is a digital currency that operates on a decentralized blockchain network. It allows for peer-to-peer transactions without the need for intermediaries such as banks. GAL works on a proof-of-stake consensus algorithm, where users hold GAL coins in their wallets to validate transactions and secure the network.

What are the advantages of investing in Galxe (GAL)?

Investing in Galxe (GAL) has several advantages. Firstly, Galxe is an emerging cryptocurrency with great growth potential. It has a limited supply, which can drive up its value over time. Additionally, the Galxe network offers fast and secure transactions, making it a convenient option for users. Lastly, investing in Galxe allows individuals to diversify their investment portfolio and potentially earn a good return on investment.