GAL is a revolutionary DeFi (Decentralized Finance) token that aims to provide investors with a diversified portfolio of digital assets. With GAL, investors can gain exposure to a wide range of cryptocurrencies and tokens, which can help them mitigate risks and increase their potential returns.

Building a diversified DeFi portfolio is crucial for investors who want to maximize their profits while minimizing risks. By investing in a variety of digital assets, investors can spread their risk and take advantage of different opportunities in the fast-growing DeFi market.

GAL offers a unique solution for building a diversified DeFi portfolio. It is designed to provide investors with exposure to a carefully selected basket of digital assets, including cryptocurrencies, stablecoins, and tokens from various industries and use cases.

By holding GAL, investors can be confident that they have a stake in multiple projects and asset classes, reducing their reliance on any single asset. This diversification helps protect their investment and increase the potential for long-term growth.

In addition to diversification, GAL also offers investors the opportunity to earn passive income through staking. By staking GAL tokens, investors can participate in the platform’s governance and earn rewards in the form of additional GAL tokens. This allows investors to make their portfolio work for them, generating income while they hold their diversified assets.

In conclusion, building a diversified DeFi portfolio with GAL is a smart and innovative strategy for investors who want to take advantage of the fast-growing DeFi market. With GAL, investors can gain exposure to a wide range of digital assets, spread their risk, and potentially increase their returns. Furthermore, the opportunity to earn passive income through staking makes GAL an attractive option for investors looking to make their portfolio work for them.

Understanding DeFi and Its Importance

DeFi, short for Decentralized Finance, refers to a new financial system that operates on the blockchain. Unlike traditional finance that relies on centralized institutions such as banks, DeFi replaces intermediaries with smart contracts to provide financial services.

DeFi offers a range of financial products and services including lending, borrowing, trading, and investing. These services are accessible to anyone with an internet connection and can be used without the need for a middleman. DeFi is built on open protocols and is designed to be accessible, transparent, and inclusive.

One of the main advantages of DeFi is its ability to eliminate the need for trust. By using smart contracts, DeFi platforms ensure that transactions are executed automatically and without the need for intermediaries. This reduces the risk of fraud and allows for greater security and efficiency in financial transactions.

Another important aspect of DeFi is its potential for financial inclusion. Traditional financial systems often exclude large segments of the population due to various barriers. DeFi, on the other hand, allows anyone with access to the internet to participate in the financial system and access financial services.

DeFi also enables users to have greater control over their financial assets. With traditional financial systems, individuals often have limited control over their assets, as they are held and managed by trusted third parties. In DeFi, users have complete control over their assets and can interact directly with the blockchain.

The importance of DeFi lies in its potential to revolutionize the financial industry. By providing open, transparent, and accessible financial services, DeFi has the potential to democratize finance and provide equal opportunities to individuals worldwide. It has the power to disrupt traditional financial systems and empower individuals to take control of their financial future.

| Key Benefits of DeFi |

|---|

| 1. Increased financial inclusion |

| 2. Enhanced security and transparency |

| 3. Greater control over assets |

| 4. Potential for higher returns |

| 5. Enables innovation in financial services |

The Definition and Benefits of DeFi

DeFi, which stands for Decentralized Finance, refers to a financial system that operates on blockchain technology and aims to provide open and permissionless access to various financial services. Unlike traditional finance, which relies on intermediaries such as banks and other financial institutions, DeFi allows for the direct peer-to-peer transfer of assets and the execution of financial transactions without the need for intermediaries.

One of the key benefits of DeFi is its ability to provide financial services to individuals who may not have access to traditional banking services. By leveraging blockchain technology, DeFi enables anyone with an internet connection to participate in financial activities such as lending, borrowing, trading, and investing.

Another benefit of DeFi is its transparency and security. Transactions and interactions within the DeFi ecosystem are recorded on a public blockchain, making them visible and traceable to all participants. This transparency reduces the risk of fraud and provides a higher level of security compared to traditional financial systems.

Additionally, DeFi offers the potential for faster and more efficient financial transactions. By eliminating the need for intermediaries, DeFi reduces the time and cost associated with traditional financial processes. This can lead to faster settlements, lower fees, and increased accessibility for individuals and businesses.

Furthermore, DeFi opens up opportunities for innovation and experimentation in the financial sector. Developers and entrepreneurs can build and deploy decentralized applications (dApps) on existing DeFi platforms, creating new financial products and services that were previously not possible within the constraints of centralized systems.

In summary, DeFi represents a paradigm shift in the way financial systems operate. It offers open and permissionless access to financial services, promotes transparency and security, enables faster and more efficient transactions, and fosters innovation in the financial sector.

The Growing Popularity of DeFi

The world of decentralized finance (DeFi) has experienced exponential growth in recent years, becoming one of the hottest trends in the cryptocurrency industry. DeFi refers to a new financial system that operates on decentralized networks, such as blockchain, without the need for traditional intermediaries like banks or brokers.

DeFi offers a range of financial services and products, including lending, borrowing, staking, yield farming, decentralized exchanges, and more. These services are built using smart contracts and protocols, allowing users to interact directly with the system and retain full control over their funds.

One of the key drivers behind the growing popularity of DeFi is the potential for high returns on investment. Many DeFi protocols offer attractive interest rates and rewards for users who participate in lending, borrowing, or liquidity provision. This has attracted a large number of investors and traders looking to capitalize on the opportunities offered by DeFi.

Furthermore, DeFi has gained attention for its ability to provide financial services to individuals who are underserved or excluded by traditional banking systems. In many parts of the world, people have limited access to banking services, making it difficult for them to save, invest, or access credit. DeFi has the potential to democratize finance by providing open and inclusive financial services to anyone with internet access.

The growth of DeFi has also been fueled by the increasing number of decentralized applications (dApps) being built on blockchain platforms. These dApps offer innovative solutions for various financial needs, such as decentralized lending platforms or stablecoin protocols. The increasing adoption of dApps has created a virtuous cycle, driving more users to DeFi and encouraging further development of new applications.

However, with the growing popularity of DeFi, there are also risks and challenges to consider. Security vulnerabilities, smart contract bugs, and regulatory concerns are some of the issues that the DeFi industry must address to ensure the long-term success and sustainability of the ecosystem.

Overall, the growing popularity of DeFi is a testament to the demand for decentralized financial services and the potential for blockchain technology to revolutionize the way we think about finance. As more users and developers join the DeFi space, we can expect to see even more innovative solutions and a further expansion of the DeFi ecosystem.

Introducing GAL: A Promising DeFi Token

The GAL token is an exciting addition to the world of DeFi. Built on the Ethereum blockchain, GAL is designed to be a versatile and powerful asset that can be utilized in a wide range of decentralized finance applications. With its innovative features and strong community support, GAL has quickly gained attention as a promising DeFi token.

One of the key features of GAL is its ability to provide liquidity to decentralized exchanges (DEXs). By staking GAL in liquidity pools, users can earn rewards in the form of additional GAL tokens and trading fees. This incentivizes users to contribute their GAL holdings to the liquidity of the market, ensuring a healthy and vibrant ecosystem for trading.

In addition to providing liquidity, GAL token holders can also participate in governance activities. Through a process called decentralized governance, GAL holders can vote on important decisions related to the project, such as protocol upgrades or changes to tokenomics. This ensures that the community has a voice in the development and direction of GAL.

Another feature that sets GAL apart is its cross-chain compatibility. GAL is not limited to the Ethereum blockchain but can also be utilized in other blockchains through interoperability solutions. This allows GAL to tap into a wider market and benefit from the growing popularity of other blockchain ecosystems.

Furthermore, GAL has a deflationary tokenomics model, where a portion of every transaction is burned, reducing the total supply over time. This token burning mechanism creates a scarcity of GAL tokens, potentially increasing their value in the long run.

With its diverse range of features and strong community support, GAL is positioned to become a leading DeFi token. Whether it’s providing liquidity, participating in governance, or cross-chain compatibility, GAL offers a multitude of opportunities for users to engage and benefit from the decentralized finance ecosystem.

The Basics of GAL Token

GAL Token is the native utility token of the Global Asset Exchange (GAL) platform. It serves as the primary means of value exchange within the GAL ecosystem, allowing users to access various features and services.

Here are some key aspects of GAL Token:

- Token Supply: GAL Token has a total maximum supply of 1 billion tokens. This limited supply helps maintain scarcity and value.

- Token Distribution: GAL Tokens are distributed through different channels, including initial token sales, liquidity mining, and partnerships.

- Use Cases: GAL Token has several use cases within the GAL ecosystem. It can be used for trading fees, staking, voting, governance, and participation in token sales on the platform.

- Staking Rewards: GAL Token holders can stake their tokens to earn staking rewards, which incentivize long-term holding and participation in the network’s security.

- Governance: GAL Token holders can participate in governance decisions by voting on proposals and shaping the future development of the GAL ecosystem.

- Liquidity Mining: GAL Token holders can also participate in liquidity mining programs, where they provide liquidity to trading pairs and earn additional GAL Tokens as incentives.

It’s important to note that GAL Token is an ERC-20 token, meaning it is built on the Ethereum blockchain. This ensures compatibility with various Ethereum wallets and infrastructure.

Overall, GAL Token plays a crucial role in facilitating transactions, incentivizing participation, and enabling community governance within the Global Asset Exchange ecosystem.

Key Features and Use Cases

The GAL token is the native digital currency of the Wallet Galxe (GAL) platform. It offers several key features and use cases that make it an attractive option for building a diversified DeFi portfolio.

1. Governance

The GAL token holders have the power to participate in the decision-making process of the Wallet Galxe platform. They can vote on key proposals and initiatives, ensuring that the community has a say in the platform’s direction and development.

2. Staking and Rewards

Users can stake their GAL tokens to earn additional rewards. Staking provides a way to participate in the platform’s governance and earn passive income. The staking rewards are generated by transaction fees, bolstering the overall value of the GAL token.

3. Fee Discounts

GAL token holders enjoy fee discounts on transactions made through the Wallet Galxe platform. This incentivizes the use of GAL tokens for trading and other activities, creating a vibrant and active ecosystem for token holders.

4. Interoperability

The Wallet Galxe platform is designed to be compatible with other DeFi protocols, allowing users to seamlessly interact with various decentralized applications (dApps) in the ecosystem. This interoperability enhances the possibilities for GAL token holders to explore and engage with different DeFi projects.

5. Investment Opportunities

With Wallet Galxe, users can access a diverse range of DeFi investment opportunities. GAL token holders can invest in various projects and earn potential returns. The platform provides access to strategic partnerships and curated investment options, enabling users to build a well-rounded portfolio.

The Wallet Galxe (GAL) platform offers a comprehensive suite of features and use cases that empower users to participate in the vibrant DeFi ecosystem. Whether it’s staking for rewards, participating in governance, or exploring investment opportunities, GAL token holders have a range of options to strengthen their portfolio and engage with the community.

For more information on Wallet Galxe and the GAL token, visit the Wallet Galxe (GAL) official website.

The Potential of GAL in a Diversified Portfolio

When constructing a diversified DeFi portfolio, it’s important to consider the potential of GAL (Galaxy Token) and its role within the ecosystem. GAL has several unique characteristics that make it an attractive asset to include in a well-balanced portfolio.

First and foremost, GAL serves as the native token of the GALaxy platform, providing holders with various benefits and privileges. These include staking rewards, access to exclusive features, and voting rights in governance decisions. By holding GAL, investors can actively participate in the development and decision-making processes of the GALaxy platform, potentially influencing its future direction and success.

Additionally, GAL can play a crucial role in providing liquidity within the DeFi ecosystem. With GAL as a part of your portfolio, you can contribute to decentralized exchanges and provide liquidity to various DeFi protocols. This not only helps to improve the overall liquidity of the ecosystem but also allows you to earn additional returns through transaction fees and yield farming opportunities.

Another important aspect of GAL is its potential for price appreciation. As the GALaxy platform continues to grow and gain adoption, the demand for GAL is likely to increase. This increased demand, coupled with a finite supply, can contribute to the appreciation of GAL’s value over time. Therefore, by including GAL in your portfolio, you not only have the potential to earn staking rewards and transaction fees but also to benefit from capital gains.

Furthermore, GAL can act as a hedge against risks in the DeFi market. By diversifying your portfolio with GAL, you can reduce your exposure to risks associated with specific DeFi protocols or assets. The GAL token can provide a level of stability and security, helping to mitigate potential losses in other parts of your portfolio.

In conclusion, GAL has great potential within a diversified DeFi portfolio. Its various benefits, including governance participation, liquidity provision, potential price appreciation, and risk mitigation, make it a valuable asset to consider. Including GAL in your portfolio can not only provide you with additional income sources but also help in actively shaping and contributing to the GALaxy platform’s development and success.

Building a Diversified Portfolio

Building a diversified portfolio is an essential strategy for any investor, especially in the rapidly growing field of decentralized finance (DeFi). A diversified portfolio helps to mitigate risk and increase potential returns by spreading investments across different assets and asset classes.

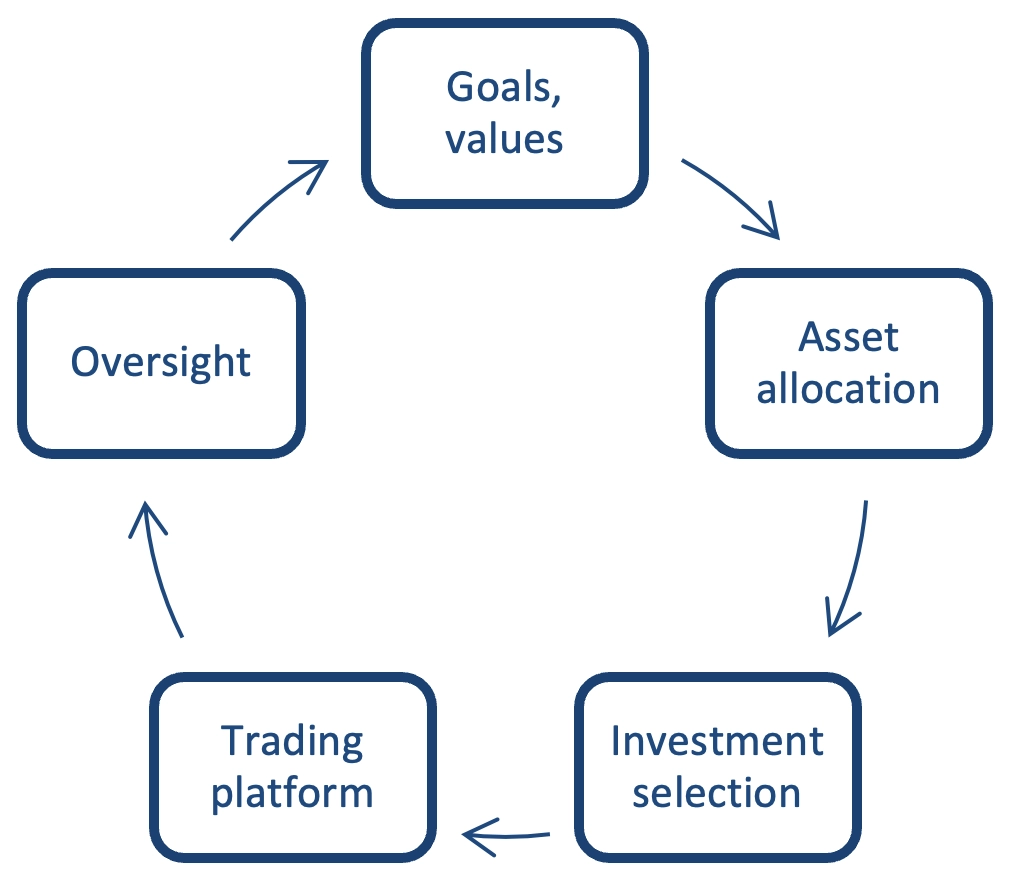

When it comes to DeFi, diversification can be achieved by investing in a variety of DeFi protocols, tokens, and assets. Here are some key steps to consider when building a diversified DeFi portfolio:

| Step | Description |

|---|---|

| 1 | Research |

| 2 | Set Investment Goals |

| 3 | Allocate Capital |

| 4 | Choose Different Asset Classes |

| 5 | Diversify Within Asset Classes |

| 6 | Monitor and Rebalance |

1. Research: Before building a diversified DeFi portfolio, it is important to conduct thorough research on the various DeFi protocols, tokens, and assets available. Understand their underlying technology, team, use cases, and market dynamics. This will help you make informed investment decisions.

2. Set Investment Goals: Determine your investment goals and risk tolerance. Are you looking for long-term growth, short-term gains, or a combination of both? Understanding your goals will guide your investment strategy.

3. Allocate Capital: Decide how much capital you are willing to allocate to your DeFi portfolio. This will depend on your overall investment portfolio and risk appetite. Make sure not to invest more than you can afford to lose.

4. Choose Different Asset Classes: Diversify your DeFi portfolio by investing in different asset classes within the DeFi ecosystem. This can include lending protocols, decentralized exchanges, yield farming protocols, stablecoins, and more. By diversifying across asset classes, you can reduce the impact of any single asset’s performance on your overall portfolio.

5. Diversify Within Asset Classes: Within each asset class, consider diversifying further by investing in multiple tokens or protocols. For example, within the lending protocol asset class, you can invest in different lending platforms or protocols to spread your risk. This will further enhance your portfolio’s resilience.

6. Monitor and Rebalance: Regularly monitor and rebalance your DeFi portfolio to ensure it aligns with your investment goals and risk tolerance. As the market conditions change, you may need to adjust your portfolio allocation to maintain diversification. Stay informed about the latest developments in the DeFi space to make informed investment decisions.

By following these steps, you can build a well-diversified DeFi portfolio that maximizes your potential returns while minimizing your risk. Remember, diversification does not guarantee profits, but it is an important risk management strategy.

Understanding the Importance of Diversification in DeFi

Decentralized Finance (DeFi) has emerged as a revolutionary force in the world of finance, promising to democratize access to financial services and eliminate the need for intermediaries. With the rise of DeFi, investors are presented with a multitude of investment opportunities and the potential for significant returns. However, it is important to understand the importance of diversification in DeFi in order to mitigate risks and maximize potential gains.

Diversification is a strategy that involves spreading investments across a variety of assets, sectors, or investment types. In the context of DeFi, diversification can mean investing in different protocols, projects, or tokens.

One of the main benefits of diversification in DeFi is risk management. By diversifying your portfolio, you reduce the concentration risk associated with investing in a single asset or protocol. In the volatile and rapidly evolving world of DeFi, it is crucial to spread your investments to minimize potential losses in case of a market downturn or protocol failure.

Furthermore, diversification can also enhance potential returns. Different assets and protocols in the DeFi space have different risk profiles and return potentials. By investing in a diversified portfolio, you can benefit from the upside of multiple assets, potentially increasing overall returns.

Moreover, diversification allows you to participate in different sectors and niches within the DeFi ecosystem. DeFi is a rapidly growing and evolving space, with new projects and protocols being launched regularly. By diversifying your investments, you can gain exposure to multiple sectors such as lending, decentralized exchanges, derivatives, or yield farming, and capitalize on the growth of different areas within DeFi.

However, it is important to note that diversification does not guarantee profits or protect against losses. It is essential to conduct thorough research and due diligence before investing in any DeFi project or token. Additionally, it is important to regularly monitor and rebalance your portfolio to ensure it aligns with your investment goals and risk tolerance.

In conclusion, diversification is a key strategy in building a successful DeFi portfolio. By spreading investments across different assets, protocols, and sectors, investors can manage risks, enhance potential returns, and capitalize on the growth of the DeFi ecosystem. However, it is crucial to approach diversification with caution and conduct proper research to mitigate potential risks.

Factors to Consider when Building a Diversified DeFi Portfolio

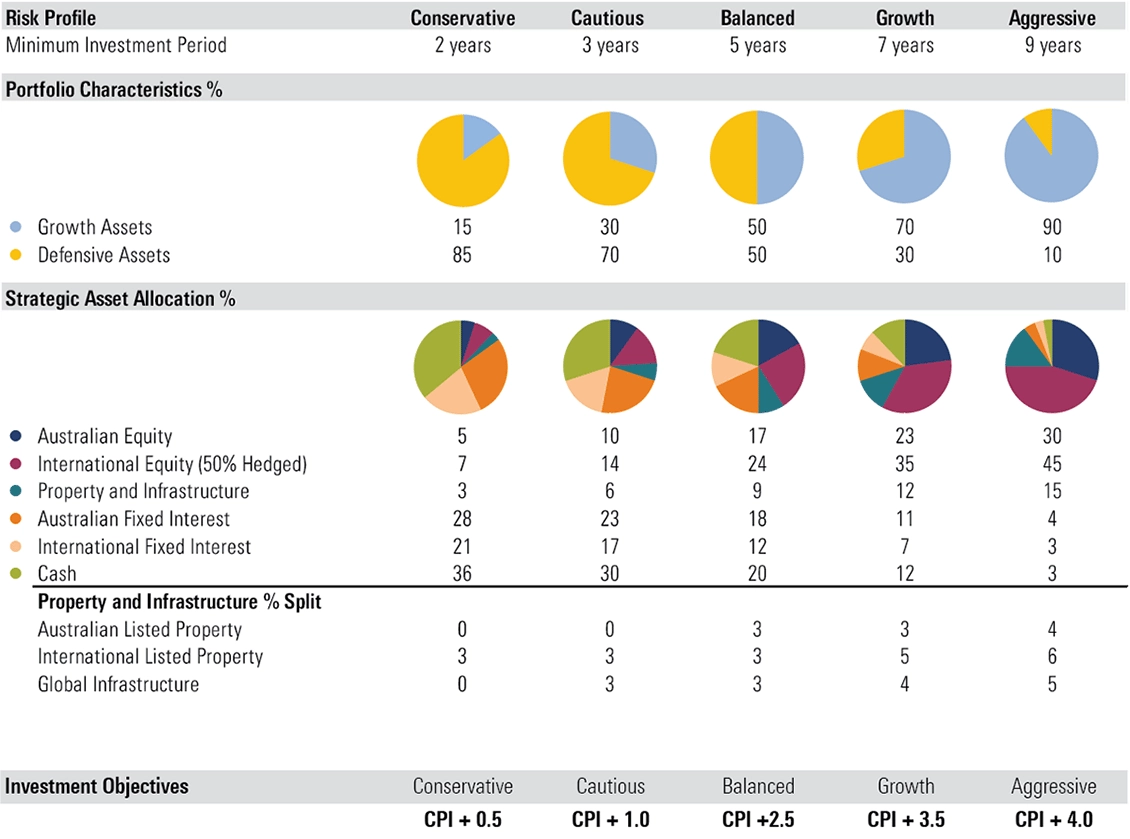

When it comes to building a diversified DeFi portfolio, there are several factors that should be taken into consideration. These factors can help investors navigate the complex and rapidly evolving world of decentralized finance, while also minimizing risks and maximizing potential returns.

1. Project fundamentals: Before investing in any DeFi project, it is important to thoroughly evaluate its fundamentals. This includes assessing the project’s team, technology, roadmap, and overall potential for success. It is crucial to invest in projects that have a solid foundation and a clear value proposition.

2. Market analysis: A comprehensive market analysis is essential when building a diversified DeFi portfolio. This includes analyzing the current state of the DeFi market, identifying emerging trends, and understanding the competitive landscape. By staying up-to-date with market developments, investors can make informed decisions and capitalize on opportunities.

3. Risk management: Managing risks is crucial in any investment strategy, and DeFi is no exception. When building a diversified DeFi portfolio, it is important to assess the risk profile of each investment. This includes evaluating the project’s security measures, conducting due diligence on smart contracts, and considering potential regulatory risks. Diversifying investments across different protocols can also help mitigate risks.

4. Liquidity and trading volume: Liquidity and trading volume play a significant role in the success of any DeFi project. When building a diversified portfolio, it is important to consider the liquidity and trading volume of each asset. Higher liquidity and trading volume can provide better opportunities for buying and selling assets, as well as reduce the risk of price manipulation.

5. Token utility and governance: Understanding the utility and governance of DeFi tokens is crucial when building a diversified portfolio. This includes assessing the role of tokens within the ecosystem, their use cases, and their potential for future growth. Additionally, understanding the governance mechanisms of each project can help investors assess the decision-making process and potential risks.

6. Asset allocation: Lastly, when building a diversified DeFi portfolio, it is important to consider asset allocation. This involves spreading investments across different asset classes, such as stablecoins, lending platforms, decentralized exchanges, and yield farming strategies. A well-allocated portfolio can help mitigate risks and take advantage of various opportunities within the DeFi ecosystem.

In conclusion, building a diversified DeFi portfolio requires careful consideration of various factors. By evaluating project fundamentals, conducting market analysis, managing risks, considering liquidity and trading volume, understanding token utility and governance, and allocating assets wisely, investors can create a portfolio that maximizes potential returns while minimizing risks.

Allocating Different Weights to Different DeFi Assets

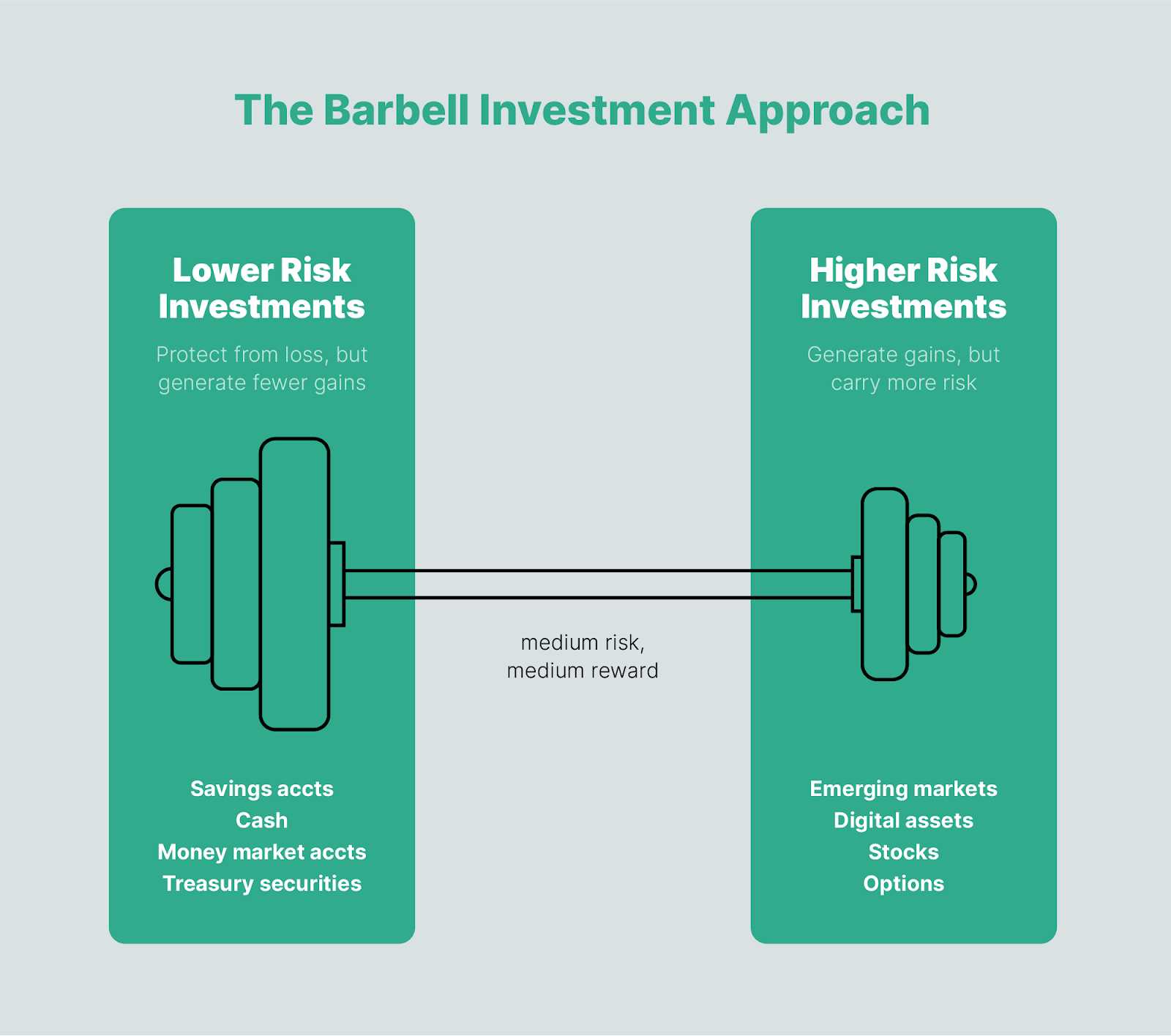

One of the key strategies for building a diversified DeFi portfolio is allocating different weights to different DeFi assets. This is important because it allows you to balance your portfolio and minimize risk.

When allocating weights, it’s crucial to consider various factors such as the potential returns, volatility, and liquidity of each asset. The goal is to distribute your investments across different assets in a way that maximizes potential gains while minimizing potential losses.

There are several ways to allocate weights to different DeFi assets. One common method is to use a percentage-based approach. For example, you might allocate 50% of your portfolio to asset A, 30% to asset B, and 20% to asset C. This allows you to have exposure to multiple assets while still maintaining a balanced portfolio.

Another approach is to allocate weights based on the risk-reward ratio of each asset. Assets with higher potential returns but also higher volatility might be given a smaller weight, while assets with lower potential returns but also lower volatility might be given a larger weight.

Additionally, you can consider diversifying your portfolio across different types of DeFi assets. For example, you might allocate weights to decentralized exchanges, lending platforms, and stablecoins. This helps to spread your risk across different sectors within the DeFi ecosystem.

It’s important to regularly review and adjust your weight allocations as the market conditions change. This ensures that your portfolio remains aligned with your investment goals and risk tolerance.

In conclusion, allocating different weights to different DeFi assets is a crucial aspect of building a diversified DeFi portfolio. It allows you to balance your investments, minimize risk, and maximize potential gains. By considering factors such as potential returns, volatility, and liquidity, you can strategically distribute your investments across various assets and sectors within the DeFi ecosystem.

Incorporating Other Promising DeFi Tokens Alongside GAL

While Galactic Coin (GAL) may be a strong DeFi token to include in your portfolio, it is important to also consider diversifying your holdings by incorporating other promising DeFi tokens. By spreading your investments across various tokens, you can mitigate risk and potentially increase your overall returns.

One promising DeFi token to consider is Stellar (XLM), which is known for its fast and low-cost transactions. Stellar has gained traction in the DeFi space due to its ability to facilitate cross-border payments and decentralized exchanges. Its strong network and partnerships make it an attractive addition to a diversified DeFi portfolio.

Another DeFi token worth considering is Aave (AAVE), which is a decentralized lending and borrowing protocol. Aave allows users to deposit their crypto assets and earn interest, as well as borrow against their holdings. With a robust ecosystem and innovative features like flash loans, Aave has established itself as a leader in the DeFi lending space.

Uniswap (UNI) is another prominent DeFi token that should be on your radar. Uniswap is a decentralized exchange protocol that enables users to trade tokens directly from their wallets. It has gained significant attention for its role in facilitating the growth of decentralized finance and has a large user base and liquidity pool.

Finally, Compound (COMP) is a DeFi protocol that allows users to lend and borrow crypto assets. With features like algorithmic interest rates and support for multiple assets, Compound has become a popular choice among DeFi enthusiasts. Its governance token, COMP, also allows holders to participate in the decision-making process of the protocol.

By incorporating other promising DeFi tokens like Stellar, Aave, Uniswap, and Compound alongside GAL, you can create a well-rounded and diversified DeFi portfolio. However, it is important to conduct thorough research and consider factors such as the token’s use case, team, and community before making any investment decisions.

Remember, diversification is key when it comes to investing in DeFi, as it helps spread risk and potentially maximize returns. Keep an eye on the evolving DeFi landscape and adjust your portfolio as needed to stay ahead in this exciting and fast-paced industry.

FAQ:

What is GAL and how does it help in building a diversified DeFi portfolio?

GAL is a decentralized finance (DeFi) protocol that aims to provide users with an easy way to build a diversified portfolio. It accomplishes this by allowing users to invest in multiple DeFi projects using a single token, GAL. By holding GAL, users gain exposure to a variety of different DeFi projects, reducing risk and increasing potential returns.

Why is diversification important in DeFi investing?

Diversification is important in DeFi investing because it helps to mitigate risk. By spreading investments across different projects, investors can reduce their exposure to any single project or asset. This can help protect against losses and increase the likelihood of generating positive returns. Diversification is a key strategy for managing risk in any investment portfolio, including those in the DeFi space.

How does GAL work to provide diversification?

GAL works by allowing users to invest in a basket of DeFi projects using a single token. When users hold GAL, they gain exposure to multiple projects within the DeFi space. This provides instant diversification, as users are not reliant on the success or failure of any one individual project. By holding GAL, users can access a range of different DeFi opportunities, reducing risk and increasing the potential for returns.

What are the benefits of using GAL to build a diversified DeFi portfolio?

There are several benefits of using GAL to build a diversified DeFi portfolio. Firstly, GAL allows users to gain exposure to multiple DeFi projects using a single token, simplifying the investment process. Additionally, because GAL represents a diversified portfolio, users can reduce risk by spreading their investments across different projects. Finally, GAL provides potential for increased returns, as users can benefit from the success of multiple DeFi projects.