Traditional banking has long been a cornerstone of the global economy, providing individuals and businesses with essential financial services. However, as technology advances and the world becomes increasingly interconnected, the traditional banking system is facing numerous challenges and limitations. From lengthy transaction times to high fees and limited accessibility, there are many reasons why people are seeking alternative solutions.

Enter Galxe (GAL), a revolutionary digital currency that is poised to disrupt the traditional banking system as we know it. Built on the principles of decentralization and transparency, Galxe offers a fast, secure, and accessible alternative to traditional banking. With Galxe, individuals and businesses can send and receive money globally in a matter of seconds, without the need for intermediaries or exorbitant fees.

One of the key features that sets Galxe apart from traditional banking is its decentralized nature. Unlike traditional banking systems that rely on a central authority to facilitate transactions, Galxe operates on a peer-to-peer network. This means that transactions are verified and recorded by a network of computers, eliminating the need for a central authority and reducing the risk of fraud or manipulation.

Another advantage of Galxe is its transparency. Every transaction made with Galxe is recorded on a public ledger called the blockchain, which is accessible to anyone. This level of transparency ensures that all transactions are visible and verifiable, providing a higher level of trust and security compared to traditional banking systems.

In conclusion, Galxe (GAL) is setting out to disrupt the traditional banking system by offering a fast, secure, and transparent alternative. With its decentralized nature and transparent transactions, Galxe provides individuals and businesses with a new way to manage their finances, free from the limitations and challenges of traditional banking. As technology continues to advance, it’s clear that Galxe is at the forefront of the digital currency revolution, paving the way for a more inclusive and accessible financial future.

The Rise of Galxe (GAL)

Galxe (GAL) is a disruptive force in the traditional banking system. With its innovative approach and use of blockchain technology, Galxe is reshaping the way we think about finance and banking.

One of the main reasons for the rise of Galxe is its emphasis on decentralization. Unlike traditional banks, which rely on a centralized system, Galxe operates on a peer-to-peer network. This means that transactions are verified by a network of computers, rather than a single institution.

This decentralization not only increases security and transparency, but it also allows for greater financial inclusion. With traditional banks, many people, especially those in developing countries or marginalized communities, have limited access to banking services. Galxe aims to change that by providing a platform that is accessible to anyone with an internet connection.

Another factor contributing to the rise of Galxe is its low fees and fast transaction times. In the traditional banking system, fees can be high and transactions can take days to be completed. Galxe, on the other hand, offers low transaction fees and near-instantaneous transfers. This makes it an attractive option for individuals and businesses alike.

Furthermore, Galxe is not only disrupting the traditional banking system, but it is also challenging the status quo of the financial industry as a whole. With its use of blockchain technology, Galxe is providing an alternative to traditional financial institutions, one that is more transparent, secure, and accessible.

As the popularity and adoption of Galxe continue to grow, it is clear that the rise of Galxe is changing the way we think about banking and finance. With its decentralized nature, low fees, and fast transactions, Galxe is offering a viable alternative to the traditional banking system, one that has the potential to revolutionize the financial industry for years to come.

What is Galxe (GAL)?

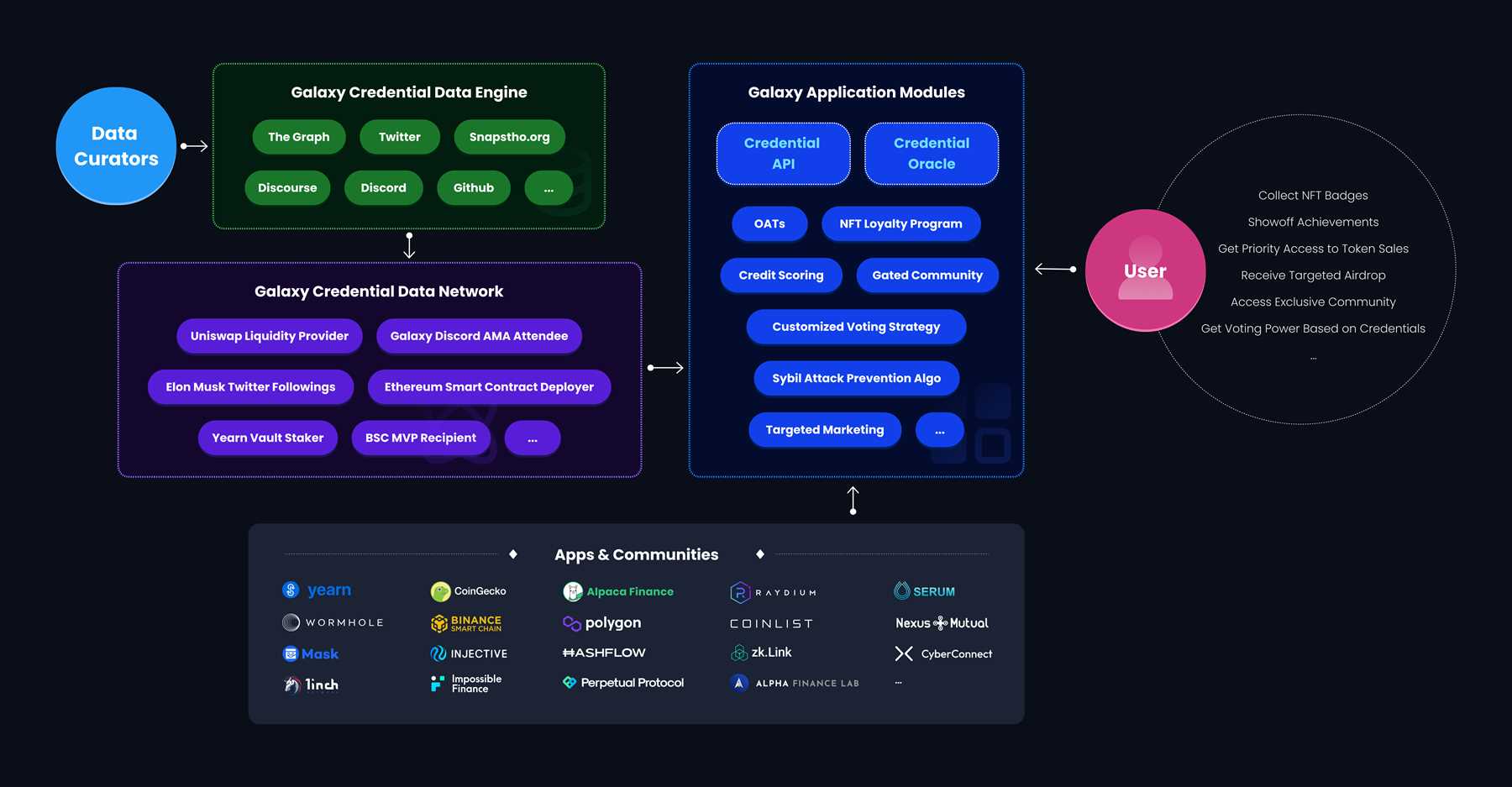

Galxe (GAL) is a digital currency and decentralized payment system that aims to disrupt the traditional banking system. It is built on blockchain technology, which provides security, transparency, and immutability.

Galxe enables fast and low-cost transactions across borders without the need for intermediaries, such as banks. This makes it ideal for people who want to send money internationally or make cross-border payments.

One of the key features of Galxe is its peer-to-peer network, which allows users to transact directly with each other. This eliminates the need for a central authority, like a bank, to process and verify transactions. Instead, transactions are validated by a network of computers, or nodes, that participate in the Galxe network.

Galxe also aims to provide financial inclusion to the unbanked population. According to the World Bank, an estimated 1.7 billion people around the world do not have access to formal banking services. Galxe aims to bridge this gap by providing a digital payment solution that can be accessed by anyone with a smartphone and internet connection.

Additionally, Galxe is designed to be secure and resistant to hacking or fraud. Transactions on the Galxe network are secured using cryptographic techniques, and the decentralized nature of the network makes it less vulnerable to hacking attacks.

In summary, Galxe is a digital currency and payment system that aims to disrupt the traditional banking system by providing fast, low-cost, and secure transactions. It is built on blockchain technology and aims to provide financial inclusion to the unbanked population.

How Galxe (GAL) Works

Galxe (GAL) is a cryptocurrency that is disrupting the traditional banking system by providing a decentralized and transparent alternative for financial transactions. Here is how Galxe works:

- Peer-to-Peer Network: Galxe operates on a peer-to-peer network, meaning that transactions are directly between users without the need for intermediaries such as banks. This enables faster and more efficient transactions.

- Blockchain Technology: Galxe utilizes blockchain technology to ensure security, transparency, and immutability of transactions. Each transaction is recorded on a public ledger and cannot be altered, providing trust and reliability.

- Mining: Like many other cryptocurrencies, Galxe is mined through a process called proof-of-work. Miners use computational power to solve complex mathematical problems, and in return, they are rewarded with GAL coins.

- Smart Contracts: Galxe also supports smart contracts, which are self-executing contracts with predefined conditions. These contracts are automatically enforced once the conditions are met, eliminating the need for intermediaries or trust issues.

- Decentralization: Galxe is decentralized, meaning that it is not controlled by any central authority or government. This gives users full control over their funds and eliminates the risks associated with traditional banking systems.

In conclusion, Galxe (GAL) works by leveraging peer-to-peer networks, blockchain technology, mining, smart contracts, and decentralization to provide a disruptive alternative to the traditional banking system. By enabling secure, transparent, and efficient financial transactions, Galxe is revolutionizing the way we think about money and banking.

The Problems with Traditional Banking System

The traditional banking system has long been plagued by a variety of issues that hinder its efficiency and limit its accessibility to certain groups of people. These problems include:

- Limited accessibility: Traditional banks are often concentrated in urban areas, making it difficult for individuals living in remote or rural areas to easily access their services.

- High fees: Traditional banks charge high fees for various services, such as ATM withdrawals, overdrafts, and international transactions, making basic banking services costly for many individuals.

- Slow processing times: Traditional banks usually have lengthy processing times for transactions, making it inconvenient for customers who need immediate access to their funds.

- Limited transparency: Traditional banks often lack transparency in terms of their fee structures and interest rates, leaving customers confused and vulnerable to hidden charges.

- Lack of privacy: Traditional banks require extensive personal information and documentation for account opening, putting customers’ privacy at risk.

- Inadequate financial inclusion: Many individuals, especially those in developing countries or with low incomes, are excluded from the traditional banking system due to requirements such as minimum balance thresholds or credit checks.

These problems have created a demand for alternative banking solutions that address these issues. Galxe (GAL) is one such disruptive technology that aims to revolutionize the banking industry by providing accessible, low-cost, and transparent financial services. By leveraging blockchain technology and peer-to-peer networks, Galxe aims to democratize banking and empower individuals worldwide to take control of their finances. With Galxe, users can enjoy fast transactions, low fees, privacy, and financial inclusion. For more information, you can visit analytics Galxe (GAL).

Lack of Transparency

One of the major problems with traditional banking is the lack of transparency. Customers often have difficulty understanding the fees and charges associated with their accounts, and it can be challenging to keep track of how transactions are processed and recorded.

With Galxe (GAL), this lack of transparency is eliminated. The blockchain technology that underpins Galxe ensures that all transactions are recorded on a distributed ledger, which is accessible to anyone. This means that customers can easily verify the details of their transactions and track the movement of their funds.

In addition, Galxe operates on a decentralized network, which means that there is no central authority controlling the system. This eliminates the potential for corruption and fraud, as all transactions are verified and recorded by a network of participants.

| Traditional Banking | Galxe (GAL) |

|---|---|

| Opaque fee structure | Transparent fee structure |

| Difficulty tracking transactions | Easy verification and tracking of transactions |

| Centralized control | Decentralized network |

By addressing the lack of transparency in the traditional banking system, Galxe is revolutionizing the way people manage their finances. With Galxe, customers can have confidence in the accuracy and reliability of their financial transactions.

High Fees and Hidden Charges

One of the main problems with traditional banking systems is the high fees and hidden charges that customers often have to deal with. When it comes to simple transactions such as transferring money or making payments, banks can charge exorbitant fees, which can significantly eat into the customer’s funds.

In addition to high fees, many banks also impose hidden charges that customers may not be aware of until they receive their monthly statement. These hidden charges can include ATM fees, overdraft fees, account maintenance fees, and foreign transaction fees, among others.

Furthermore, traditional banks may also engage in deceptive practices, such as offering low-interest rates on loans or credit cards, but then charging hidden fees and penalties that offset any potential savings. This lack of transparency can leave customers feeling frustrated and distrustful of the banking system.

| High Fees | Hidden Charges |

|---|---|

| Exorbitant fees for simple transactions | ATM fees, overdraft fees, account maintenance fees, foreign transaction fees |

| Deceptive practices | Low-interest rates with hidden fees and penalties |

By utilizing blockchain technology, Galxe (GAL) aims to disrupt the traditional banking system by providing a more transparent and cost-effective alternative. With Galxe, users can enjoy lower transaction fees and avoid hidden charges, allowing them to keep more of their hard-earned money.

Additionally, Galxe offers a decentralized and secure platform, giving users more control over their funds and reducing the risk of fraud or unauthorized access to their accounts. This level of trust and security is crucial in today’s digital age, where financial data and personal information are often at risk.

In conclusion, the high fees and hidden charges associated with traditional banking systems can be frustrating for customers. However, with Galxe’s innovative approach to banking, users can experience a more transparent, cost-effective, and secure financial ecosystem.

Slow and Inefficient Processes

Traditional banking systems are notorious for their slow and inefficient processes. Whether it’s opening a new account, applying for a loan, or making a simple transaction, customers are often faced with long wait times and tedious paperwork. This can be frustrating and time-consuming.

One of the main reasons for these slow processes is the reliance on outdated technology and manual input. Banks typically use legacy systems that were built many years ago and have been patched and updated over time. These systems are often cumbersome and prone to errors, requiring manual intervention and multiple checks. As a result, even simple tasks can take hours or even days to complete.

Furthermore, the traditional banking system involves multiple intermediaries and layers of bureaucracy. For example, when applying for a loan, customers need to go through various stages, including credit checks, document verification, and approval from multiple parties. Each step requires coordination and communication between different departments and individuals, adding unnecessary delays to the process.

This slow and inefficient nature of traditional banking not only inconveniences customers but also hinders innovation and growth in the financial sector. It limits the ability of banks to respond quickly to changing market conditions or introduce new products and services.

However, Galxe (GAL) is disrupting this traditional banking system by leveraging blockchain technology. With Galxe, processes that used to take days or weeks can now be completed in minutes or even seconds. The decentralized nature of blockchain eliminates the need for intermediaries and streamlines communication, resulting in faster and more efficient transactions.

In addition, Galxe’s smart contracts automate many of the manual tasks involved in traditional banking, reducing the chances of errors and increasing operational efficiency. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically execute transactions when predefined conditions are met, eliminating the need for manual intervention and reducing processing times.

By eliminating the slow and inefficient processes of traditional banking, Galxe is revolutionizing the industry and empowering customers with a more seamless and convenient banking experience.

Galxe’s Solution

Galxe is disrupting the traditional banking system by providing a decentralized and secure alternative for financial transactions. With its innovative blockchain technology, Galxe offers a revolutionary solution that eliminates the need for intermediaries and allows for faster and more cost-effective transactions.

One of the key features of Galxe’s solution is its peer-to-peer network, which enables direct transactions between users without the need for a central authority. This ensures that transactions can be conducted quickly and securely, while also reducing fees and commissions associated with traditional banking systems.

Galxe’s solution also provides transparency and security through its blockchain technology. Each transaction is recorded on the blockchain, making it immutable and tamper-proof. This ensures that all transactions are secure and can be verified by anyone on the network.

In addition, Galxe offers a range of financial services that are traditionally provided by banks, such as loans, savings accounts, and investments. These services are accessible to anyone with an internet connection, without the need for a traditional bank account.

Furthermore, Galxe’s solution is designed to be accessible to people in underserved regions who may not have access to traditional banking services. With Galxe, individuals can easily send and receive money, access financial services, and participate in the global economy.

In conclusion, Galxe’s solution disrupts the traditional banking system by providing a decentralized and secure alternative for financial transactions. With its peer-to-peer network, blockchain technology, and range of financial services, Galxe is revolutionizing the way we conduct financial transactions and opening up access to financial services for individuals worldwide.

| Key Features | Benefits |

|---|---|

| Decentralized peer-to-peer network | Direct, fast, and cost-effective transactions |

| Blockchain technology | Transparency and security |

| Range of financial services | Accessible to anyone with an internet connection |

| Global accessibility | Enables participation in the global economy |

Blockchain Technology

Blockchain technology, the underlying technology behind cryptocurrencies like Galxe (GAL), is revolutionizing the traditional banking system. It is a distributed ledger technology that allows for secure and transparent transactions without the need for intermediaries.

One of the key features of blockchain technology is its decentralized nature. Instead of relying on a central authority like a bank to verify and process transactions, blockchain technology allows for peer-to-peer transactions. This eliminates the need for intermediaries and reduces transaction costs.

Another important aspect of blockchain technology is its immutability. Once a transaction is recorded on the blockchain, it cannot be altered or tampered with. This increases trust and security in the system, as transactions are transparent and cannot be manipulated.

Blockchain technology also enables faster and more efficient cross-border transactions. Traditional banking systems often involve multiple intermediaries and can take days or even weeks to process international transactions. With blockchain technology, transactions can be processed in a matter of minutes or even seconds.

Moreover, blockchain technology can also provide financial services to the unbanked population. Many people around the world do not have access to traditional banking services due to various reasons. Blockchain technology allows for the creation of decentralized financial systems that can provide financial services to the unbanked population.

Overall, blockchain technology has the potential to disrupt the traditional banking system by providing secure, transparent, and efficient financial transactions. Galxe (GAL) is at the forefront of this disruption, leveraging blockchain technology to create a decentralized banking system that offers benefits to both individuals and businesses.

Decentralization and Peer-to-Peer Transactions

The traditional banking system is based on a centralized authority, such as a government or a financial institution, that controls and regulates all financial transactions. However, Galxe (GAL) is disrupting this system by introducing the concept of decentralization and peer-to-peer transactions.

Decentralization means that there is no central authority controlling the transactions. Instead, transactions are validated and recorded on a distributed ledger, called a blockchain, which is maintained by a network of computers (nodes). This ensures transparency, security, and immutability of the transactions, as all participants in the network have access to the same information.

Peer-to-peer transactions, also known as P2P transactions, allow individuals to directly interact and transact with each other without the need for intermediaries. In the traditional banking system, intermediaries such as banks or payment processors facilitate the transactions between individuals. With Galxe, individuals can transact directly with each other, eliminating the need for intermediaries and reducing transaction costs.

The decentralization and peer-to-peer nature of Galxe’s platform provides several benefits. Firstly, it increases financial inclusion by allowing individuals who are unbanked or underbanked to access financial services. People in remote areas or developing countries, where traditional banking services are limited or unavailable, can participate in the global financial system through Galxe.

Secondly, decentralization and peer-to-peer transactions enhance security and privacy. Since transactions are recorded on a blockchain, which is immutable and transparent, it becomes difficult to alter or manipulate transaction records. Additionally, users maintain control over their own financial information and are not required to share it with a centralized authority.

Lastly, the removal of intermediaries reduces transaction fees and speeds up transaction settlement times. In the traditional banking system, intermediaries charge fees for their services, which can significantly reduce the amount of money individuals receive or pay in transactions. With Galxe, individuals can save money and time by directly transacting with each other.

In summary, Galxe is disrupting the traditional banking system by introducing decentralization and peer-to-peer transactions. This innovative approach increases financial inclusion, enhances security and privacy, and reduces transaction costs. As the adoption of blockchain technology continues to grow, the impact of Galxe and similar platforms on the traditional banking system is likely to become even more significant.

Smart Contracts and Automation

One of the key features that sets Galxe apart from traditional banking systems is its utilization of smart contracts and automation. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This means that once the conditions of the contract are met, the contract will automatically execute and enforce itself.

Galxe leverages the power of smart contracts to streamline and automate various banking processes. For example, when a customer applies for a loan, the terms and conditions are coded into a smart contract, removing the need for manual review and approval by multiple parties. Instead, the contract automatically verifies the borrower’s eligibility and disburses the funds once the conditions are met.

This automation not only speeds up the process but also eliminates the potential for human error or bias. By removing the need for intermediaries and relying solely on the code, Galxe ensures a more efficient and fair banking experience for its users.

Moreover, Galxe’s use of smart contracts extends beyond lending. It also enables automated payment transfers, asset management, and compliance monitoring. By utilizing blockchain technology, Galxe ensures the transparency and security of these transactions, further enhancing customer trust.

In conclusion, the integration of smart contracts and automation in Galxe’s banking system revolutionizes the traditional banking industry. By removing intermediaries, streamlining processes, and ensuring transparency, Galxe provides a more efficient and secure banking experience for its users.

The Benefits of Galxe (GAL)

Galxe (GAL) offers a range of benefits that are disrupting the traditional banking system. These benefits include:

- Decentralization: Galxe operates on a decentralized network, meaning that it is not controlled by a central authority or institution. This eliminates the need for intermediaries, such as traditional banks, and allows for secure and direct transactions.

- Transparency: With Galxe, all transactions are recorded on the blockchain and can be viewed by anyone. This transparency ensures that all transactions are secure and can be easily verified.

- Security: Galxe utilizes advanced encryption techniques to secure transactions and protect users’ funds. The decentralized nature of the network also makes it less vulnerable to hacking or fraud.

- Lower Fees: Traditional banks often charge high fees for various transactions, such as wire transfers or currency conversions. Galxe offers lower fees, allowing users to save money on their transactions.

- Global Reach: With Galxe, users can send and receive funds globally, without the need for traditional banking systems. This allows for faster and more efficient cross-border transactions.

- Financial Inclusion: Galxe aims to provide financial services to the unbanked and underbanked populations around the world. Its decentralized nature and accessibility make it easier for individuals who do not have access to traditional banking services to participate in the global financial system.

These benefits make Galxe a disruptive force in the traditional banking system, offering a more secure, transparent, and accessible alternative for financial transactions.

FAQ:

What is Galxe?

Galxe is a decentralized finance (DeFi) platform built on blockchain technology that aims to disrupt the traditional banking system by providing users with a more secure, transparent, and accessible financial ecosystem.

How does Galxe disrupt the traditional banking system?

Galxe disrupts the traditional banking system by leveraging blockchain technology to create a decentralized financial ecosystem. This removes the need for intermediaries such as banks, allowing users to directly access and manage their funds. Additionally, Galxe offers lower fees, faster transactions, and increased transparency compared to traditional banking.

What advantages does Galxe offer over traditional banking?

Galxe offers several advantages over traditional banking. Firstly, it provides users with greater control over their funds, as they can securely manage their assets without relying on a third party. Secondly, Galxe offers faster and more efficient transactions, reducing the time and costs associated with traditional banking. Lastly, Galxe promotes financial inclusion by providing access to financial services to individuals who are unbanked or underbanked.

Is Galxe safe and secure?

Yes, Galxe is designed to prioritize the safety and security of user funds. It utilizes blockchain technology, which provides a high level of encryption and transparency. Additionally, Galxe implements robust security measures, such as multi-factor authentication and cold storage for storing user assets.

Can anyone use Galxe?

Yes, Galxe is designed to be accessible to anyone with an internet connection. It aims to promote financial inclusion by providing financial services to individuals who are unbanked or underbanked.