Traditional financial systems have long been dominated by centralized institutions and intermediaries that control the flow of money. However, the rise of blockchain technology has paved the way for decentralized alternatives that offer greater transparency, security, and efficiency. One such disruptive force is Galxe (GAL), a cryptocurrency that is revolutionizing the way we think about money and financial systems.

Galxe operates on a decentralized network powered by blockchain technology, which means that transactions are verified and recorded by a network of computers rather than a central authority. This eliminates the need for intermediaries such as banks and payment processors, reducing costs and speeding up transaction times. The use of cryptography also ensures the security and integrity of transactions, making Galxe a highly secure and reliable form of digital currency.

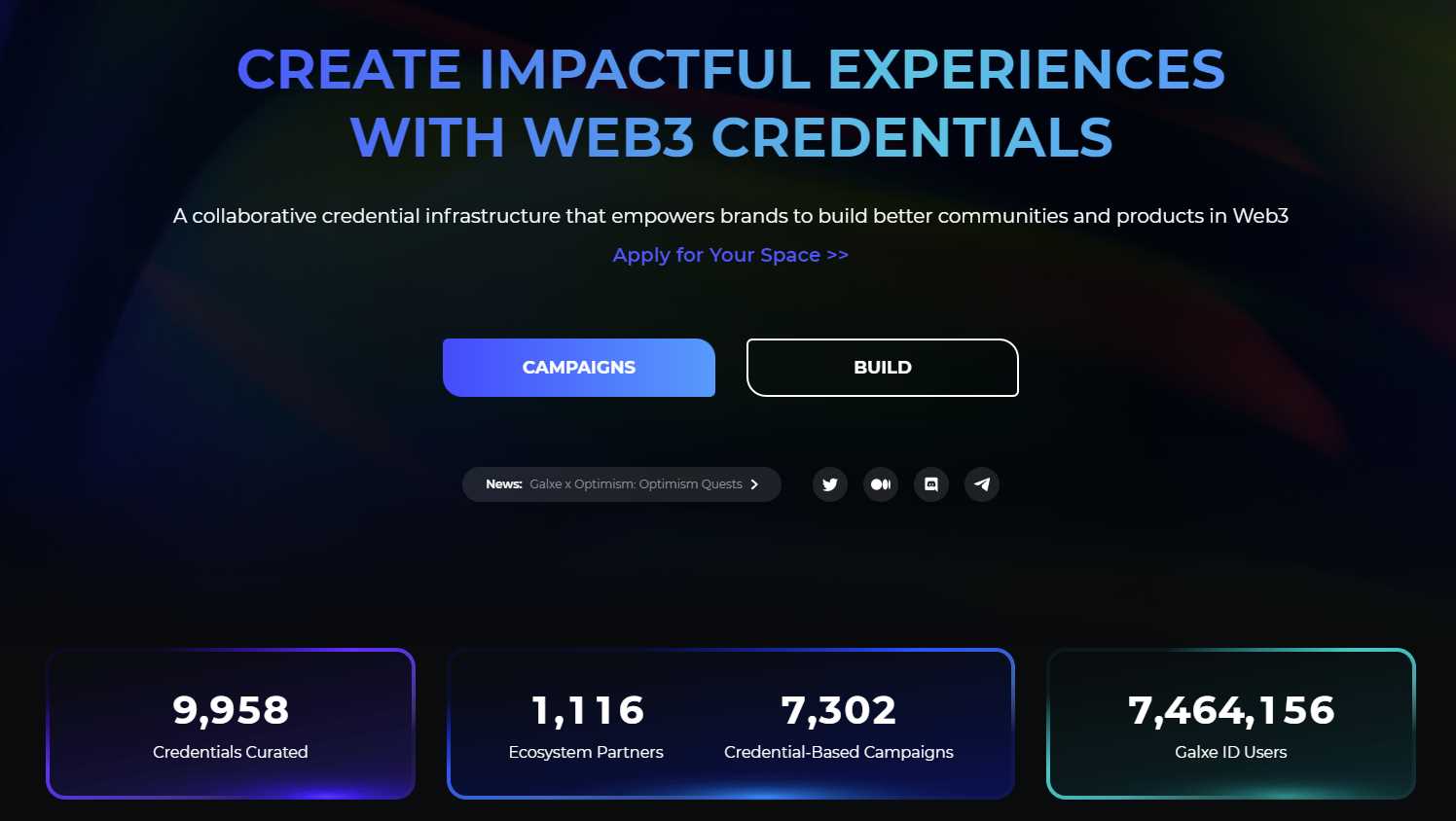

But what sets Galxe apart from other cryptocurrencies is its mission to disrupt traditional financial systems. While Bitcoin and other cryptocurrencies have gained popularity as alternative forms of currency, Galxe aims to go beyond that. The Galxe platform offers a range of financial services, including lending, borrowing, and investment opportunities, all of which can be accessed and managed directly through the Galxe ecosystem.

One of the key advantages of the Galxe platform is its inclusivity. Traditional financial systems often exclude marginalized communities and individuals who lack access to basic financial services. However, with Galxe, anyone with an internet connection can participate in the financial ecosystem and access the same services and opportunities as anyone else. This has the potential to empower individuals and communities who have been left behind by traditional financial systems.

In conclusion, Galxe is disrupting traditional financial systems by offering a decentralized, transparent, and inclusive alternative. With its secure and efficient blockchain technology, Galxe is revolutionizing the way we think about money and opening up new possibilities for financial empowerment. Whether it’s lending, borrowing, or investing, Galxe is giving individuals the power to take control of their own financial future.

Galxe: Revolutionizing Financial Systems

Galxe (GAL) is a groundbreaking blockchain-based cryptocurrency that is revolutionizing traditional financial systems. It offers a secure, decentralized, and efficient method of conducting financial transactions, making it a game-changer in the industry.

One of the key features of Galxe is its ability to disrupt traditional financial systems by providing individuals with full control over their finances. Unlike traditional banks where users have to rely on intermediaries to access and manage their funds, Galxe allows users to be their own bank.

With Galxe, users can send and receive funds globally in a matter of seconds, eliminating the need for expensive and time-consuming cross-border transactions. This makes it an ideal solution for businesses and individuals who need to make international payments quickly and cost-effectively.

In addition to its fast and low-cost transactions, Galxe also offers farmers the opportunity to earn passive income through the process of staking and farming GAL tokens. By participating in Galxe’s farming program, individuals can stake their GAL tokens and earn rewards, further incentivizing the growth of the Galxe ecosystem.

To get started with farming Galxe (GAL), individuals can visit the official Galxe website at Farming Galxe (GAL). Here, they can find detailed information on how to participate, the current farming opportunities, and the rewards they can earn.

| Key Features: | Advantages: |

|---|---|

| Decentralized | Full control over finances |

| Fast and low-cost transactions | No reliance on intermediaries |

| Global accessibility | Earn passive income through farming |

Overall, Galxe is disrupting traditional financial systems by providing individuals with a secure, efficient, and decentralized solution for their financial needs. Through its innovative features and opportunities for passive income, Galxe is changing the way we think about money and putting the power back into the hands of the people.

Understanding the Need for Disruption

Traditionally, financial systems have been monopolized by centralized institutions that operate on a hierarchical structure. These institutions hold complete control over the flow of money and dictate the rules and regulations governing financial transactions.

However, over time, it has become evident that this system is riddled with inefficiencies, limitations, and disparities. The fees and transaction costs imposed by these institutions make financial services inaccessible to a large portion of the population, particularly those in developing countries. Additionally, the centralized nature of these systems poses significant security risks, as they are prone to hacking, fraud, and corruption.

GALXE (GAL) is disrupting these traditional financial systems by leveraging blockchain technology and decentralization. By eliminating the need for intermediaries, GALXE enables direct peer-to-peer transactions, slashing transaction costs and increasing efficiency.

Furthermore, GALXE embraces financial inclusivity, making financial services accessible to individuals who were previously excluded from the traditional financial system. Through its decentralized nature, GALXE empowers individuals by giving them complete control over their assets and transactions.

Moreover, GALXE’s integration of smart contracts ensures the automation and enforcement of transactions, eliminating the need for third-party intermediaries. This not only increases trust and security but also reduces the risk of fraud and corruption.

In conclusion, the need for disruption in traditional financial systems is clear. GALXE is revolutionizing the industry by leveraging blockchain technology and decentralization to create a more efficient, accessible, and secure financial system for all individuals.

The Rise of Galxe

Galxe (GAL) is quickly gaining recognition as a disruptive force in traditional financial systems. Created as a decentralized, peer-to-peer network, Galxe offers a new approach to financial transactions, aiming to replace the outdated and inefficient systems that have dominated the industry for decades.

Galxe’s rise can be attributed to several key factors. First, its blockchain technology provides a secure and transparent platform for conducting financial transactions. This eliminates the need for intermediaries such as banks, which leads to faster and more cost-effective transactions.

Furthermore, Galxe’s decentralized nature ensures that no single entity has control over the network, reducing the risk of manipulation or censorship. This level of decentralization also allows for greater inclusivity, as anyone with an internet connection can participate in the Galxe network.

Another significant factor in Galxe’s rise is its focus on privacy. By utilizing advanced cryptography techniques, Galxe ensures that personal and financial information remains confidential and secure. This addresses concerns regarding data breaches and unauthorized access to sensitive information that have plagued traditional financial systems.

Galxe’s disruption of traditional financial systems is not limited to individual transactions. Its potential extends to areas such as remittances, micropayments, and cross-border transactions, where existing systems have proven to be slow, expensive, and cumbersome.

A key driver behind Galxe’s rise is the increasing demand for financial services in underserved regions. By leveraging blockchain technology, Galxe can provide access to financial services to individuals who have traditionally been excluded from the mainstream banking system. This has the potential to empower individuals, promote financial inclusion, and drive economic growth.

In conclusion, the rise of Galxe represents a significant shift in the financial landscape. Its decentralized, secure, and inclusive nature has the potential to disrupt traditional financial systems and usher in a new era of efficiency, transparency, and accessibility. As Galxe continues to gain momentum, it will be interesting to see how it transforms the way we think about and engage with finance.

How Galxe is Changing the Game

Galxe (GAL) is revolutionizing the traditional financial systems by introducing a decentralized blockchain platform.

Traditional financial systems are often centralized, meaning that a few entities have control over the entire system. This can lead to inefficiencies, delays, and high transaction costs. Galxe aims to change this by creating a decentralized network where transactions can be made directly between individuals without the need for intermediaries.

One of the key features of Galxe is its ability to facilitate fast and secure transactions. With the use of blockchain technology, transactions can be processed in a matter of seconds, significantly reducing the time it takes for funds to reach their intended recipients. Additionally, the use of advanced cryptographic algorithms ensures that transactions remain secure and tamper-proof.

Galxe also aims to make financial services more accessible to individuals around the world. The traditional financial systems often exclude those who do not have access to bank accounts or credit cards. With Galxe, anyone with a smartphone and internet connection can participate in the network and make transactions.

Furthermore, Galxe is challenging the traditional banking system by providing alternative solutions to banking services. Through its network, users can store their funds securely in digital wallets and access them at any time. This eliminates the need for traditional banks and allows individuals to have full control over their finances.

Another way Galxe is changing the game is by enabling cross-border transactions at a fraction of the cost of traditional methods. Traditional remittance services often charge high fees for transferring funds internationally, making it expensive for individuals to send money to their loved ones abroad. Galxe allows for low-cost and fast cross-border transactions, making it easier for individuals to support their families and businesses globally.

In conclusion, Galxe is disrupting traditional financial systems by providing a decentralized, fast, secure, and accessible platform for individuals to make transactions. It is changing the game by challenging the existing banking system and enabling low-cost cross-border transactions. With Galxe, the future of finance is becoming more inclusive and efficient.

Decentralization and Transparency

Decentralization and transparency are two key principles that Galxe (GAL) brings to the traditional financial systems. By leveraging blockchain technology, Galxe eliminates the need for intermediaries such as banks, enabling peer-to-peer transactions and removing the centralized control of traditional financial systems.

The decentralized nature of Galxe ensures that no single entity or authority has control over the entire network. Instead, transactions are verified and recorded by a distributed network of nodes, making it nearly impossible for any single party to manipulate or alter the transaction data. This decentralization promotes trust and reliability, as users can have confidence in the integrity of the transactions.

In addition to decentralization, Galxe also brings transparency to the financial industry. All transactions conducted on the Galxe platform are recorded on the blockchain, which is a public ledger that is accessible to anyone. This means that anyone can view and verify transactions, ensuring that there is no hidden or tampered information.

Furthermore, Galxe also promotes transparency through its token economy. The GAL token, the native cryptocurrency of the Galxe platform, is used as a means of exchange and governance within the ecosystem. The token economy is designed to be transparent, with clear rules and mechanisms that determine its supply, distribution, and value. This transparency provides users with a clear understanding of how the platform operates and how their investments are being utilized.

| Benefits of Decentralization and Transparency in Galxe |

|---|

| 1. Security: Decentralization eliminates single points of failure and reduces the risk of hacking or manipulation. |

| 2. Trust: The transparency of the blockchain ensures that all transactions are visible, promoting trust among users. |

| 3. Efficiency: Peer-to-peer transactions eliminate the need for intermediaries, making transactions faster and more cost-effective. |

| 4. Financial Inclusion: Galxe opens up access to financial services for the unbanked and underbanked populations. |

| 5. Innovation: Decentralization and transparency pave the way for new and innovative financial products and services. |

In conclusion, Galxe disrupts traditional financial systems by championing the principles of decentralization and transparency. These principles not only promote trust and reliability but also enable greater security, efficiency, and financial inclusion. With Galxe, the future of finance is decentralized and transparent.

Smart Contracts and Automation

Galxe (GAL) utilizes smart contracts to revolutionize the way financial systems operate. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically execute and enforce transactions once certain conditions are met.

By implementing smart contracts on the Galxe platform, traditional financial processes are streamlined and automated, removing the need for intermediaries and reducing transaction costs. The decentralized nature of Galxe ensures trust and transparency in these transactions, providing a secure environment for users.

With smart contracts, Galxe enables the automation of various financial functions, including lending, investing, and insurance. This automation eliminates the need for manual intervention and significantly reduces the time and effort required for these processes.

| Benefits of Smart Contracts and Automation on Galxe |

|---|

| 1. Efficiency: Smart contracts automate processes, reducing the time and effort required for financial transactions. |

| 2. Cost Savings: By removing intermediaries and streamlining processes, Galxe reduces transaction costs for users. |

| 3. Trust and Transparency: The decentralized nature of Galxe ensures trust and transparency in financial transactions. |

| 4. Security: Smart contracts on Galxe are secure and tamper-proof, protecting user data and assets. |

| 5. Accessibility: Galxe’s automated financial system is accessible to anyone with an internet connection, providing financial services to the unbanked and underbanked populations. |

Overall, the implementation of smart contracts and automation on the Galxe platform is disrupting traditional financial systems by providing efficient, cost-effective, and secure financial services to users worldwide.

Efficiency and Cost Reduction

The traditional financial systems often suffer from inefficiencies and high costs. Processes such as cross-border transactions, clearing and settlement, and money transfers can be time-consuming and costly. However, Galxe (GAL) is disrupting these traditional systems by offering a more efficient and cost-effective solution.

With Galxe, cross-border transactions can be completed in a matter of minutes, rather than days or weeks. The platform uses advanced blockchain technology to ensure fast and secure transactions, while eliminating the need for intermediaries and reducing the associated costs.

In addition, Galxe simplifies the clearing and settlement process. By leveraging smart contracts, the platform automates the execution of financial agreements, reducing the need for manual intervention and minimizing the risk of errors. This not only improves efficiency but also reduces costs associated with human resources and potential disputes.

Moreover, Galxe offers low-cost money transfers across borders. Users can send and receive funds instantly, with minimal fees, making it more cost-effective compared to traditional banking methods or remittance services.

In summary, Galxe is revolutionizing the financial industry by improving efficiency and reducing costs. Its blockchain technology enables faster cross-border transactions, automated clearing and settlement, and low-cost money transfers. As a result, businesses and individuals can save time and money, making Galxe an attractive alternative to traditional financial systems.

The Potential Impact of Galxe

Galxe (GAL) has the potential to revolutionize traditional financial systems and reshape the way we transact and store value. With its efficient and secure blockchain technology, Galxe offers a range of benefits that can have a significant impact on various sectors.

One of the key advantages of Galxe is its ability to provide fast and low-cost transactions. Traditional financial systems often involve intermediaries, which can result in slow and expensive transactions. Galxe eliminates the need for intermediaries, allowing for near-instantaneous transactions at a fraction of the cost. This has the potential to greatly improve the efficiency of financial transactions, making it easier and more affordable for individuals and businesses to send and receive payments.

Furthermore, Galxe’s blockchain technology ensures transparency and security. Unlike traditional financial systems, which may lack transparency and can be vulnerable to fraud and hacking, Galxe’s decentralized network provides a high level of security. Transactions on the Galxe blockchain are recorded and verified by multiple participants, making it virtually impossible to alter or manipulate transaction data. This can help prevent financial fraud and ensure the integrity of transactions.

Galxe also has the potential to increase financial inclusion. Traditional financial systems often exclude individuals and communities with limited access to banking services. Galxe’s decentralized nature allows anyone with internet access to participate in its financial ecosystem. This can empower the unbanked and underbanked populations by providing them with a means to store and transact value, thereby increasing their financial options and opportunities.

Moreover, Galxe can streamline cross-border transactions. Traditional cross-border transactions can be complex, time-consuming, and expensive due to the involvement of multiple intermediaries and different currencies. Galxe’s blockchain technology allows for borderless transactions, eliminating the need for intermediaries and the associated fees. This can simplify and expedite cross-border transactions, facilitating international trade and commerce.

In addition, Galxe has the potential to disrupt the traditional banking industry. As more individuals and businesses adopt Galxe, the need for traditional banking services may decrease. Galxe offers a decentralized alternative that is not controlled by any central authority, allowing individuals to have direct control over their funds. This can reduce dependency on traditional banks and provide individuals with more financial autonomy.

|

Overall, Galxe has the potential to disrupt traditional financial systems and transform the way we transact and store value. Its fast and low-cost transactions, transparency and security, financial inclusion, streamlined cross-border transactions, and potential impact on the banking industry make it a powerful force in the financial landscape. As Galxe continues to evolve and gain adoption, its impact on traditional financial systems is expected to grow significantly. |

Empowering Individuals and Businesses

Galxe (GAL) is revolutionizing traditional financial systems by empowering individuals and businesses to take control of their finances. Through its innovative blockchain technology and decentralized platform, Galxe provides a secure and transparent way for users to manage their assets and engage in financial transactions.

One of the key ways Galxe empowers individuals and businesses is by eliminating the need for intermediaries such as banks or financial institutions. This not only reduces costs but also eliminates the hurdles and delays associated with traditional financial systems. Users can now transact directly with each other, leading to faster and more efficient financial operations.

Additionally, Galxe provides individuals and businesses access to global financial markets without the need for complex paperwork or extensive verification processes. With Galxe, anyone can participate in international trade, investments, and fundraising, thereby leveling the playing field and promoting global economic inclusivity.

The decentralized nature of Galxe also ensures greater security and privacy for individuals and businesses. Transactions conducted on the Galxe platform are secured through the use of advanced cryptographic techniques, making it virtually impossible for unauthorized parties to gain access to sensitive information or manipulate the system. Users have full control over their assets and can be confident that their financial data is secure.

Furthermore, Galxe’s decentralized platform allows for greater financial innovation and entrepreneurship. By removing the barriers imposed by traditional financial systems, Galxe encourages the development of new, disruptive business models and financial products. Entrepreneurs can now explore innovative ways to raise capital, manage assets, and create value, leading to a more dynamic and inclusive financial ecosystem.

In conclusion, Galxe is empowering individuals and businesses by providing them with greater control over their finances, access to global markets, enhanced security and privacy, and increased opportunities for financial innovation and entrepreneurship. As traditional financial systems continue to be disrupted, Galxe is leading the way in transforming the way individuals and businesses interact with money.

Enabling Financial Inclusion

Financial inclusion is a key goal for many countries and organizations around the world. It refers to the accessibility and affordability of financial services for all individuals and businesses, regardless of their socioeconomic status.

Galxe (GAL) is disrupting traditional financial systems by enabling financial inclusion on a global scale. With its blockchain technology and decentralized infrastructure, Galxe offers a low-cost and accessible financial ecosystem for individuals who are unbanked or underbanked.

One of the main barriers to financial inclusion is the lack of access to traditional banking services. Many individuals in developing countries, rural areas, and marginalized communities do not have access to basic financial services such as bank accounts, loans, and insurance. Galxe aims to bridge this gap by offering a secure and user-friendly platform that anyone with a smartphone or internet connection can access.

Galxe’s decentralized infrastructure allows individuals to create their own digital wallet and access a range of financial services, including remittances, peer-to-peer lending, and microloans. This gives individuals the opportunity to save money, invest in businesses, and improve their financial well-being.

In addition to providing access to financial services, Galxe also promotes financial education and literacy. Through its platform, users can access educational resources, tutorials, and financial planning tools to improve their understanding of personal finance and make informed financial decisions.

By enabling financial inclusion, Galxe is empowering individuals and communities to participate in the global economy and improve their economic opportunities. The democratization of financial services through blockchain technology has the potential to transform the lives of millions of people around the world, reducing poverty, and fostering economic growth.

Disrupting Traditional Institutions

The traditional financial system is built on centralized institutions such as banks, credit card companies, and payment processors. These institutions have long dominated the market and controlled the flow of money. However, with the rise of blockchain technology, decentralized platforms like Galxe (GAL) are disrupting traditional institutions and changing the way we transact and store value.

One of the key advantages of Galxe is that it operates on a blockchain, which is a distributed ledger technology that allows for transparent and secure transactions. This means that there is no central authority controlling the network, and transactions can be verified by multiple participants.

By utilizing blockchain technology, Galxe is able to provide financial services in a more efficient and cost-effective manner. Transactions can be processed faster and at a lower cost compared to traditional institutions. This makes Galxe an attractive alternative for individuals and businesses looking for a more streamlined and affordable way to manage their finances.

Moreover, Galxe offers a range of financial services that are traditionally provided by banks and other institutions. These include lending, borrowing, and asset management. By leveraging smart contracts, Galxe eliminates the need for intermediaries and allows users to directly access these services.

In addition to disrupting traditional financial institutions, Galxe is also challenging the status quo by promoting financial inclusion. With traditional institutions, access to financial services is often limited to those who meet certain criteria, such as having a high credit score or a certain amount of wealth. Galxe, on the other hand, aims to provide financial services to anyone with an internet connection, regardless of their background or financial status.

| Benefits of Galxe in Disrupting Traditional Institutions: |

|---|

| 1. Faster and cheaper transactions |

| 2. Decentralized and transparent network |

| 3. Direct access to financial services |

| 4. Promoting financial inclusion |

FAQ:

What is Galxe (GAL) and how is it disrupting traditional financial systems?

Galxe (GAL) is a decentralized finance platform that aims to disrupt traditional financial systems by providing innovative solutions for payments, lending, and investing, all powered by blockchain technology. It offers fast and secure transactions, eliminates the need for intermediaries, and enables users to have full control over their assets. Through its decentralized nature, Galxe aims to democratize access to financial services and provide economic empowerment to individuals around the world.

How does Galxe (GAL) ensure the security of transactions?

Galxe (GAL) ensures the security of transactions through its use of blockchain technology. The platform employs advanced cryptographic algorithms to secure transactions and user data. Transactions are stored on a distributed ledger, making it virtually impossible for anyone to manipulate or alter the transaction history. Additionally, GAL token holders can participate in the consensus mechanism of the network, further enhancing the security of the platform. Overall, Galxe prioritizes the privacy and security of its users, providing them with a safe and trusted environment for financial transactions.