Decentralized finance (DeFi) has taken the world by storm, offering new avenues for financial freedom and innovation. The Global Asset List (GAL) DeFi landscape is a complex ecosystem of diverse protocols, projects, and tokens. Navigating this landscape requires careful planning and strategic portfolio management to ensure success.

Tip 1: Do Your Research

Before diving into the GAL DeFi landscape, it is crucial to do your due diligence and research the various protocols and projects. Understand the fundamentals of each project, including its goals, team composition, and tokenomics. Consider factors such as its security measures, audits, and community engagement. Solid research will help you make informed decisions and avoid potential scams or pitfalls.

Tip 2: Diversify Your Portfolio

A well-diversified portfolio is key to success in the GAL DeFi landscape. Allocate your investment across various sectors, such as lending, decentralized exchanges, yield farming, and governance tokens. Diversification helps mitigate risks and reduces exposure to a single project or protocol. Remember to assess the risk-reward ratio of each investment and aim for a healthy balance between stable and high-yield assets.

Tip 3: Stay Updated

The GAL DeFi landscape is a rapidly evolving space, with new projects and protocols launching regularly. Stay updated with the latest news, trends, and developments in the DeFi ecosystem. Follow reputable sources, participate in community discussions, and join forums to stay ahead of the curve. Keeping up with industry updates will enable you to make informed decisions and take advantage of new opportunities as they arise.

Tip 4: Manage Risk

Risk management is crucial in DeFi investing. Assess the risks associated with each project or protocol before investing. Consider factors such as smart contract vulnerabilities, market volatility, and liquidity risks. Set realistic investment goals and adhere to them. Implement risk mitigation strategies, such as setting stop-loss orders and using insurance platforms. Remember, managing risk is just as important as maximizing returns.

Tip 5: Embrace DeFi Principles

Finally, embrace the principles of decentralized finance. Participate in governance processes, vote on proposals, and contribute to the improvement of the GAL DeFi ecosystem. Engage with the community and share your knowledge and experiences. By actively participating in the DeFi community, you not only enhance your understanding but also contribute to the growth and development of the space.

In conclusion, navigating the GAL DeFi landscape requires careful planning, research, and risk management. By following these tips and staying informed, you can optimize your portfolio management and increase your chances of success in the ever-changing world of decentralized finance.

Understanding Decentralized Finance

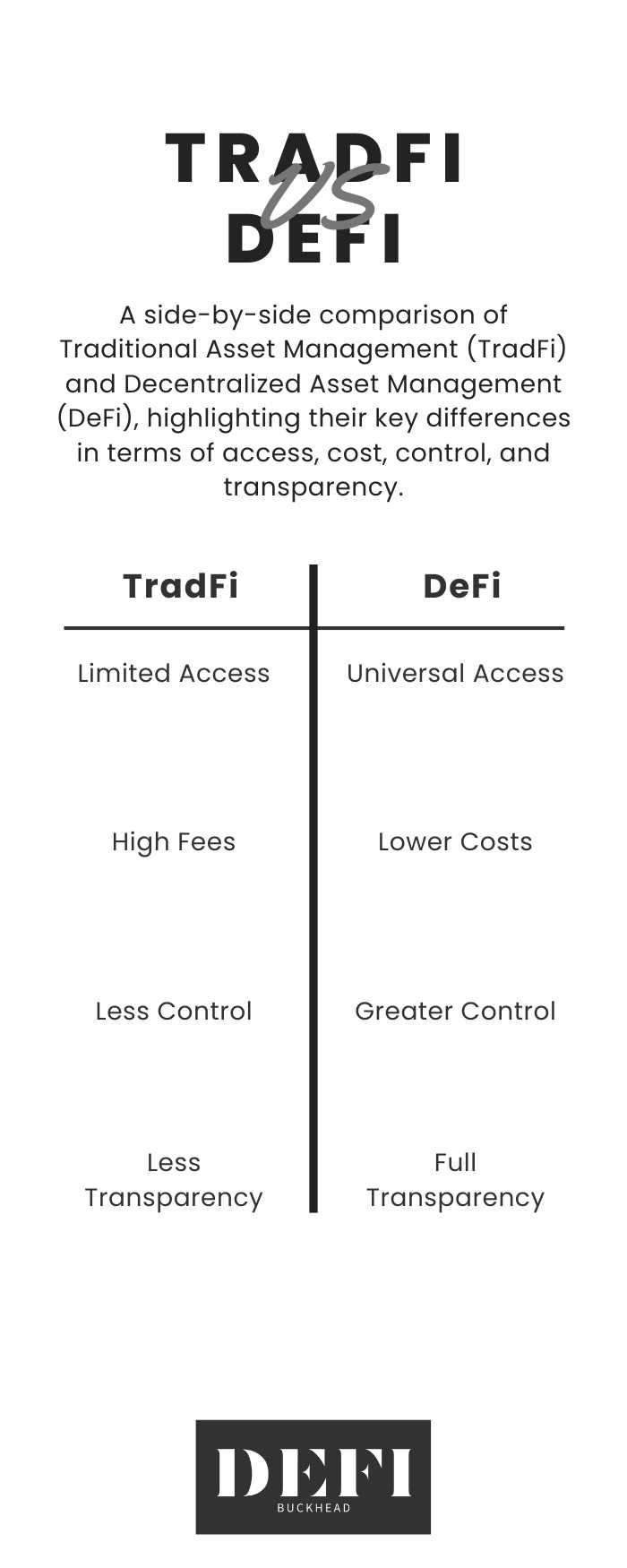

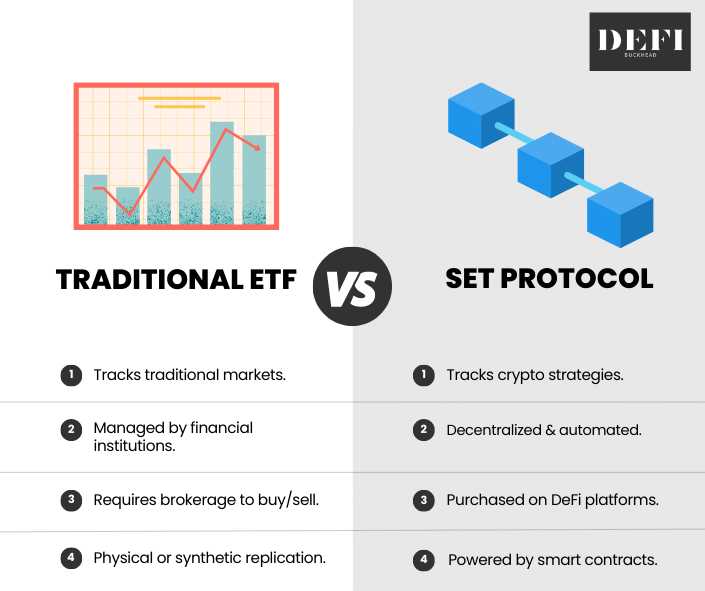

Decentralized Finance, also known as DeFi, refers to the use of blockchain technology and cryptocurrencies to recreate traditional financial systems in a decentralized and open manner. Unlike traditional financial systems that rely on intermediaries such as banks and brokers, DeFi aims to eliminate the need for middlemen by utilizing smart contracts and decentralized applications (dApps).

One of the key features of DeFi is its focus on transparency and accessibility. In traditional financial systems, individuals often have limited access to crucial financial tools and services. DeFi, on the other hand, allows anyone with an internet connection to participate in various financial activities, such as lending, borrowing, and trading cryptocurrencies.

Another important aspect of DeFi is the concept of programmable money. Through the use of smart contracts, DeFi platforms can automate actions and enforce predetermined conditions without the need for human intervention. This not only streamlines various financial processes but also reduces the risk of fraud and manipulation.

DeFi also offers various benefits compared to traditional financial systems. For instance, DeFi platforms typically operate 24/7, allowing users to access their funds and perform transactions at any time. Additionally, the decentralized nature of DeFi reduces the risk of censorship and confiscation, as there is no central authority that can control or freeze users’ assets.

However, it is important to note that DeFi is still a relatively new and rapidly evolving space. As such, it is crucial for individuals to exercise caution and conduct thorough research before participating in any DeFi activities. Understanding the risks involved and ensuring the security of personal information and funds are essential steps for successful portfolio management in the GAL DeFi landscape.

| Benefits of DeFi | Challenges of DeFi |

|---|---|

| 1. Accessibility to financial tools and services for everyone. | 1. Lack of regulation and potential for scams. |

| 2. Reduced reliance on intermediaries and lower transaction fees. | 2. Risk of smart contract vulnerabilities and hacking. |

| 3. Ability to access funds and perform transactions at any time. | 3. Limited scalability and high network fees during periods of high demand. |

| 4. Reduced risk of censorship and asset confiscation. | 4. Complexity and steep learning curve for beginners. |

By understanding the principles and potential risks of decentralized finance, individuals can navigate the GAL DeFi landscape more effectively and make informed decisions when managing their portfolios.

Exploring the GAL DeFi Market

The GAL DeFi market offers a wealth of opportunities for investors looking to diversify their portfolios and tap into the potential of decentralized finance. GAL, short for Global Asset List, is a comprehensive platform that brings together various DeFi protocols, tokens, and assets.

One of the key advantages of the GAL DeFi market is the accessibility it provides to a wide range of DeFi projects. Investors can explore different protocols and tokens all in one place, without the need to navigate multiple platforms or conduct extensive research.

By exploring the GAL DeFi market, investors can gain exposure to exciting new projects and technologies that are shaping the future of finance. From decentralized exchanges and lending platforms to yield farming and staking opportunities, GAL offers a diverse array of options to suit various investment strategies and risk appetites.

In addition to the range of projects available, the GAL DeFi market also offers transparency and security. The platform conducts extensive due diligence on the projects listed, ensuring that investors can trust the integrity of the offerings. This helps to mitigate the risks associated with investing in decentralized finance.

Furthermore, the GAL DeFi market provides liquidity and ease of use. The platform offers seamless integration with popular wallets and enables users to easily trade, stake, and participate in various DeFi activities. This simplifies the process for investors, making it more convenient to manage their DeFi investments.

When exploring the GAL DeFi market, it is essential for investors to conduct their own research and due diligence. They should consider the fundamentals of the projects they are interested in, evaluate their tokenomics and team expertise, and assess the overall market conditions and trends.

Overall, exploring the GAL DeFi market can be a rewarding experience for investors seeking to tap into the potential of decentralized finance. With its diverse range of projects, transparency, and ease of use, GAL provides a valuable platform for investors to navigate and participate in the growing DeFi ecosystem.

Building a Well-Diversified Portfolio

When it comes to investing in the GAL DeFi landscape, one of the most important factors to consider is building a well-diversified portfolio. Diversification is the key to minimizing risk and maximizing potential returns.

Here are some tips to help you build a well-diversified portfolio:

1. Allocate Across Different Asset Classes:

Investing in a variety of asset classes can help spread your risk. Consider allocating your portfolio across different types of cryptocurrencies, tokens, and other digital assets.

2. Consider Different Risk Levels:

Not all DeFi projects have the same risk level. Some may be more established and safer, while others may be newer and riskier. It’s important to consider a mix of high-risk, high-reward investments and lower-risk, more stable assets.

3. Research the Projects:

Before investing in any DeFi project, it’s crucial to do your due diligence and research the team behind it, the technology they are using, and their potential for growth. Look for projects with a solid roadmap, active community, and a clear value proposition.

4. Monitor and Rebalance:

Once you’ve built your portfolio, it’s important to regularly monitor and rebalance it. Markets are constantly changing, and what may be a good investment today may not be tomorrow. Keep an eye on your investments and adjust your portfolio accordingly.

5. Stay Informed:

Finally, make sure to stay informed about the latest trends and developments in the GAL DeFi landscape. Join online communities, follow industry experts and news outlets, and attend conferences and events. The more information you have, the better equipped you’ll be to make informed investment decisions.

By following these tips and building a well-diversified portfolio, you’ll be better positioned to navigate the GAL DeFi landscape and increase your chances of success.

Identifying Different Investment Opportunities

When it comes to navigating the GAL DeFi landscape, it’s important to be aware of the diverse investment opportunities available. Here are some different types of investments to consider:

| Type of Investment | Description |

|---|---|

| Decentralized Exchanges (DEX) | Investing in decentralized exchanges, such as Uniswap or SushiSwap, allows you to trade digital assets directly from your wallet without the need for intermediaries. |

| Lending and Borrowing Platforms | These platforms allow you to earn interest by lending your crypto assets to other users, or borrow assets by putting up collateral. Examples include Aave and Compound. |

| Staking | Staking involves locking up your tokens in a wallet or smart contract to support network security and consensus. In return, you earn rewards for your participation. Projects like Ethereum 2.0 and Polkadot offer staking opportunities. |

| Yield Farming | Yield farming involves providing liquidity to decentralized finance protocols and earning additional tokens as incentives. This can be a high-risk, high-reward strategy and requires careful research and evaluation. |

| Non-Fungible Tokens (NFTs) | NFTs are unique digital assets that can be bought, sold, and traded. Investing in NFTs involves speculating on the value and demand for these digital collectibles, which can include artwork, virtual real estate, or in-game items. |

Identifying the different investment opportunities within the GAL DeFi landscape allows you to diversify your portfolio and potentially achieve higher returns. It’s important to thoroughly research each opportunity, understand the associated risks, and consider your own risk tolerance and investment goals before making any decisions.

Allocating Funds Strategically

Allocating funds strategically is a crucial aspect of successful portfolio management in the GAL DeFi landscape. It involves making careful decisions about how much capital to allocate to different investment opportunities to maximize returns and manage risk effectively.

Diversification: One key strategy for allocating funds is diversification. By spreading investments across different assets, platforms, and strategies, you can effectively reduce the risk associated with any single investment. Diversification helps to protect your portfolio from potential losses and increase the potential for gains.

Risk and Reward: Another important factor in allocating funds strategically is assessing the risk and reward potential of each investment opportunity. It’s essential to evaluate the risk associated with an investment and the potential returns it may generate. Balancing high-risk, high-reward opportunities with more conservative investments can help create a well-rounded portfolio.

Research and Analysis: Investing in the GAL DeFi landscape requires thorough research and analysis. It’s important to scrutinize each investment opportunity, its underlying technology, team, market conditions, and potential risks. Conducting proper due diligence will help you make informed decisions and allocate your funds to the most promising opportunities.

Monitoring and Adjusting: Once you have allocated your funds, it’s essential to monitor your investments regularly and make necessary adjustments. The GAL DeFi landscape is highly volatile, and market conditions can change rapidly. By staying vigilant and adjusting your allocations as needed, you can take advantage of emerging opportunities and protect your portfolio from potential losses.

Caution: It’s important to exercise caution and only allocate funds that you can afford to lose. The GAL DeFi landscape can be unpredictable, and not all investments will yield the desired outcomes. Be prepared to accept the risks associated with DeFi investments and only invest what you can afford to lose.

Managing Risk and Maximizing Returns

When it comes to navigating the GAL DeFi landscape, one of the most crucial aspects to consider is managing risk and maximizing returns. With so many opportunities and potential pitfalls, a sound investment strategy is key. Galxe (GAL) is a platform that can help investors achieve their goals by providing access to a wide range of DeFi projects.

One way to manage risk is by diversifying your portfolio. By investing in a variety of projects with different risk profiles, you can mitigate the impact of any individual project’s performance on your overall portfolio. Diversification can help protect your investments from volatility and unexpected market events.

GAL provides a comprehensive overview of different DeFi projects, allowing investors to assess the risk and potential returns associated with each project. This information can be invaluable when making investment decisions, as it empowers investors to make informed choices about which projects align with their risk tolerance and financial goals.

Another important aspect of managing risk is conducting thorough due diligence. Before investing in any DeFi project, it is essential to research the team behind the project, the technology they are using, and any potential risks or vulnerabilities. GAL offers a wealth of information about each project, including team profiles, technical details, and user reviews, making it easier for investors to conduct their due diligence.

Maximizing returns is another key consideration when navigating the GAL DeFi landscape. By investing in projects with strong potential for growth and profitability, investors can increase their overall returns. GAL provides users with performance metrics, including historical returns and projected growth rates, helping investors identify projects with the greatest potential.

It is also important to stay informed and up-to-date with the latest developments in the DeFi space. GAL offers a news and updates section, providing users with the latest information on new projects, partnerships, and regulatory developments. By staying informed, investors can capitalize on opportunities and mitigate risks in real-time.

Overall, managing risk and maximizing returns are two critical components of successful portfolio management in the GAL DeFi landscape. By leveraging the resources and tools provided by GAL, investors can make informed decisions that align with their risk tolerance and financial goals.

How can Galxe (GAL) help you navigate the DeFi landscape? Find out more here.

Implementing Risk Management Strategies

When it comes to investing in the rapidly evolving world of decentralized finance (DeFi), implementing risk management strategies is crucial for successful portfolio management. The volatile nature of DeFi markets can lead to substantial gains but also profound losses, making it imperative for investors to carefully navigate the risks involved.

Here are a few risk management strategies that can help mitigate potential losses and optimize investment returns in the GAL DeFi landscape:

1. Diversification: Diversifying your investments across different projects and assets can help spread out the risk and minimize exposure to individual projects. By allocating funds to a variety of DeFi projects, investors can reduce the impact of a single project failure on their overall portfolio.

2. Conduct thorough research: Before investing in any DeFi project, it is important to conduct thorough research and due diligence. This includes analyzing the project’s whitepaper, team members, market demand, and potential risks. By understanding the fundamentals of a project, investors can make more informed decisions and reduce the likelihood of investing in risky or fraudulent projects.

3. Set clear investment goals: Defining clear investment goals can help investors establish risk tolerance levels and make more calculated investment decisions. Setting specific targets for profit-taking and determining the maximum acceptable loss can provide a framework for decision-making and prevent emotional, impulsive investments.

4. Stay updated with market trends: The DeFi landscape is highly dynamic, with new projects and market trends emerging regularly. Staying informed about the latest developments, news, and market trends can help investors make timely adjustments to their portfolios and identify opportunities or potential risks.

5. Regularly review and rebalance your portfolio: Regularly reviewing and rebalancing your portfolio is essential for optimal risk management. As DeFi markets fluctuate, certain assets or projects may become overexposed or underperforming. By realigning your portfolio with your investment goals, you can maintain a balanced and well-managed investment strategy.

6. Allocate only what you can afford to lose: DeFi investments carry a certain level of risk, and it is essential to only allocate funds that you can afford to lose entirely. Investing more than you can afford to lose can lead to financial stress and emotional decision-making, potentially resulting in larger losses.

Implementing these risk management strategies can help navigate the GAL DeFi landscape with more confidence and reduce the potential risks associated with decentralized finance investments.

Staying Updated on Market Trends

To successfully navigate the GAL DeFi landscape and effectively manage your portfolio, it’s essential to stay updated on market trends. Here are some tips to help you stay ahead:

1. Follow Industry News: Stay informed about the latest news and developments in the DeFi space. Subscribe to industry newsletters, follow influential Twitter accounts, and join relevant online communities. This way, you can gain insights into market trends and developments that may impact your portfolio.

2. Conduct Research: Take the time to research and understand the projects and tokens in your portfolio. Look for factors such as the team’s experience, the project’s goals, and the token’s utility and adoption. Stay updated on the project’s progress and any updates or announcements that may affect its value.

3. Monitor Market Data: Regularly check and analyze market data, including prices, trading volumes, and market capitalizations. Keep an eye on price movements and trading patterns, as these can provide valuable insights into market sentiment and trends. Utilize reliable market data platforms to track and analyze the performance of your portfolio and make informed decisions.

4. Follow Influencers and Experts: Identify and follow trusted influencers and experts in the DeFi space. These individuals often share valuable insights and analysis that can help you stay updated on market trends. Engage with their content, ask questions, and join discussions to gain further knowledge and insights.

5. Attend Webinars and Conferences: Participate in webinars and conferences focused on DeFi and blockchain technology. These events often bring together industry leaders, experts, and enthusiasts who share their perspectives and knowledge. By attending these events, you can stay updated on the latest trends, developments, and innovations in the GAL DeFi landscape.

6. Stay Open to Learning: The DeFi space is constantly evolving, and new trends and innovations emerge frequently. Stay open to learning and adapting your investment strategies based on new information and market dynamics. Engage with the community, ask questions, and seek advice from experts to stay updated and enhance your portfolio management skills.

Remember, staying updated on market trends requires continuous effort and dedication. By following these tips and remaining proactive, you can navigate the GAL DeFi landscape with confidence and optimize your portfolio management decisions.

Tips for Successful Portfolio Management

Managing a portfolio in the rapidly evolving world of decentralized finance (DeFi) can be challenging. Here are some tips to help you navigate the GAL DeFi landscape and ensure successful portfolio management:

- Do thorough research: Before investing in any GAL DeFi project, make sure to do your due diligence. Research the team behind the project, the technology they are using, and the potential risks and rewards involved. This will help you make informed investment decisions.

- Diversify your holdings: One of the key principles of portfolio management is diversification. Invest in a variety of GAL DeFi projects across different sectors and platforms to spread out your risks and increase the chances of higher returns.

- Monitor your investments: Keep a close eye on your GAL DeFi investments. Regularly review the performance of the projects in your portfolio and stay updated with any news or developments. This will enable you to make timely adjustments and take advantage of potential opportunities.

- Set realistic goals: Define your investment goals and set realistic expectations. Understand that the GAL DeFi market is highly volatile, and it’s important to have a long-term perspective. Don’t expect overnight riches and be prepared for ups and downs along the way.

- Stay informed: The GAL DeFi landscape is constantly evolving, with new projects and trends emerging regularly. Stay informed about the latest market developments, regulatory changes, and industry news. This will help you adapt to the changing landscape and make informed decisions.

- Manage risk: DeFi investments carry certain risks, including smart contract vulnerabilities and market volatility. Assess and manage these risks by allocating a portion of your portfolio to more conservative investments and implementing risk management strategies, such as stop-loss orders.

By following these tips, you can enhance your chances of successful portfolio management in the GAL DeFi landscape. Remember to stay vigilant, adapt to market changes, and always do your own research before making any investment decisions.

Setting Clear Investment Goals

Before diving into the GAL DeFi landscape, it’s important to set clear investment goals. Whether you’re a newcomer or an experienced investor, having defined objectives can guide your decision-making process and ultimately lead to a more successful portfolio management.

1. Define your risk appetite: Assess your willingness to take on risk and determine how much volatility you can tolerate. Set a risk level that aligns with your financial situation and investment preferences.

2. Determine your investment horizon: Consider your time horizon and when you’ll need to access the funds. Short-term goals may require a more conservative investment approach, whereas long-term goals may allow for more aggressive strategies.

3. Set realistic expectations: Understand the potential returns and risks associated with DeFi investments. While the DeFi market offers exciting opportunities, it’s crucial to have realistic expectations about the potential returns and be prepared for possible fluctuations in value.

4. Consider diversification: Diversify your portfolio by investing in a range of DeFi assets. By spreading your investments across different projects and sectors, you can potentially mitigate risk and increase the likelihood of achieving your goals.

5. Stay informed: Stay up-to-date with the latest developments in the DeFi space. Regularly monitor market trends, news, and regulatory changes that may impact your investments. This knowledge will help you make informed decisions and adjust your portfolio as needed.

6. Review and adjust: Periodically review and assess your investment goals to ensure they align with your evolving financial situation and market conditions. Be prepared to make adjustments to your portfolio as needed to stay on track towards achieving your desired outcomes.

By setting clear investment goals, you can establish a roadmap for your DeFi portfolio management and increase your chances of success in the GAL ecosystem. Remember to regularly reassess your goals, stay informed, and diversify your investments to optimize your investment journey.

FAQ:

What is DeFi?

DeFi stands for decentralized finance. It refers to a set of financial applications and platforms built on blockchain technology that aim to provide financial services in a decentralized manner, without the need for intermediaries like banks or brokers.

What is the GAL DeFi landscape?

The GAL DeFi landscape refers to the various projects and platforms in the decentralized finance space that use the GAL token as a key component. These projects may include lending and borrowing platforms, decentralized exchanges, yield farming protocols, and more.