Cross-border transactions have always been a complex and time-consuming process, involving numerous intermediaries, high fees, and lengthy settlement times. However, with the emergence of blockchain technology, new possibilities have arisen to revolutionize cross-border transactions. One such solution is Galxe (GAL), a decentralized cryptocurrency specifically designed to facilitate seamless and efficient cross-border transactions.

One of the key advantages of using Galxe for cross-border transactions is its ability to eliminate the need for intermediaries. Traditional cross-border transactions often involve multiple banks, payment processors, and clearing houses, each taking a share of the transaction fees. With Galxe, these intermediaries are no longer required, resulting in lower costs and faster settlement times.

Another advantage of Galxe is its transparency and security. Blockchain technology ensures that every transaction is recorded on a public ledger, making it virtually impossible to alter or tamper with the transaction history. This transparency not only enhances the security of cross-border transactions but also reduces the risk of fraud and money laundering.

Furthermore, Galxe offers the potential for greater financial inclusion. Traditional cross-border transactions often exclude individuals and businesses with limited access to banking services. However, with Galxe, anyone with internet access can participate in cross-border transactions, opening up new opportunities for economic growth and development.

Despite these advantages, there are also challenges to overcome when using Galxe for cross-border transactions. One of the main challenges is regulatory compliance. Different countries have varying regulations regarding cryptocurrencies, which can make it difficult to ensure full compliance when conducting cross-border transactions with Galxe. Additionally, the volatility of Galxe and other cryptocurrencies can pose a risk to the stability of cross-border transactions.

In conclusion, Galxe offers significant advantages for cross-border transactions, including cost savings, increased security, and greater financial inclusion. However, regulatory challenges and the volatility of cryptocurrencies must be addressed to fully realize the potential of Galxe for cross-border transactions. As blockchain technology continues to evolve, it is likely that these challenges will be overcome, paving the way for a new era of seamless and efficient cross-border transactions.

Advantages

1. Faster Transactions: When using GAL for cross-border transactions, users can enjoy faster transaction times compared to traditional methods. GAL transactions are processed on a decentralized network, eliminating the need for intermediaries and reducing the time it takes to complete a transaction.

2. Lower Costs: GAL transactions can be completed at a lower cost compared to traditional cross-border transactions. By eliminating intermediaries and reducing the need for manual processing, GAL reduces transaction fees and associated costs, making it a more cost-effective option.

3. Enhanced Security: GAL transactions offer enhanced security compared to traditional methods. The decentralized nature of GAL eliminates the single point of failure, making it highly resistant to hacking and fraud. Additionally, GAL uses advanced encryption techniques to protect transaction data, ensuring the privacy and security of users.

4. Greater Accessibility: GAL provides greater accessibility for users worldwide. Traditional cross-border transactions often require users to have a bank account and comply with various regulatory requirements. With GAL, users only need a smartphone or computer with internet access to participate in cross-border transactions, making it accessible to a larger population.

5. Transparency and Traceability: GAL offers transparency and traceability in cross-border transactions. Every transaction on the GAL network is recorded on a public ledger, ensuring transparency and enabling users to trace the history of transactions. This can be beneficial for auditing purposes and building trust between parties involved in cross-border transactions.

6. Flexibility: GAL provides users with flexibility in cross-border transactions. With GAL, users can choose to transact in various currencies, eliminating the need for currency conversions and reducing associated costs. This flexibility makes GAL a convenient option for users engaged in international business and cross-border trade.

7. Potential for Innovation: The use of GAL for cross-border transactions opens up opportunities for innovation. As GAL continues to gain popularity and adoption, it can stimulate the development of new financial products and services that leverage the benefits of GAL. This can lead to a more efficient and inclusive global financial system.

Overall, GAL offers numerous advantages for cross-border transactions, including faster transaction times, lower costs, enhanced security, greater accessibility, transparency and traceability, flexibility, and potential for innovation. As more individuals and businesses recognize these advantages, the adoption of GAL for cross-border transactions is likely to grow.

Fast and Secure Transactions

One of the key advantages of using Galxe (GAL) for cross-border transactions is the speed at which transactions can be processed. Traditional cross-border transactions often involve multiple intermediaries, resulting in delays and increased costs. With Galxe, transactions can be executed and settled in a matter of seconds, significantly reducing the time required for funds to reach their destination.

In addition to being fast, Galxe also offers enhanced security for cross-border transactions. The Galxe network utilizes decentralized blockchain technology, which ensures that each transaction is recorded on a distributed ledger. This provides a transparent and immutable record of all transactions, making it difficult for fraud or manipulation to occur.

| Advantages of Galxe for Cross-Border Transactions |

|---|

| Fast transaction processing |

| Reduced costs compared to traditional transactions |

| Enhanced security through decentralized blockchain technology |

| Transparent and immutable transaction records |

Lower Fees and Costs

One of the major advantages of using Galxe (GAL) for cross-border transactions is the significantly lower fees and costs compared to traditional payment methods.

With traditional banking systems, international transfers can be expensive due to various fees and charges imposed by intermediaries, such as banks and payment processors. These fees can add up and significantly reduce the amount received by the recipient.

However, by using Galxe, the fees associated with cross-border transactions can be greatly reduced. Galxe operates on a decentralized blockchain network, which eliminates the need for intermediaries and their associated fees. This can result in substantial cost savings for both the sender and the recipient.

In addition to lower fees, Galxe transactions also offer faster processing times compared to traditional methods. Cross-border transactions using traditional banking systems can take days or even weeks to complete, especially when involving multiple correspondent banks. On the other hand, Galxe transactions can be completed within minutes, providing faster access to funds for the recipient.

The lower fees and faster processing times offered by Galxe make it an attractive option for individuals and businesses involved in cross-border transactions. Whether it’s sending money to family or friends abroad, paying international suppliers, or conducting business globally, Galxe can help reduce costs and improve efficiency.

Decentralized and Borderless Nature

The use of Galxe (GAL) for cross-border transactions offers several advantages due to its decentralized and borderless nature. Unlike traditional banking systems, which are often centralized and subject to various restrictions, Galxe operates on a decentralized blockchain platform. This allows for more efficient and secure transactions, eliminating the need for intermediaries and reducing transaction costs.

With Galxe, cross-border transactions can be conducted directly between parties without the need for traditional banking intermediaries, such as correspondent banks. This eliminates the lengthy and cumbersome process of involving multiple parties and ensures faster and more streamlined transactions.

In addition, Galxe provides borderless access to financial services. It does not require users to have a local bank account or be limited by geographical borders. This makes it particularly advantageous for those who may not have access to traditional banking services or find it difficult to conduct cross-border transactions due to various regulatory restrictions.

The decentralized and borderless nature of Galxe also enhances financial inclusion by providing access to financial services to the unbanked and underbanked populations. For individuals and businesses in developing countries, Galxe offers a more accessible and affordable means of conducting cross-border transactions, which can lead to economic growth and prosperity.

While there are several advantages to using Galxe for cross-border transactions, there are also challenges that need to be addressed. These include regulatory concerns, scalability issues, and the need for wider adoption of Galxe across various industries.

Overall, the decentralized and borderless nature of Galxe (GAL) offers numerous benefits for cross-border transactions, providing a more efficient, secure, and accessible alternative to traditional banking systems. To learn more about Galxe and its features, visit the Current Galxe (GAL) website.

Challenges

While there are many advantages to using Galxe (GAL) for cross-border transactions, there are also several challenges that need to be addressed.

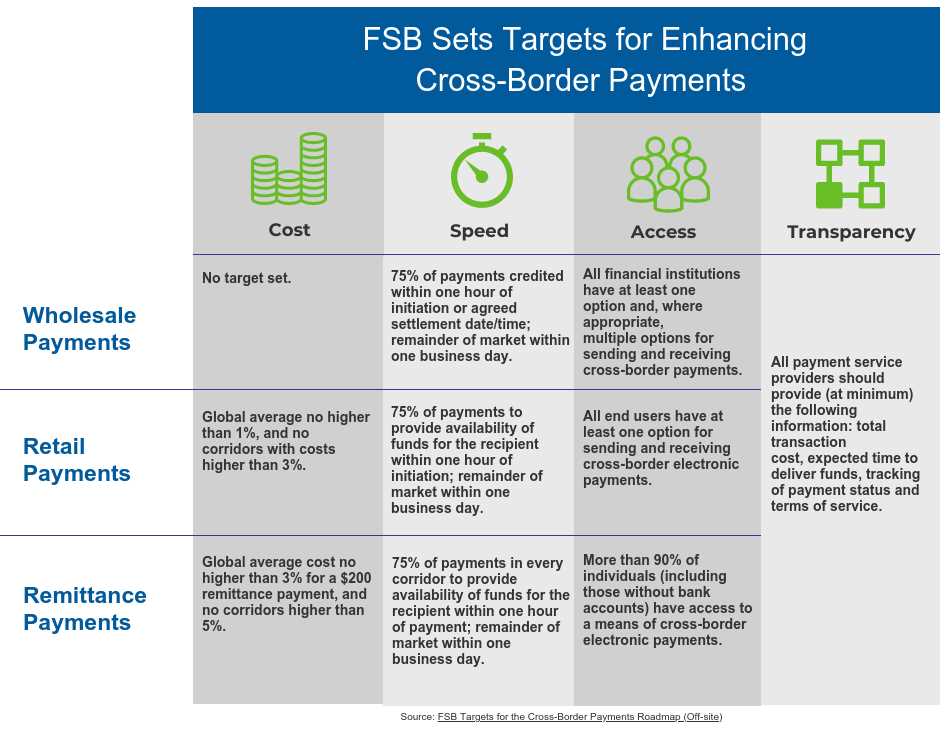

1. Regulatory Compliance: One of the main challenges with cross-border transactions is navigating the complex regulatory landscape. Different countries have different laws and regulations concerning financial transactions, and ensuring compliance can be a time-consuming and costly process.

2. Scalability: As the demand for cross-border transactions grows, it is essential to have a scalable system in place. Galxe needs to be able to handle a high volume of transactions quickly and efficiently, without compromising security or stability.

3. Liquidity: To ensure smooth cross-border transactions, there needs to be sufficient liquidity in the Galxe ecosystem. This means having enough participants actively trading GAL tokens to facilitate transactions of various sizes.

4. Network Security: Another challenge is maintaining the security of the Galxe network. With cross-border transactions, there is an increased risk of fraud and cyberattacks. Implementing robust security measures and regularly updating them is crucial to protect user funds and personal information.

5. Interoperability: Achieving interoperability with existing financial systems is essential for the widespread adoption of Galxe. It is necessary to develop integration solutions that allow Galxe to seamlessly interact with other payment networks and platforms.

6. User Education: To encourage the adoption of Galxe for cross-border transactions, it is vital to educate users about its benefits and provide guidance on how to use the platform effectively. This includes explaining the technical aspects of the Galxe network and providing user-friendly interfaces and resources.

In conclusion, while Galxe offers various advantages for cross-border transactions, there are challenges that need to be addressed. These challenges include regulatory compliance, scalability, liquidity, network security, interoperability, and user education. By tackling these challenges, Galxe can become a more efficient and widely adopted solution for cross-border transactions.

Adoption and Integration

Adoption and integration of Galxe (GAL) for cross-border transactions have the potential to revolutionize the way global businesses conduct their financial operations. With its blockchain-based technology, Galxe offers various advantages that make it an attractive option for businesses looking to streamline their cross-border transactions.

One key advantage of Galxe is its ability to facilitate faster and more efficient transactions. Traditional cross-border transactions can take several days to settle, as they often involve multiple intermediaries and undergo numerous verification processes. Galxe, on the other hand, enables near-instantaneous transactions through its decentralized and transparent network. This speed can significantly reduce the time and cost associated with cross-border transactions, making it an appealing option for businesses.

Another advantage of adopting Galxe is its security and transparency. As a blockchain-based platform, Galxe offers enhanced security measures to protect financial transactions from fraud and unauthorized access. Each transaction is recorded on the blockchain, creating an immutable ledger that cannot be tampered with. This transparency ensures that all parties involved have a clear view of the transaction history and can verify its authenticity with ease.

Furthermore, Galxe offers the advantage of lower transaction fees compared to traditional cross-border payment systems. Traditional methods often involve high fees charged by intermediaries such as banks, currency exchanges, and payment processors. Galxe eliminates the need for intermediaries, resulting in lower transaction fees. This cost-effectiveness can benefit businesses by reducing their overall expenses and increasing their profitability.

Despite these advantages, there are also challenges to overcome in the adoption and integration of Galxe for cross-border transactions. One of these challenges is the need to educate businesses about the benefits and functionalities of Galxe. Many businesses may be unfamiliar with blockchain technology and its potential applications in the financial sector. Therefore, educating businesses on the advantages and security features of Galxe is essential to encourage its adoption.

Additionally, regulatory issues and compliance requirements may pose challenges to the integration of Galxe into existing financial systems. Governments and financial institutions may need to adapt their regulations and policies to accommodate the use of blockchain technology for cross-border transactions. This process may take time and careful consideration to ensure that regulatory frameworks can support the secure and efficient use of Galxe.

| Advantages | Challenges |

|---|---|

| • Faster and more efficient transactions | • Need for education on blockchain technology |

| • Enhanced security and transparency | • Regulatory issues and compliance requirements |

| • Lower transaction fees |

In conclusion, the adoption and integration of Galxe for cross-border transactions can bring significant advantages to businesses in terms of speed, security, and cost-effectiveness. However, challenges such as educating businesses and addressing regulatory issues need to be overcome to fully realize the benefits of Galxe in the global financial landscape.

Regulatory and Legal Hurdles

While Galxe (GAL) offers many advantages for cross-border transactions, there are still several regulatory and legal hurdles that need to be addressed.

One of the main challenges is ensuring compliance with local laws and regulations in different jurisdictions. Each country has its own set of rules and requirements for financial transactions, and navigating through this legal landscape can be complex and time-consuming.

Another hurdle is obtaining the necessary licenses and permits to operate in different countries. This can involve a lengthy application process and meeting strict criteria set by regulatory bodies. Failure to comply with these requirements can result in penalties, fines, or even legal action.

Moreover, there may be concerns regarding anti-money laundering (AML) and know your customer (KYC) regulations. These regulations require financial institutions to verify the identity of their customers and to report any suspicious or potentially illegal activities. Implementing effective AML and KYC procedures can be challenging, especially when dealing with cross-border transactions.

In addition, cross-border transactions often involve currency exchange, which can introduce additional regulatory and legal complexities. Exchange control regulations may restrict or regulate the flow of currency across borders, and failure to comply with these regulations can result in severe consequences.

| Challenges | Possible Solutions |

|---|---|

| Compliance with local laws and regulations | Seek legal guidance and establish local partnerships |

| Obtaining necessary licenses and permits | Engage with regulatory bodies and meet their requirements |

| Anti-money laundering (AML) and know your customer (KYC) regulations | Implement robust AML and KYC procedures |

| Currency exchange regulations | Ensure compliance with exchange control regulations |

Overall, overcoming these regulatory and legal hurdles is crucial for the widespread adoption and success of Galxe (GAL) in cross-border transactions. It requires collaboration between various stakeholders, including financial institutions, regulatory bodies, and legal experts, to establish a framework that facilitates secure and compliant cross-border transactions.

Volatility and Price Fluctuations

One of the challenges of using Galxe (GAL) for cross-border transactions is the volatility and price fluctuations that are inherent in the cryptocurrency market. Unlike traditional fiat currencies, cryptocurrencies are known for their price volatility, with values that can fluctuate dramatically within short periods of time.

This volatility can be attributed to several factors, including market speculation, regulatory changes, and external events. For individuals and businesses engaging in cross-border transactions, this volatility can pose significant risks.

For example, let’s say you are a business owner in the United States looking to purchase goods from a supplier in another country. If you choose to use Galxe (GAL) for this transaction, the value of GAL could change significantly between the time you initiate the transaction and the time it is completed.

If the value of GAL increases during this time, you may end up paying more for the goods than initially anticipated. On the other hand, if the value of GAL decreases, you may benefit from a lower cost for the goods. However, this uncertainty makes it challenging to accurately estimate the cost of cross-border transactions and can potentially impact your budget and profitability.

Furthermore, price fluctuations can also impact the speed and efficiency of cross-border transactions. If the value of GAL experiences a rapid change during the transaction process, it may result in delays or complications. This can be particularly problematic for time-sensitive transactions or businesses that rely on quick and efficient cross-border payments.

While price volatility is a challenge, it’s worth noting that cryptocurrencies like Galxe (GAL) also offer advantages in terms of speed, accessibility, and cost-efficiency for cross-border transactions. It ultimately comes down to weighing the risks and benefits and determining the best approach for your specific needs and circumstances.

FAQ:

What is Galxe (GAL)?

Galxe (GAL) is a cryptocurrency that is primarily used for cross-border transactions. It provides a fast, secure, and cost-effective way of transferring money internationally.

How does Galxe (GAL) work for cross-border transactions?

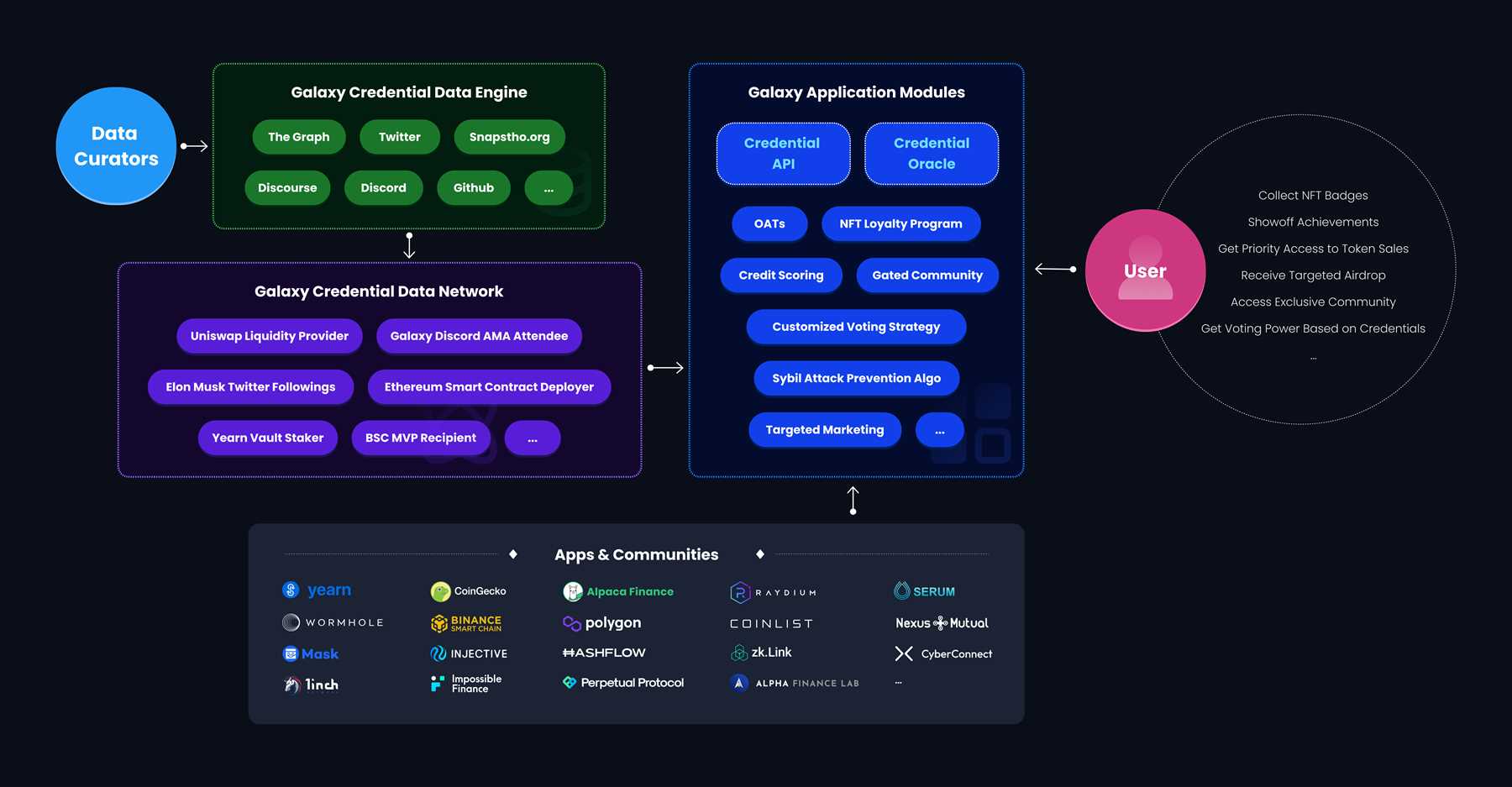

Galxe (GAL) utilizes blockchain technology to facilitate cross-border transactions. It allows for direct peer-to-peer transfers without the need for intermediaries, such as banks. Transactions are recorded on a decentralized ledger, providing transparency and security.

What are the advantages of using Galxe (GAL) for cross-border transactions?

Using Galxe (GAL) for cross-border transactions has several advantages. Firstly, it offers fast and near-instantaneous transactions, eliminating the delays typically associated with traditional methods. Secondly, it is a cost-effective solution, with lower fees compared to traditional banking systems. Lastly, Galxe (GAL) provides a high level of security and privacy, protecting users’ sensitive information.

What are the challenges of using Galxe (GAL) for cross-border transactions?

While Galxe (GAL) offers many advantages, there are also some challenges to consider. One challenge is the lack of widespread adoption and acceptance of cryptocurrencies, which can limit the usability of Galxe (GAL) in certain areas. Additionally, there may be regulatory hurdles and compliance requirements that need to be addressed when using Galxe (GAL) for cross-border transactions. Lastly, the volatility of cryptocurrency prices can pose a risk when converting Galxe (GAL) to traditional fiat currencies.