Decentralized Finance (DeFi) has emerged as one of the most promising sectors in the cryptocurrency industry, providing users with opportunities to earn passive income and participate in innovative financial products. As DeFi continues to gain traction, investors are increasingly looking for the best DeFi tokens to include in their portfolios. In this article, we will explore some of the top DeFi tokens that should be on your radar.

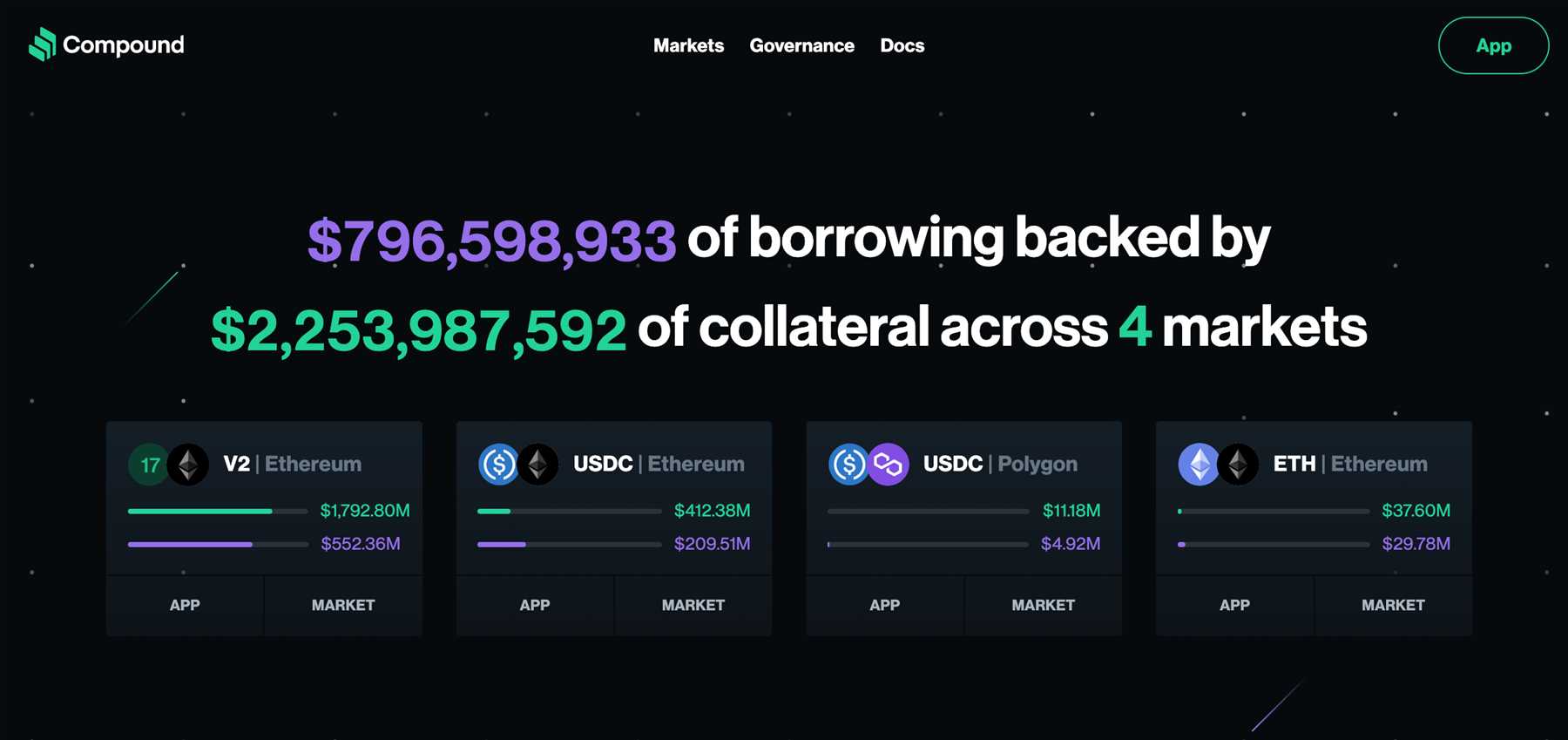

One of the standout DeFi tokens is Compound (COMP). Compound is an algorithmic money market protocol that allows users to lend and borrow cryptocurrencies. By utilizing smart contracts, Compound automatically adjusts interest rates based on supply and demand, providing users with dynamic interest rates that are often higher than traditional savings accounts. With its reliable track record and growing user base, Compound is a strong contender for any DeFi portfolio.

Another DeFi token that has generated significant buzz is Uniswap (UNI). Uniswap is a decentralized exchange protocol that allows users to trade ERC-20 tokens directly from their wallets, without the need for intermediaries. The protocol utilizes an automated market maker (AMM) model, which relies on liquidity pools and smart contracts to facilitate trades. With its innovative approach to liquidity provision and its strong community support, Uniswap has become a go-to platform for decentralized trading.

In addition to Compound and Uniswap, Maker (MKR) is another DeFi token that should be on your radar. Maker is the governance token of the MakerDAO protocol, which operates as a decentralized lending platform and stablecoin issuer. By leveraging collateralized debt positions (CDPs), Maker allows users to borrow stablecoins like Dai by locking up their cryptocurrency holdings. With its unique approach to decentralized lending and its role in maintaining the stability of the Dai stablecoin, Maker is a key player in the DeFi space.

In conclusion, the DeFi sector offers exciting investment opportunities for those willing to explore new financial frontiers. Compound, Uniswap, and Maker are just a few of the top DeFi tokens that should be considered for inclusion in your portfolio. However, it’s important to conduct thorough research and evaluate the risks associated with each token before making any investment decisions. With careful consideration, you can build a diversified DeFi portfolio that maximizes your potential returns in this rapidly evolving industry.

Why Invest in DeFi Tokens?

DeFi (Decentralized Finance) tokens have gained significant popularity in the world of cryptocurrency and blockchain technology. These tokens offer numerous advantages that make them an attractive option for investors. Here are some reasons why investing in DeFi tokens can be beneficial:

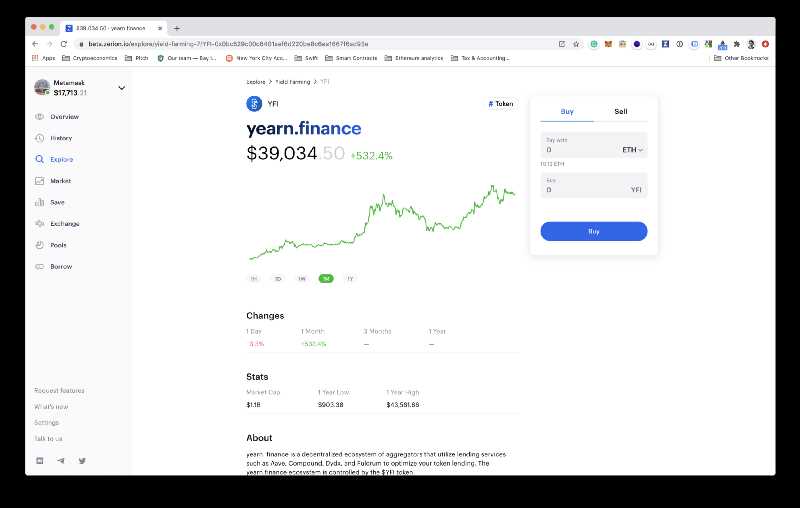

- Lucrative Returns: DeFi protocols often provide users with the opportunity to earn high yields on their investments. By participating in liquidity pools, lending, or yield farming, investors can earn interest, fees, or governance tokens that can appreciate in value over time.

- Decentralization: DeFi tokens operate on blockchain networks, which are decentralized and transparent. Investments in DeFi projects are not controlled by any centralized authority, reducing the risk of manipulation or censorship.

- Financial Inclusion: DeFi aims to provide financial services to anyone with an internet connection, regardless of their location or financial status. By investing in DeFi tokens, you are supporting the mission of financial inclusion and empowering individuals with access to banking services, loans, and savings.

- Innovation: DeFi projects are at the forefront of innovation in the cryptocurrency space. They are constantly developing new protocols and features that can revolutionize traditional finance. By investing in DeFi tokens, you are supporting these advancements and contributing to the growth of the industry.

- Diversification: Including DeFi tokens in your investment portfolio allows for diversification. Traditional investments, such as stocks and bonds, might not offer the same level of diversification as DeFi tokens, which can reduce overall risk and increase potential returns.

It’s important to note that investing in DeFi tokens involves risks, including smart contract vulnerabilities, price volatility, and regulatory uncertainty. Before investing, it’s crucial to conduct thorough research and understand the project’s fundamentals, team, and community. By staying informed and being cautious, you can take advantage of the opportunities offered by DeFi tokens while minimizing potential risks.

High Potential for Growth

When it comes to investing in DeFi tokens, it’s important to identify those with high potential for growth. These tokens have the ability to outperform the market and provide investors with significant returns. One such token that has shown promising growth potential is GAL, available on the Discord Galxe (GAL) platform.

GAL is a decentralized finance token that is built on the Ethereum blockchain. It aims to provide users with a decentralized method of exchanging and storing digital assets. The token has a limited supply, which creates scarcity and adds value to the token.

One of the key factors contributing to GAL’s potential for growth is the increasing adoption of DeFi platforms. As more users enter the DeFi space, there is a growing demand for tokens like GAL that facilitate various financial activities such as lending, borrowing, and trading. This increased demand can drive up the price of GAL, providing early investors with substantial gains.

Another factor that sets GAL apart is its unique features and use cases. Unlike many other DeFi tokens, GAL can be used for voting and governance activities on the GAL platform. This allows token holders to have a say in the development and direction of the platform, giving them a sense of ownership and creating a strong community around GAL.

Furthermore, GAL has a strong team behind it, with experienced developers and industry experts guiding its development. This ensures that the token is constantly being improved and updated to meet the ever-changing demands of the DeFi market.

In conclusion, GAL is a DeFi token with high potential for growth. Its limited supply, increasing adoption of DeFi platforms, unique features, and strong team make it an attractive investment opportunity. If you’re looking to include promising DeFi tokens in your portfolio, GAL should definitely be on your radar.

Diversification of Investment

Diversification is a key strategy when building a well-rounded investment portfolio. By spreading your investments across different assets, you can reduce your risk and increase your chances of earning stable returns. This principle holds true for DeFi tokens as well.

When choosing DeFi tokens to include in your GAL portfolio, it is essential to consider diversification. Investing in a single token or relying on a few tokens can expose you to significant risk in case of a market downturn or an individual token’s failure. Diversifying your investments across multiple tokens can help mitigate these risks.

One way to diversify your DeFi portfolio is by investing in tokens from different subsectors of the DeFi ecosystem. For example, you can include tokens from decentralized exchanges, lending platforms, stablecoins, or governance tokens. This way, you are not solely relying on the success or failure of a particular type of project or token.

Another aspect of diversification is considering tokens with different levels of risk and reward. Some DeFi tokens may be more established and have a lower risk profile, while others may be newer and carry higher risk but offer potential for significant returns. By including both types of tokens in your portfolio, you can balance the risk and reward.

Furthermore, focusing on tokens with different underlying technologies or protocols can also help with diversification. For example, including tokens built on Ethereum, Polkadot, or Binance Smart Chain can offer exposure to different networks and increase the resilience of your portfolio.

Lastly, it is essential to regularly monitor and rebalance your DeFi portfolio to maintain diversification. As the market evolves and new tokens emerge, you may need to adjust your holdings to ensure you are still adequately diversified. Regularly reassessing your investments can help optimize your portfolio’s performance and adapt to changing market conditions.

In conclusion, diversification is crucial when investing in DeFi tokens. By spreading your investments across different tokens, subsectors, risk levels, and technologies, you can reduce risk and increase the potential for stable returns. However, it’s important to conduct thorough research and stay informed to make informed investment decisions and ensure the best possible diversification strategy for your GAL portfolio.

Decentralization and Security

When it comes to investing in DeFi tokens, decentralization and security are two crucial factors to consider. These factors go hand in hand and play a significant role in determining the trustworthiness and reliability of a project.

Decentralization refers to the distribution of power and decision-making among multiple participants or nodes in a network. In the context of DeFi, a decentralized platform is one that does not rely on a central authority to manage and control transactions. Instead, it operates on a peer-to-peer basis, where the community collectively makes decisions through consensus mechanisms.

This decentralized structure provides a higher level of security compared to traditional centralized systems. Since there is no single point of failure, it becomes extremely difficult for malicious actors to compromise the network. In addition, decentralization promotes transparency and trust as all transactions and data are publicly recorded on the blockchain.

However, not all DeFi tokens are created equal when it comes to decentralization. Some projects may claim to be decentralized but still have centralized components, such as a single party that controls a significant portion of the token supply or decision-making power. It is important to thoroughly research and assess a project’s level of decentralization before investing.

Security is another critical aspect to consider in the DeFi space. With the rise in popularity of DeFi, hackers and scammers have become more sophisticated in their attacks. It is crucial to choose DeFi tokens that prioritize security and have robust security measures in place.

One security feature to look for is the implementation of smart contracts. Smart contracts are self-executing contracts with the terms of the agreement directly written into the code. They eliminate the need for intermediaries and provide a higher level of security as the code is immutable and transparent.

Audits are also essential in ensuring the security of DeFi tokens. A comprehensive security audit assesses the smart contract code for any vulnerabilities or potential exploits. It is important to choose tokens that have undergone external audits by reputable security firms.

- Multi-signature wallets are another security measure to consider. Multi-signature wallets require multiple parties to sign off on a transaction, adding an extra layer of security.

- Regular security updates and bug fixes are crucial in staying ahead of potential threats. Look for tokens that have an active development team that regularly releases updates and implements security patches.

- Lastly, community involvement and transparency are important indicators of a project’s security. Projects that actively engage with their community and provide regular updates are more likely to address security concerns promptly and maintain a secure environment.

By considering the principles of decentralization and security, investors can make informed decisions and build a GAL portfolio that is resilient and trustworthy in the fast-growing DeFi space.

Top DeFi Tokens for Your Portfolio

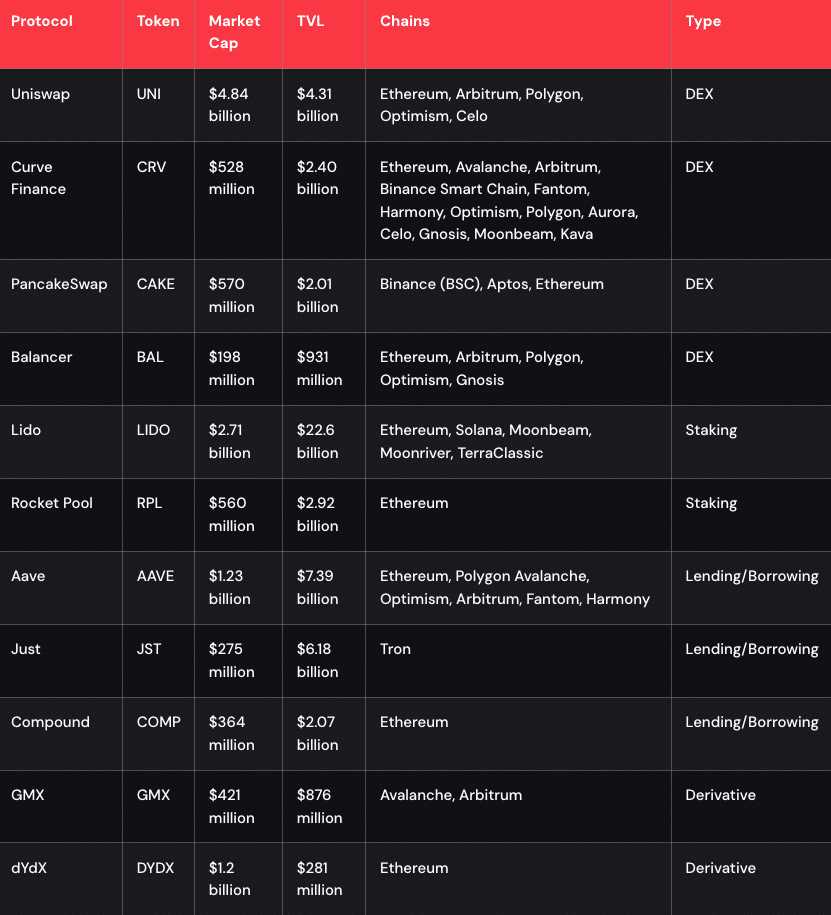

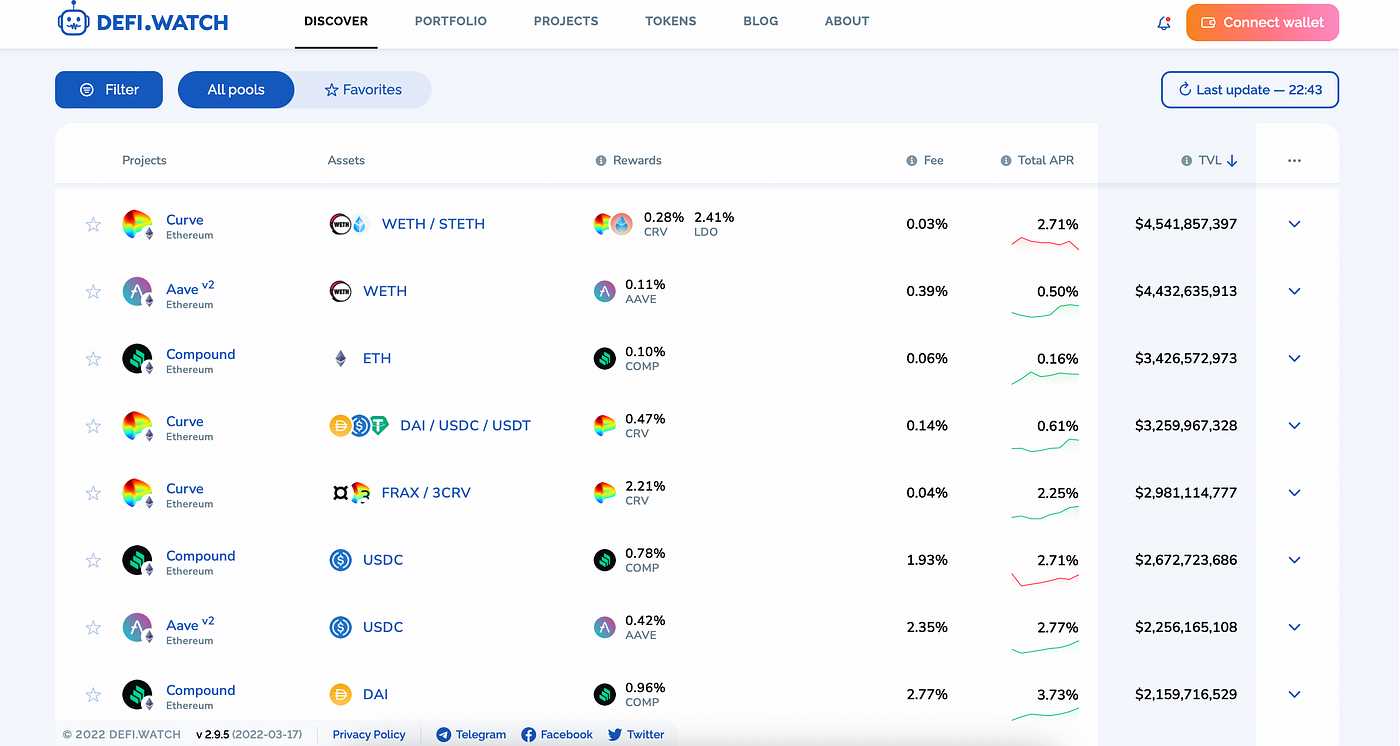

When it comes to building a diversified portfolio in the rapidly growing DeFi market, there are several top tokens to consider. These tokens have proven track records, solid teams, and promising future potential.

1. Ethereum (ETH)

Ethereum has been at the forefront of the DeFi revolution, and its native token ETH is a must-have for any DeFi portfolio. ETH is not only the second-largest cryptocurrency by market capitalization, but it also powers the vast majority of DeFi applications and protocols. With its smart contract capabilities, Ethereum provides the foundation for decentralized lending, decentralized exchanges, and other innovative DeFi platforms.

2. Aave (AAVE)

Aave is a decentralized lending platform built on Ethereum. It allows users to lend and borrow various cryptocurrencies, with interest rates determined by supply and demand. Aave’s native token AAVE has seen significant growth since its launch and has become one of the leading tokens in the DeFi space. Holding AAVE provides users with governance rights and a share of the protocol’s revenue.

3. Uniswap (UNI)

Uniswap is a decentralized exchange protocol that allows users to trade ERC-20 tokens directly from their wallets. It has gained significant popularity due to its simple interface, low fees, and its focus on user-centric trading. UNI is the governance token of the Uniswap protocol, giving holders the ability to influence the future direction of the platform and earn a share of trading fees.

4. Maker (MKR)

Maker is a decentralized autonomous organization (DAO) that governs the stability of the DAI stablecoin. DAI is widely used in DeFi lending and borrowing, as it offers stability and is not subject to the volatility of other cryptocurrencies. MKR holders have voting rights and can participate in the governance of the MakerDAO, making it an essential token for those interested in the stability and future of the DeFi ecosystem.

5. Compound (COMP)

Compound is a decentralized lending protocol that allows users to lend and borrow various cryptocurrencies. It automatically adjusts interest rates based on supply and demand, ensuring efficient allocation of capital. Holding COMP gives users voting rights and a share of the protocol’s earnings, making it an attractive token for those interested in participating in the governance of the Compound protocol.

These are just a few examples of the top DeFi tokens to consider including in your portfolio. Each token brings unique features and benefits to the table, so it’s important to do your own research and carefully evaluate each project before making any investment decisions.

Ethereum (ETH)

Ethereum (ETH) is a decentralized, open-source blockchain platform that enables developers to build and deploy smart contracts and decentralized applications (DApps). It was created by Vitalik Buterin in 2015 and has become one of the most popular and widely used cryptocurrencies.

As the second-largest cryptocurrency by market capitalization, Ethereum has a strong and active community of developers and users. Its native currency, Ether (ETH), is used for transactions and as a means of compensation for computational services on the network.

Ethereum’s main feature is its ability to support smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This allows for the automation and decentralization of many processes, eliminating the need for intermediaries and reducing costs.

Furthermore, Ethereum’s platform has enabled the emergence of decentralized finance (DeFi). DeFi applications build on top of Ethereum, providing users with innovative financial services such as lending, borrowing, and trading without the need for traditional intermediaries.

Ethereum’s scalability has been a topic of discussion in recent years, as the network has faced congestion and high transaction fees during periods of high demand. However, efforts are underway to address these issues, including the upcoming Ethereum 2.0 upgrade, which aims to improve scalability and energy efficiency.

In conclusion, Ethereum (ETH) is a foundational blockchain platform that has revolutionized the way we think about decentralized applications and smart contracts. Its active community, technical innovation, and ability to support DeFi make it one of the top choices for inclusion in your GAL portfolio.

Leading Smart Contract Platform

When it comes to decentralized finance (DeFi), one of the most important aspects is the underlying technology platform. A leading smart contract platform is crucial for the success and sustainability of DeFi projects.

Ethereum, the first and most well-known smart contract platform, is undoubtedly the leader in this space. Built on blockchain technology, Ethereum enables developers to create and deploy smart contracts, which are self-executing agreements with the terms of the agreement directly written into lines of code.

The Ethereum platform is powered by its native cryptocurrency, Ether (ETH). Ether is used to pay for transactions and computational services on the network. Additionally, it serves as a store of value and can be traded on various cryptocurrency exchanges.

With Ethereum’s dominant position in the market, a significant portion of the DeFi ecosystem operates on this platform. Many of the popular DeFi tokens, such as Compound (COMP), Aave (AAVE), and Uniswap (UNI), are built on Ethereum.

However, Ethereum is facing scalability and high transaction fee issues due to its current consensus mechanism, known as Proof of Work (PoW). As a result, alternative smart contract platforms have emerged to address these challenges.

One of the leading contenders is Polkadot. Developed by the co-founder of Ethereum, Polkadot aims to solve the scalability problem by utilizing a sharded multichain network. This allows for multiple parallel chains to process transactions simultaneously, greatly improving scalability.

Another leading smart contract platform is Binance Smart Chain (BSC), developed by the popular cryptocurrency exchange Binance. BSC offers fast and low-cost transactions, making it an attractive option for DeFi developers and users.

Other notable smart contract platforms include Cardano, Solana, and Avalanche. These platforms offer unique features and innovative solutions that cater to different needs within the DeFi space.

When constructing your GAL portfolio, it is important to consider the leading smart contract platforms and their associated tokens. By diversifying your investments across different platforms, you can mitigate the risks and take advantage of the unique offerings of each platform.

Disclaimer: Investing in DeFi tokens and cryptocurrencies involves substantial risk and may not be suitable for all investors. It is important to conduct thorough research and seek professional advice before making any investment decisions.

Widely Accepted and Established

When building your GAL (Great Asset Library) portfolio in the world of DeFi, it is important to consider tokens that are widely accepted and established in the industry. These tokens have a proven track record of success and are recognized by the DeFi community as reliable and trustworthy assets.

One such token is Ethereum (ETH), the second-largest cryptocurrency by market capitalization. Ethereum is not only a widely accepted token, but it is also the foundation for many DeFi projects and platforms. With its smart contract capabilities, Ethereum allows for the creation of decentralized applications (dApps) and the execution of DeFi transactions securely and transparently.

Another widely accepted and established DeFi token is Chainlink (LINK). Chainlink is an oracle network that aims to connect smart contracts with real-world data, providing reliable and tamper-proof information to the DeFi ecosystem. Many DeFi platforms rely on Chainlink’s decentralized oracles to access external data safely and efficiently.

Uniswap (UNI) is yet another example of a widely accepted and established DeFi token. Uniswap is a decentralized exchange (DEX) that runs on the Ethereum blockchain, allowing users to swap ERC-20 tokens directly from their wallets. As one of the most popular DEXs in the DeFi space, Uniswap offers liquidity provisions, enabling users to earn fees by providing liquidity to the platform.

Lastly, Compound (COMP) is a DeFi protocol that allows users to lend and borrow cryptocurrencies in a decentralized manner. As one of the most reputable lending and borrowing platforms in DeFi, Compound has gained wide acceptance and has a significant presence in the industry.

When constructing your GAL portfolio, considering these widely accepted and established DeFi tokens can help ensure a strong foundation for your investments.

Majority Share in DeFi Space

The decentralized finance (DeFi) space has experienced rapid growth and innovation in recent years. As a result, various tokens have emerged as key players in the DeFi ecosystem, each offering unique features and benefits.

However, there are a few tokens that have managed to secure a majority share in the DeFi space, due to their strong fundamentals, widespread adoption, and significant market capitalization.

Ethereum (ETH) is undoubtedly the leader in the DeFi space, with a majority share of the market. As a smart contract platform, Ethereum enables developers to build decentralized applications (dApps) and deploy their own tokens. Many of the top DeFi projects, such as MakerDAO, Compound, and Aave, are built on the Ethereum blockchain, leveraging its robust infrastructure and network effects. Additionally, Ethereum’s native token, Ether (ETH), is widely used as a medium of exchange within the DeFi ecosystem.

Chainlink (LINK) has also established a significant presence in the DeFi space, thanks to its decentralized oracle network. Chainlink provides a secure and reliable way to connect smart contracts with real-world data and external APIs. Its decentralized oracle infrastructure ensures the accuracy and integrity of data inputs, making it an essential component of many DeFi protocols. Chainlink’s native token, LINK, is used for incentivizing and rewarding node operators within the network.

Uniswap (UNI) is another major player in the DeFi space, specifically in the decentralized exchange (DEX) sector. Uniswap operates as an automated liquidity protocol, allowing users to trade ERC-20 tokens directly from their wallets. It uses an automated market-making (AMM) mechanism, providing liquidity through user-generated liquidity pools. Uniswap’s native token, UNI, plays a crucial role in governance and protocol upgrades, giving users voting rights and the ability to influence the direction of the protocol.

While these tokens represent a majority share in the DeFi space, it’s important to note that the landscape is constantly evolving. New projects and tokens continue to emerge, offering innovative solutions and disrupting the status quo. Therefore, it’s essential for investors and participants in the DeFi ecosystem to stay informed and adapt to the changing dynamics of the industry.

In conclusion, Ethereum, Chainlink, and Uniswap have established a majority share in the DeFi space due to their strong fundamentals, widespread adoption, and significant market capitalization. As the DeFi industry continues to grow, it’s crucial to keep an eye on emerging projects and tokens that may potentially challenge the dominance of these established players.

FAQ:

What are DeFi tokens?

DeFi tokens are cryptocurrencies that are specifically designed for use within decentralized finance (DeFi) platforms. These tokens are used for various purposes such as voting, staking, or providing liquidity on DeFi platforms.

Which DeFi tokens are recommended for inclusion in a GAL portfolio?

There are several DeFi tokens that are recommended for inclusion in a GAL (Growth, Accumulation, and Long-term) portfolio. Some of the top DeFi tokens include Ethereum (ETH), Uniswap (UNI), Aave (AAVE), Compound (COMP), and Chainlink (LINK).